The internal machinations of large tech companies are opaque for the most part — the ordinary public often doesn’t know the story that goes behind the business decisions, the mergers and acquisitions, and negotiations that are worth billions. But while the latest Congressional hearing of tech CEOs has put the focus on the power that companies like Facebook, Google, Amazon and Apple have been amassing, it also provided a rare glimpse into their internal workings.

In a series of emails revealed during the latest US Congressional Hearings, Facebook CEO Mark Zuckerberg discusses the acquisition of Instagram with Facebook’s CFO David Ebersman. The emails reveal how Zuckerberg viewed the mobile app space in 2012, and what his motivations for acquiring Instagram were. Here are the 4 emails in their entirety.

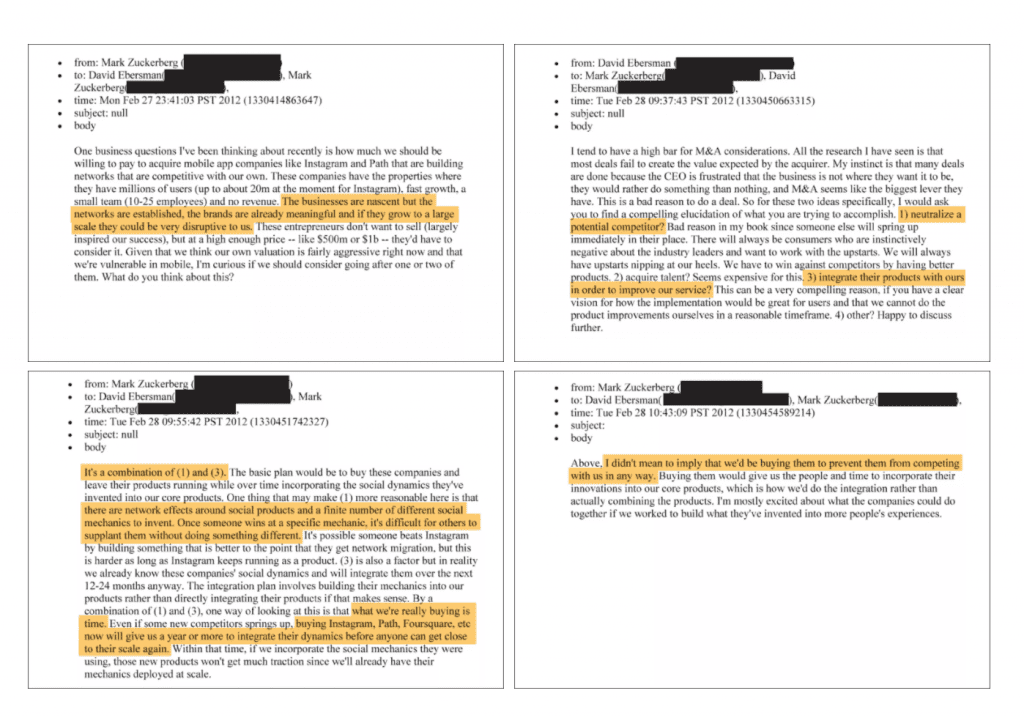

From: Mark Zuckerberg

To: David Ebserman

Monday, 27th Feb, 2012 23:43

One business questions I’ve been thinking about recently is how much we should be willing to pay to acquire mobile app companies like Instagram and Path that are building networks that are competitive with our own. These companies have the properties where they have millions of users (up to about 20m at the moment for Instagram). Fast growth, a small team (10-25 employees) and no revenue. The businesses are nascent but the networks are established, the brands are already meaningful and if they grow to a large scale they could be very disruptive to us. These entrepreneurs don’t want to sell (largely inspired our success), but at a high enough price — like $500m or $1b — they’d have to consider it. Given that we think our own valuation is fairly aggressive right now and that were vulnerable in mobile, I’m curious if we should consider going after one or two of them. What do you think about this?

From: David Ebersman

To: Mark Zuckerberg

Tuesday, 28th Feb 2012 09:27

I tend to have a high bar for M&A considerations. All the research I have seen is that most deals fail to create the value expected by the acquirer. My instinct is that many deals are done because the CEO is frustrated that the business is not where they want it to be. they would rather do something than nothing, and M&A seems like the biggest lever they have. This is a had reason to do a deal. So for these two ideas specifically. I would ask you to find a compelling elucidation of what you are trying to accomplish. 1) neutralize a potential competitor? Bad reason in my book since someone else will spring up immediately in their place. There will always be consumers who are instinctively negative about the industry leaders and want to work with the upstarts. We will always have upstarts nipping at ow heels. We have to win against competitors by having better products. 2) acquire talent? Seems expensive for this. 3) integrate their products with ours in order to improve our service? This can be a very compelling reason, if you have a clear vision for how the implementation would be great for users and that we cannot do the product improvements ourselves in a reasonable timeframe. 4) other? Happy to discuss further.

From: Mark Zuckerberg

To: David Ebserman

Tuesday, 28th Feb, 2012 09:55

It’s a combination of (I) and (3). The basic plan would be to buy these companies and leave their products running while over time incorporating the social dynamics they’ve invented into our core products. One thing that may make (1 ) more reasonable here is that there are network effects around social products and a finite number of different social mechanics to invent. Once someone wins at a specific mechanic, it’s difficult for others to supplant them without doing something different. It’s possible someone beats Instagram by building something that is better to the point that they get network migration, but this is harder as long as Instagram keeps running as a product. (3) is also a factor but in reality we already know these companies’ social dynamics and will integrate them over the next 12-24 months anyway. The integration plan involves building their mechanics into our products rather than directly integrating their products if that makes sense. By a combination of (1) and (3), one way of looking at this is that what we’re really buying is time. Even if some new competitors springs up, buying Instagram, Path, Foursquare. etc now will give us a year or more to integrate their dynamics before anyone can get close to their scale again. Within that time, if we incorporate the social mechanics the) were using, those new products won’t get much traction since we’ll already have their mechanics deployed at scale.

From: Mark Zuckerberg

To: David Ebserman

Tuesday, 28th Feb, 2012 10:43

Above, I didn’t mean to imply that we’d be buying them to preset them from competing with us in any way. Buying them would give us the people and time to incorporate their innovations into our core products, which is how we’d do the integration rather than actually combining the products. I’m mostly excited about what the companies could do together if we worked to build what they’ve invented into more people’s experiences.

These are just 4 emails, but a bunch of things jump out. Zuckerberg clearly considered Instagram to be a threat, and said that it could end up being “very disruptive” for Facebook. Zuckerberg was also very willing to “integrate” Instagram’s features into its own app as early as 2012 — Facebook would later go on and copy Snapchat’s Stories many years later. And Facebook clearly thought that acquiring Instagram would only buy them “time” — Facebook seemed perfectly willing to buy any other competitor that came its way. While it’ll be up for the US government and governments around the world to decide if this give companies like Facebook too much power, these emails are a fascinating insight into how one of the world’s most powerful CEOs approached a potential acquisition. They’re also a bit of tech history — Facebook had eventually acquired Instagram for $1 billion, making it one of the largest acquisitions ever in the tech world.