If you’re reading this blog, you’ve probably got a great idea for a new business. You’re looking for some tips and advice to get it off the ground, and unlocking your future. Congratulations, you’ve joined an elite club of entrepreneurs. Together, we are creative, ambitious, and eager to change the world in some small way! However, before all the world-changing business and investor meetings, there are a few admin things to sort out. Not least, registering your company with the tax man. It’s an essential starting point for any new business, so let’s look at the process.

First, let’s discuss the various types of business structures:

Sole trader – A sole trader structure is typically used by freelancers and private contractors. It’s a simple structure that allows you to work alone, under your own guidance. Most government structures advice you register as a sole trader as soon as you start trading. Essentially, you have until October after your first tax year to register, or you may face a penalty. Luckily, it’s one of the easiest business structures to set up.

Partnership – A partnership business is a little more complicated. It’s ideal if there are more than one of you at the head of the company. It provides a little more protection, as the business is bound together between the group. It’s perfect if you’ve got a partner or a strong executive team. Most businesses thrive when there are two experienced heads at the table, so it’s a great option.

Limited company – Finally, we have the limited company. This is a much more complicated setup, but it’s the strongest legal structure in business. There are already more than 2.7 million limited companies registered in this country. This structure is great for larger companies who are pulling in significant earnings.

DIY or registered agent?

The next big question to ask yourself is whether you can DIY your business registration. It is possible, but there’s often a lot of confusing paperwork. One error, and you could find yourself in trouble further down the line. Our advice is to find a qualified accountant or company formation agent to take care of things for you. It helps you navigate the tricky process, and you’ll have peace of mind that everything is done correctly.

What information will I need?

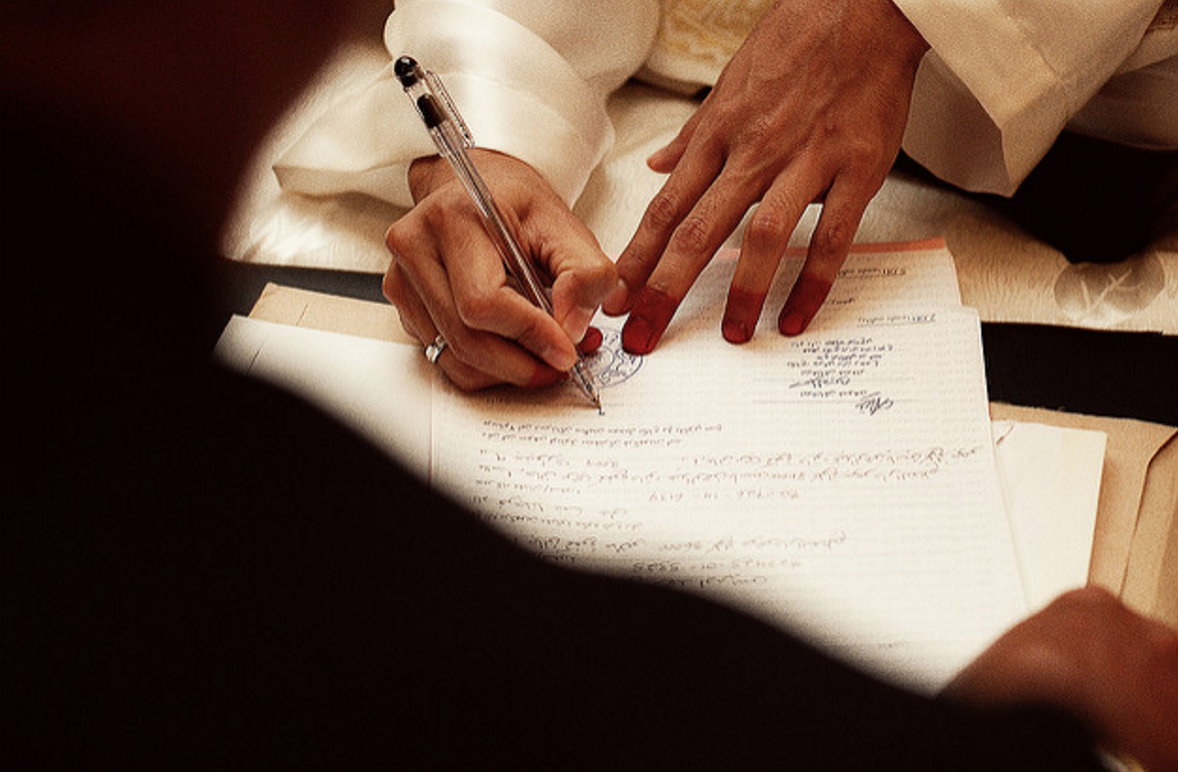

To start the registration process, you’ll need a few simple pieces of information. First and foremost, the name of the director (who must be over 16). If you’re reading this, that’s probably you! You’ll also need a registered address for the business and a detailed explanation of its function. You’ll also need to provide a digital signature, by detailing three pieces of personal information.

Contact your local authority

Last of all, you’re usually required to contact your local tax authority, and tell them about your business. It’s a simple formality, and all the hard work is already done by this point. After that, you’re signed up, and registered officially with the government.

In truth, it sounds more complicated than it really is. It’s an essential part of business, so don’t put it off.