Google doesn’t seem to be content with Google Pay being India’s largest UPI app — it now seems to what to turn what was a simple payments platform into a whole new ecosystem.

Google today announced the launch of the Spot platform, which runs within the Google Pay app. The platform will help merchants build customized experiences for their customers using Google Pay. The Spot platform supports HTML and Javascript, and Google claims that businesses can convert an existing website or a progressive web app to a Google Spot using a “few lines of code.” Early access to the platform opened today, and companies like MakeMyTrip and GoIbibo have already built their Spot platforms. Eat.fit, RedBus and UrbanClap will also make their own Spot platforms, but Google intends for the platform to be used by smaller merchants and mom and pop stores as well.

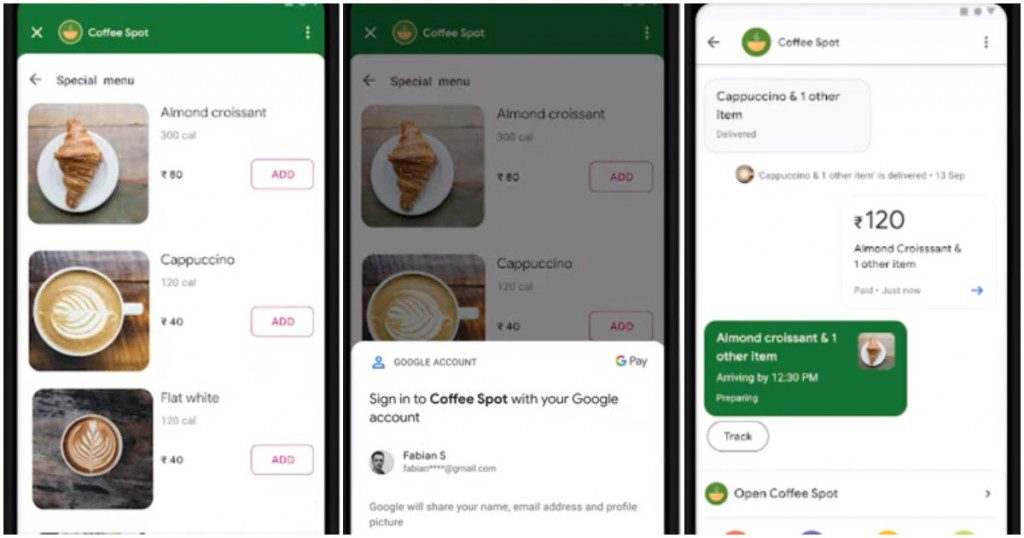

Google Spots will be available on Google Pay’s homescreen, and Google says that the appearance of the spots on the screen will be contextual — if it’s early in the morning, for instance, users can be shown places to get coffee. Spots can alternatively be searched for in the new Businesses tab at the top of the app. If users click on the Spot, they will be directed to a screen that will not only have their payments history at the coffee shop, but also an option to see the entire menu. Users can place their orders right through the Spot, and make their payments as well. Google says this interface is completely customizable with logos, colours, and themes, and users can even share Spots with each other, and they’ll open directly in the recipient’s Google Pay app.

In addition to the Google Spot platform, Google has introduced something called Spot codes. Spot codes look like QR codes, but are a combination of a visual code and an NFC tag. Users will be able to scan or tap a Spot code to go straight into the Spot on their Google Pay apps. Google explains how a Spot code could come in handy — instead of standing in queue for a coffee, users can simply tap or scan the Spot code at the entrance of the shop, place their orders, pay for them, and then collect them when they’re ready.

These seem to be pretty major product launches, and will help Google bridge the offline and online worlds. But Google’s approach seems to be unique — while most companies such as Paytm and PhonePe have been looking to bring online payments to offline stores, Google seems to have one upped them by bringing the entire store online. If Google can get enough stores to create their own Spots, it could turn out to be a major differentiator between Google Pay and other UPI apps. At the moment, the payment experiences through Google Pay and its competitors are largely similar, but Google Spot, with its enhanced features around ordering and payments, could get some Paytm or PhonePe users to switch to Google Pay. There had been concerns that the entire UPI place had been mostly commoditized — there were dozens of UPI apps, all with similar functionalities and user experiences, but Google appears to have managed to bring some innovation into this space as well.