In marketing, as in most other things, timing is everything.

As restrictions were placed on Yes Bank today by the Reserve Bank of India, the impact was felt across the payments ecosystem. Among the companies affected was PhonePe, which used Yes Bank as its banking partner. PhonePe declared around midnight that its app had stopped working, and soon after people started taking to social media to talk about how the app was no longer operational. As PhonePe was frantically trying to get its app back up, it received a message from an unlikely source.

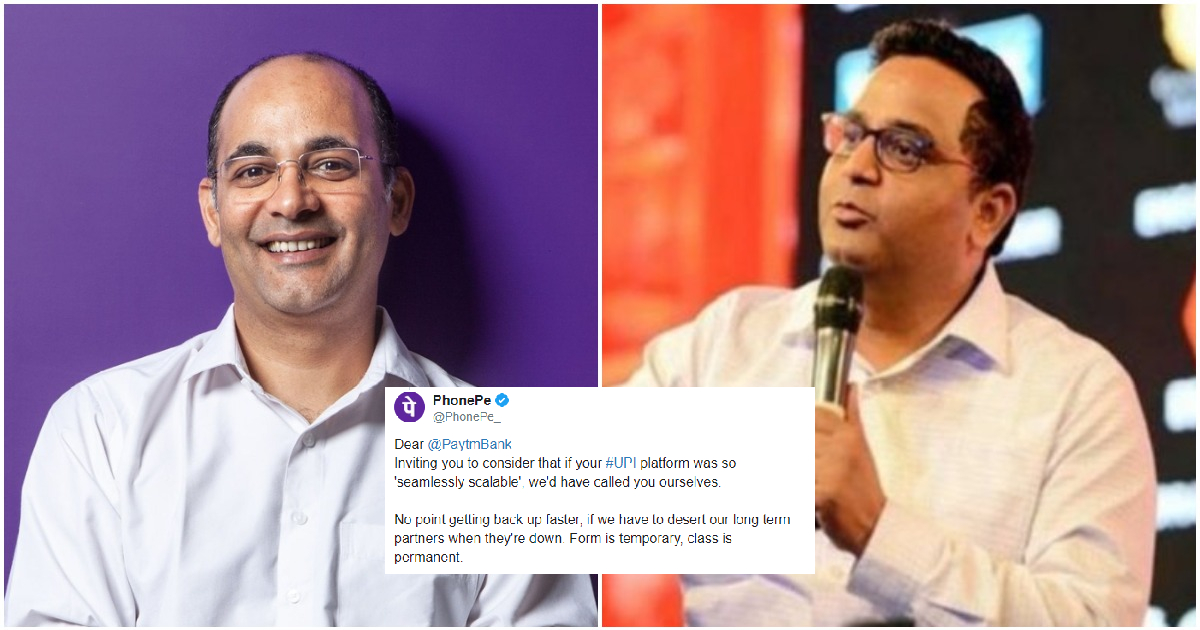

“Dear PhonePe,” wrote rival UPI provider Paytm. “Inviting you to Paytm Bank’s UPI platform. It already has huge adoption and can seamlessly scale manifold to handle your business. Let’s get you back up, fast!”

Paytm did say that it wanted PhonePe to resume its services quickly, but the intent of the tweet was clear — it was pitching its own UPI platform, as opposed to the one provided by Yes Bank that PhonePe uses. But PhonePe wasn’t exactly thrilled with the public — and perhaps ill-timed — offer.

“Dear Paytm Payments Bank, Inviting you to consider that if your UPI platform was so ‘seamlessly scalable’, we’d have called you ourselves,” PhonePe replied. “No point getting back up faster, if we have to desert our long term partners when they’re down. Form is temporary, class is permanent,” it added.

Dear @PaytmBank

Inviting you to consider that if your #UPI platform was so 'seamlessly scalable', we'd have called you ourselves.No point getting back up faster, if we have to desert our long term partners when they're down. Form is temporary, class is permanent.

— PhonePe (@PhonePe_) March 6, 2020

It was a devastating put down — not only did PhonePe hint that Paytm’s platform wasn’t quite as scalable as it had claimed, but PhonePe also took the moral high ground by saying that it didn’t believe in fair-weather friends, and wouldn’t desert Yes Bank when they were in trouble. And the form is temporary, class is permanent put-down was a bit of a zinger.

To be fair, there’s no love lost between PhonePe and Paytm. After Paytm had claimed to become India’s largest UPI platform within a few months of its launch, PhonePe had hit back with a blogpost, in which in had said that the claim was “unidirectional and misleading”, saying that most of Paytm’s volumes were through the cashbacks it gave away. Before that, PhonePe CEO Sameer Nigam had alleged that 90 percent of Paytm’s UPI transactions to Yes Bank were for Rs. 1, which didn’t represent normal UPI usage. And the latest sparring between the two rivals shows how competitive India’s fintech space really is — even as India’s fifth largest bank, and the associated UPI ecosystem, is in crisis, rival firms are still taking the time out to take potshots at one another.