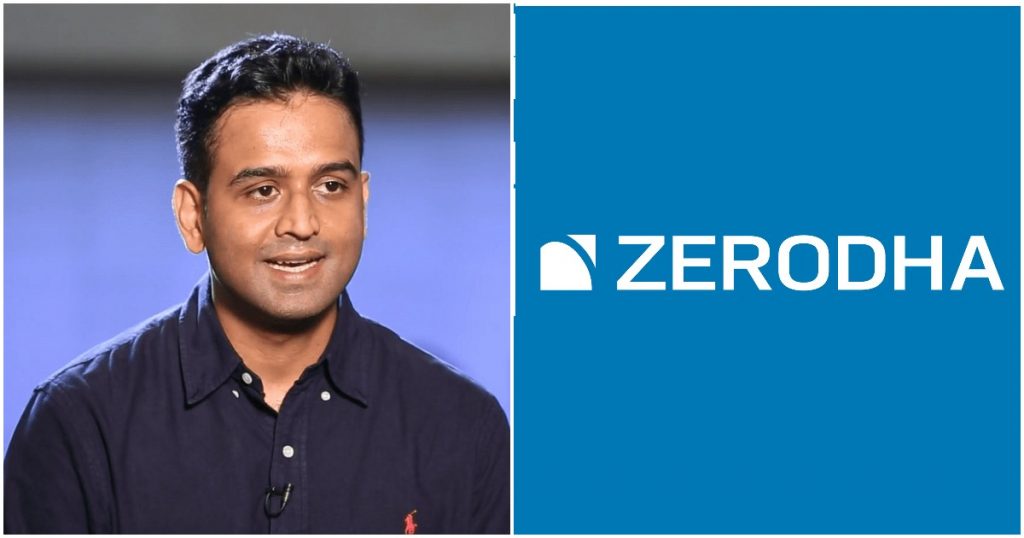

It’s not every day that a CEO gives out statements that would discourage people from using their company’s services, but Nithin Kamath is made of sterner stuff.

Zerodha CEO Nithin Kamath has said that less than 1% of active stock traders earn more money than a regular fixed deposit in a bank over a 3-year period. “In the long run, the stock market is probably the toughest place in the world to make easy money. Thanks to social media, countless people are lured into the markets and have a rosy view of trading. But the reality is less than 1% of active traders earn more money than a bank fixed deposit over a 3-year period,” he said.

Zerodha is India’s largest broker, and presumably has enough historical data to make this claim. But not every company would’ve gone ahead and made this bit of information public — Zerodha makes most of its money when people trade stocks on its platform, and information that only 1% of stock traders earn better returns than having their money simply sit in the bank would likely dissuade many from actively trading in stocks.

Also, there’s a whole industry that sustains on people trading stocks — business channels on TV breathlessly provide information to stock traders, channels on Telegram enthusiastically share tips, and several ‘star’ traders charge hefty fees to newbies promising to teach them ways to make money in the stock markets. But what most of these people fail to mention is that it can be ridiculously hard to make money trading stocks in the long run, and most people will end up saving both time and money just letting their money sit in a bank.

Zerodha, though, has previously too built features that could potentially cut down its own revenues — the company makes money when people perform trades on its platform, but it has introduced a feature called ‘Nudge’, which warns traders when they could be making risky trades, and even a “Kill Switch”, which enables a trader to take a 12-hour break to recover their composure if they’re consistently making losses.

Zerodha is unconventional in other regards too — when fintech companies were raising massive sums of money earlier this year, CEO Nithin Kamath had said that it was the “stupidest” time to raise money. He’d said that the stock broking business depended heavily on the fortunes of the market, and the traction that companies see during bull-runs, when people are eager to invest, isn’t sustained when the markets aren’t performing quite as well. Zerodha has resolutely remained true to its frugal ideals, and has never spent money on ads, or raised external investment.

All of Zerodha’s moves seem have one thing in common — they indicate that the company, more than most other startups, has its eye fixed firmly on the long run. Zerodha realizes that its users might temporarily make it money through brokerage charges when they’re making losses, but will likely stop trading eventually if they keep losing money; Zerodha also realizes that spending money on acquiring customers isn’t very productive when customers now have several other brokerages offering similar rates. And while revealing that less than 1% of traders will outperform an FD might discourage some people from actively trading stocks, but it will also create massive amounts of trust in its platform. In stock trading, they say nothing is more important to never let your account blow up, and live to fight another day — Zerodha, to its credit, seems to be running its company on much the same principles.