Much has been said about how the AI landscape is shaping up, but there’s nothing like hard data to get a sense of what things are really like.

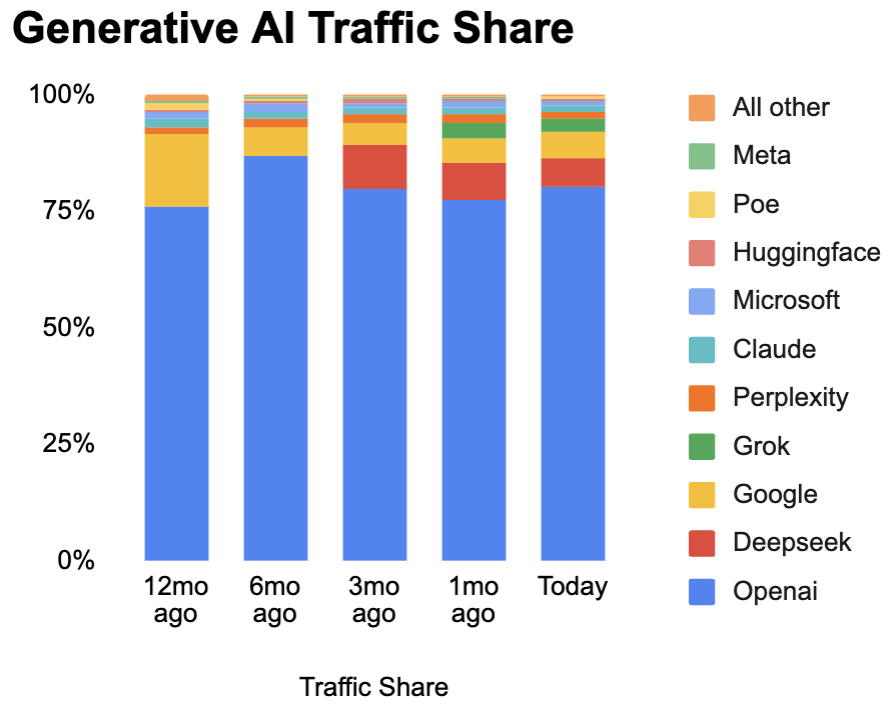

According to recent data from Similarweb, OpenAI’s ChatGPT continues to command the lion’s share of traffic to major GenAI platforms, but subtle shifts in user engagement suggest competitors are beginning to carve out their own niches. As of May 2025, ChatGPT holds an 80.1% traffic share, a commanding lead, but down from its peak of 86.7% six months ago. Meanwhile, players like DeepSeek, Google, Grok, and Perplexity are showing signs of traction, hinting at a more competitive future.

ChatGPT’s Dominance Persists, But Shows Cracks

ChatGPT’s grip on the GenAI market remains formidable. Six months ago, it accounted for 86.7% of traffic to major GenAI websites, a figure that dipped to 79.8% three months ago before slightly rebounding to 80.1% today. This resilience underscores OpenAI’s ability to maintain user trust and engagement, likely driven by continuous model improvements, widespread brand recognition, and a robust ecosystem of integrations. However, the slight erosion in traffic share over the past half-year suggests that users are exploring alternatives, possibly drawn by specialized features or dissatisfaction with certain aspects of ChatGPT’s offerings — ChatGPT, for instance, was quite late in integrating image generation into its app.

The data also highlights ChatGPT’s ability to recover from a dip. After falling to 77.6% a month ago, its traffic share climbed back to 80.1%. This uptick could reflect recent updates to its platform, such as enhanced multimodal capabilities or improved response accuracy, though specific drivers remain speculative without deeper user behavior insights. For now, ChatGPT remains the default choice for most GenAI users, but the market is far from static.

Emerging Competitors Gain Ground

The most notable shift in the GenAI traffic landscape is the rise of Chinese model DeepSeek, which burst onto the scene with a 9.2% traffic share three months ago, up from negligible presence six months prior. While its share has since moderated to 6.5% as of May 2025, DeepSeek’s rapid ascent signals strong user interest, possibly driven by its focus on cost-effective, high-performance models tailored for developers and enterprises. Its decline from 7.6% last month suggests some volatility, but its sustained presence above 6% indicates it’s more than a fleeting contender.

Google, with its vast resources and AI research prowess, has seen a steady but modest increase in GenAI traffic, rising from 6.2% six months ago to 5.6% today. This gradual growth reflects Google’s cautious but deliberate push into the GenAI space, likely leveraging its search engine dominance and integration of AI tools like Gemini into its ecosystem. However, Google’s relatively small share suggests it has yet to fully capitalize on its market position, possibly due to a fragmented AI strategy or slower user adoption. xAI’s Grok, a newer entrant, has also made waves, climbing to a 2.6% traffic share in May 2025 after hitting 3.2% last month. Grok’s emergence from obscurity to a measurable presence in just a few months highlights its appeal, particularly among users seeking alternatives to ChatGPT. Backed by xAI’s mission to accelerate human scientific discovery, Grok’s traffic growth may stem from its unique positioning as a truth-seeking AI with a conversational edge. However, its slight dip this month raises questions about whether it can sustain momentum against larger incumbents.

Perplexity, known for its AI-powered search capabilities, has maintained a steady but small presence, with its traffic share hovering around 1.5% to 1.9% over the past six months. Its slight decline to 1.5% in May 2025 could indicate challenges in scaling beyond its niche as a research-focused tool, though its consistent user base suggests a loyal following.

What the Numbers Mean for the GenAI Market

The traffic data paints a picture of a market dominated by ChatGPT but increasingly open to disruption. The slight erosion in OpenAI’s share, coupled with the rise of DeepSeek and Grok, suggests users are willing to experiment with alternatives that offer specialized features, lower costs, or differentiated user experiences. For businesses and tech leaders, this signals an opportunity to invest in or partner with emerging players, particularly those addressing underserved use cases like open-source AI (DeepSeek) or conversational truth-seeking (Grok).

Google’s slow but steady gains also warrant attention. As a tech giant with unparalleled distribution channels, its GenAI offerings could accelerate if integrated more seamlessly into products like Search, Workspace, or Android. However, its current 5.6% share indicates it’s playing catch-up, a surprising position given its AI research legacy. Perplexity’s stagnation, meanwhile, highlights the challenges of competing in a crowded field. While its search-focused AI has carved out a niche, scaling to rival ChatGPT or even DeepSeek will require significant innovation or partnerships to boost visibility and adoption.

Looking Ahead: A More Competitive GenAI Landscape?

The GenAI race is far from over, and the traffic data suggests a dynamic future. ChatGPT’s lead is secure for now, but the emergence of DeepSeek, Grok, and incremental gains by Google point to a market where user preferences are diversifying. For businesses, developers, and investors, the key will be identifying which platforms can deliver not just cutting-edge technology but also compelling user experiences and scalable ecosystems.

As of May 2025, ChatGPT remains the king of GenAI traffic, but the crown is no longer uncontested. Whether DeepSeek’s enterprise focus, Grok’s conversational edge, or Google’s slow-burn strategy can chip away at OpenAI’s dominance will depend on their ability to innovate and capture the imagination of a growing AI-hungry audience. One thing is clear: the GenAI race is heating up, and the next six months could bring even more surprises.