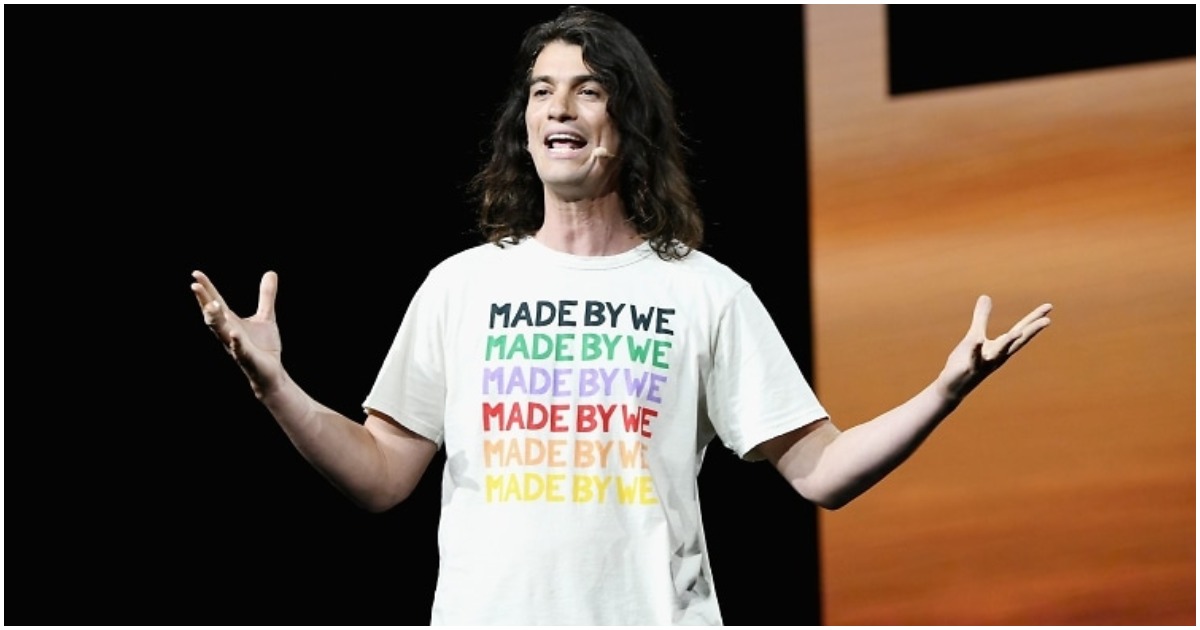

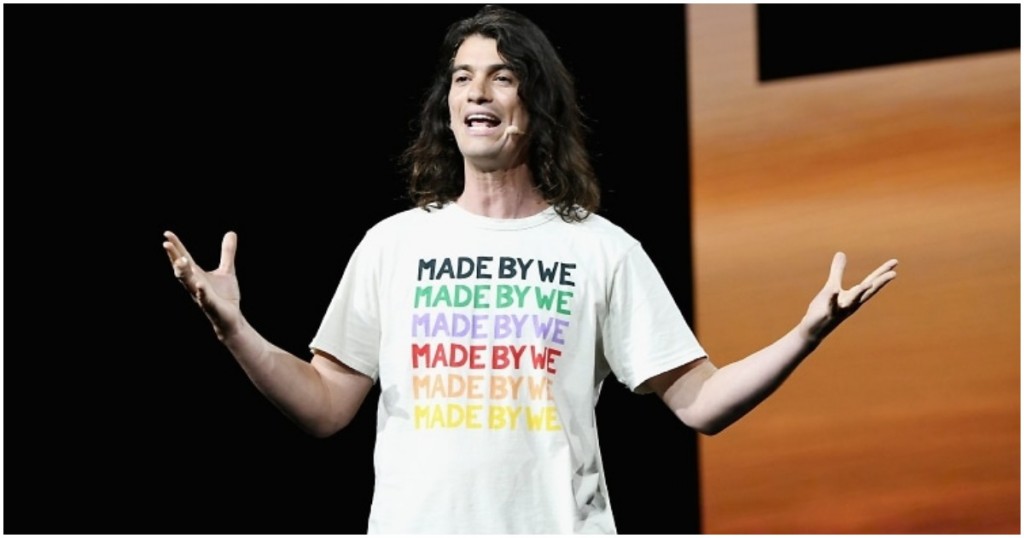

Until two months ago, WeWork was on top of the world. The coworking spaces provider, which at $47 billion (Rs. 3.3 lakh crore) was among the highest valued startups in the world, had announced that it was going public. Its IPO was going to be among the biggest tech IPOs this year, and was meant to make WeWork CEO Adam Neumann, its biggest investor Softbank, and thousands of WeWork employees a lot of money.

But it was not to be — soon after the company released its S-1, through which it gave details around its finances and plans, it found few takers. Reports suggested that WeWork was overvalued, and would manage to go public only at a valuation of $20 billion. That figure then went down to $10 billion. And finally, the IPO was scrapped. Amidst the melee, CEO Adam Neumann lost his job, Softbank saw its biggest bet crumble, and WeWork’s reputation was tarnished forever.

But the backlash from the financial markets might have been partly of WeWork’s own making. There were several situations about the company that caused some to raise eyebrows, and some others that looked downright illegal. Here are some of the most egregious ones.

1. Trademark of the name “We”: As its IPO approached, WeWork changed the name of its company from WeWork to simply We, to reflect its growing aspirations beyond the co-working spaces market. But investors learnt that the name “We” hadn’t been trademarked by the company, but by CEO Adam Neumann through a holding company. WeWork was paying CEO Adam Neumann $6 million (Rs. 42 crore) a year just to be able to use the name “We”.

2. Voting rights: Investors discovered that even after the company went public, CEO Adam Neumann would have disproportionate voting rights at the firm. This is not uncommon in tech — at Facebook, CEO Mark Zuckerberg has similar voting shares — but at WeWork, this was compounded by other factors. One of the clauses in its S-1 said that in the event of Neumann’s death, it wasn’t the company’s board that would choose his successor. Instead, Adam Neumann’s wife, who was also the Chief Brand Officer of the company, would choose his successor.

3. Conflict of interest: WeWork leases office buildings from thousands of landlords across the world, and then leases them out to freelancers and startups. But it was discovered that Neumann himself owned four buildings that WeWork had leased, and was receiving payments from the firm. This was an obvious conflict of interest that didn’t sit well with public markets.

4. Adam Neumann’s investments: WeWork’s S-1 gave the impression that WeWork’s investments weren’t always well thought out, or in the best interests of the firm. CEO Adam Neumann was an avid surfing fan, and WeWork had invested millions in two surfing startups. Investors found it hard to imagine why a coworking spaces company would invest in surfing businesses.

5. Adam Neumann’s financial profligacy: Apart from investing money in surfing startups, Adam Neumann had made some questionable business decisions as well. The company had purchased a $60 million plane to ferry executives across the globe. It was thought that for a company that had lost nearly $1 billion in the previous year, it might not have been the best investment.

6. Drug use: Some concerning issues around Adam Neumann’s drug use also came to light. The CEO had reportedly smoked marijuana while on a private jet, and the company that had owned the jet had later found a sizeable chunk of the drug on the plane and had recalled it. Neumann reportedly also had tequila shots while at work, and once showed up to an investor meeting with an apparent hangover.

7. WeWork’s eccentricities: The S-1 is a formal document that lays out a company’s plans ahead of its IPO, but WeWork’s was somewhat unusual from the average company’s. WeWork’s S-1 began with the somewhat bizarre proclamation: “We dedicate this to the energy of We — greater than any one of us, but inside each of us.” WeWork also had an unusual corporate culture — CEO Adam Neumann would often walk around office barefoot, and because the company believed in going vegetarian, no employee was allowed to expense meat items when they ate out.