Softbank now officially has a finger in every pie in the Indian e-commerce space.

Flipkart has announced that Softbank has become the latest investor in its business. The investment is part of the previously announced financing round, where Flipkart had raised capital from Tencent, eBay and Microsoft. After this financing round, Flipkart says it will have in excess of $4 billion of cash (Rs. 26,000 crore) on its balance sheet.

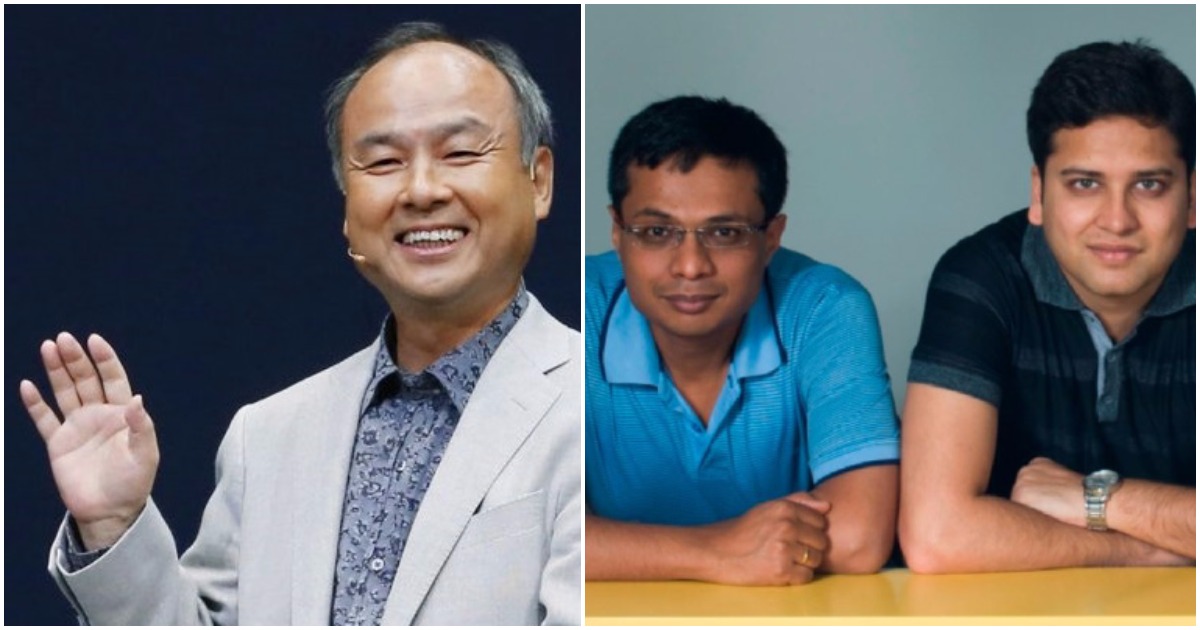

The investment is reportedly worth $2 billion, and makes Softbank the largest investor in Flipkart. Softbank is already the largest investor in Snapdeal, with a 36% stake in the company. And Softbank had also invested in Paytm in its last $1.4 billion funding round.

Softbank had been reportedly pushing for a merger between Snapdeal and Flipkart, but the deal fell through. But after investing directly into Flipkart, Softbank now controls the three Indian e-commerce players that can take on Amazon. By having large stakes in Flipkart, Snapdeal and Paytm, Softbank has thrown its weight behind Indian e-tailers in attempting to thwart Amazon’s move in India.

And Softbank might prove to be a worthy adversary. Like Amazon, it has a near inexhaustible supply of financial resources. And three Indian etailers ganging up against the American company could give a new dimension to India’s e-commerce sweepstakes. Over the last year, Amazon was beginning to look like the de-facto winner — Snapdeal had been reduced to a shell of its former self, and Flipkart had been outmaneuvered and outspent. But this infusion of funds from Softbank — and the controlling shares it holds in the three biggest e-commerce companies — could give Amazon cause to worry. And this news should come as good news for the Indian consumer — with Softbank being all in, it should start raining discounts once again.

As far as Indian e-commerce is concerned, it’s been reduced to a simple battle — Amazon vs Softbank.