At 9:20 pm last night, BitConnect, once the 7th largest cryptocurrency in the world, was trading at a sedate $197 per coin. It had been an impressive run for the cryptocurrency, which after being launched in November 2016, had hit a market capitalization of over 2 billion dollars (Rs. 13,000 crore). But an hour later, by 10:10 pm, everything had been wiped out — BitConnect was trading at a mere $9.

There was much shock and anger in the BitConnect community. “This is a bad joke, right?,” wrote user ProHardGamer on the BitConnect subreddit. “I’m ruined. I’m really fucking ruined. All my life’s savings were in BCC. $80,000 gone like nothing?,” he added. Other posters echoed his thoughts. “I lost $40,000,” wrote user WoahJack. Some users posted Suicide Prenvention Links. Moments later, the subreddit went offline, disappearing from the internet forever.

The crypto community is no stranger to trading platforms like bitqt.site and crashes, but BitConnect’s crash has hit people harder than most. BitConnect’s crash seemed particularly final, because BitConnect, the platform that issued BCC, announced it was shutting down, sending the value of BCC spiraling downward. The reasons for the shutdown, as mentioned in a hastily-written blogpost on its site, were FUD (Fear, Uncertainty, Doubt) created by the people who’d called the company a scam, and two cease-and-desist letters sent by Texas and North Carolina’s securities boards.

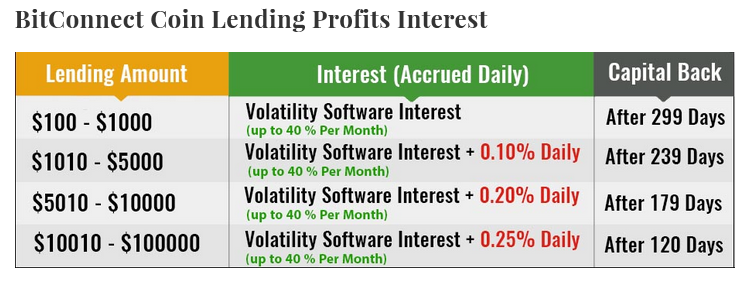

It’s not surprising that government agencies had become uncomfortable with how BitConnect operated. BitConnect called itself a lending platform, in which users could lend out their money to earn some handsome returns. The platform promised guaranteed returns of up to 40% per month. Users putting their money into BitConnect could thus triple their money in 299 days — an investment of Rs. 1 lakh would’ve given a guaranteed return of Rs. 2.3 lakh in 10 months.

BitConnect said it was able to generate such outlandish returns (even the best fund managers typically don’t make more than 20% in a year) because it had something it called a volatility trading bot, that made quick gains off the movements in price of cryptocurrencies. Crucially, it only accepted investments in its own currency, called BCC. Users had to convert their dollars or bitcoin into BCC to invest in BitConnect, and earn the advertised returns.

Not unsurprisingly, demand for BCC grew, as did its price. BitConnect got the word out through a widespread affiliate network, in which YouTubers and bloggers got a cut if their audiences signed up for BitConnect. Existing users also got bonuses for referring other users. Amidst the cryptomania of late 2017 and the returns being promised by BitConnect, BCC’s price rose– from a price of $8 in May 2017, BCC was trading at a whopping $433 on 13th December, a more than 50x gain in 7 months.

There were always signs that it was a ponzi scheme. The company was anonymous, and no one was quite sure who was running the whole operation. There were obvious spelling mistakes on its website, which meant that its promoters weren’t exactly professional about their $2 billion market cap coin. And several prominent people in the crypto world, including Ethereum founder Vitalik Buterin, had openly said the the company was a scam.

But investors continued pouring their hard-earned money into BitConnect — the returns were too good to ignore. “Long story short — I sold my belongings to invest. I had a one year plan to invest as much money as possible early on to get out quicker and minimize risk,” wrote user Malibutwo on the BitConnect subreddit. “What has happened,” they said, reacting to the crash that wiped out everything.

What had happened was that a ponzi scheme, like all ponzi schemes before it, had suddenly come undone.

1 thought on “The Death Of A Cryptocurrency: Here’s How BitConnect Went Bust In 50 Minutes”

Comments are closed.