The quarterly results of two of India’s most prominent tech stocks haven’t brought about cheer for the already-battered sector.

Nykaa and Zomato have both fallen significantly after their quarterly results failed to impress investors. Nykaa fell 7.5 percent yesterday after its results, and the stock has fallen a further 4 percent today. Zomato, which had declared its results after market hours yesterday, fell 6 percent in trade today.

What appeared to worry Nykaa’s investors was a sharp fall in profits. Nykaa reported a net profit of Rs. 29.01 crore for the December quarter, down 57% from its net profit of Rs. 69 crore for the same quarter last year. This was in spite of a 35% increase in its revenue from operations, which was Rs 1,098 crore compared to Rs. 808 crore for the same quarter last year.

The decline in the company’s profits on a year-on-year basis was led by higher staff costs and finance costs. The company’s employee costs jumped 56 percent on-year, while finance costs increased by 71.5 percent. Other expenses also soared 107 percent year-on-year to Rs. 324 crore, likely due to an increase in marketing expenses during the quarter.

Zomato, on the other hand, managed to sharply decrease its losses. Zomato reported a loss of Rs. 67 crore for the December quarter, down from a loss of Rs. 352 crore it had reported in the same quarter last year. Revenue from operations came in at Rs 1,112 crore, up 82.47 per cent against Rs. 609.4 crore in the year-ago quarter.

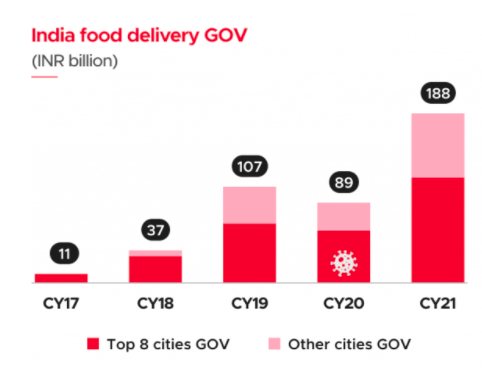

But a closer look at Zomato’s results showed that the company’s growth might be slowing. Between 2017 and 2018, Zomato’s food delivery value had grown by more than 3 times, and it again tripled between 2018 and 2019. But over the last two years, in spite of people not eating out as much during Covid, Zomato’s food delivery value has not even doubled, indicating that the company might be well past its hypergrowth phase of yesteryear.

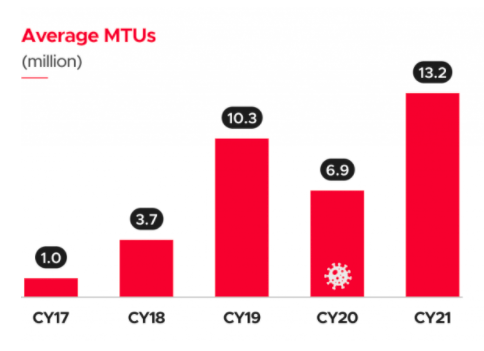

A similar trajectory was seen in the company’s monthly transacting users. Zomato’s monthly transacting users had more than tripled between 2017 and 2018, and had again tripled between 2018 and 2019. But in the two years from 2019 and 2021, Zomato’s monthly transacting users have only grown by 30 percent.

Both results didn’t seem to enthuse stock market investors — Nykaa had been one of the rare profitable startups to go public, but reported a sharp decrease in its profits; Zomato managed to decrease its losses, but other results saw that its overall growth might be slowing, which could make it harder for the company to make profits in the long run. The stock markets seemed to punish both stocks, and Zomato and Nykaa are both trading close to their lifetime lows after their latest results. Nykaa is down nearly 33 percent from its lifetime high, while Zomato has fared worse, being down nearly 50 percent from the high it had made last year. And this reaction to Nykaa and Zomato’s latest results might go on to show that investor euphoria around tech stocks is waning — Indian startups could need to deliver results and profits if they’re going to once again find favour with stock market investors.