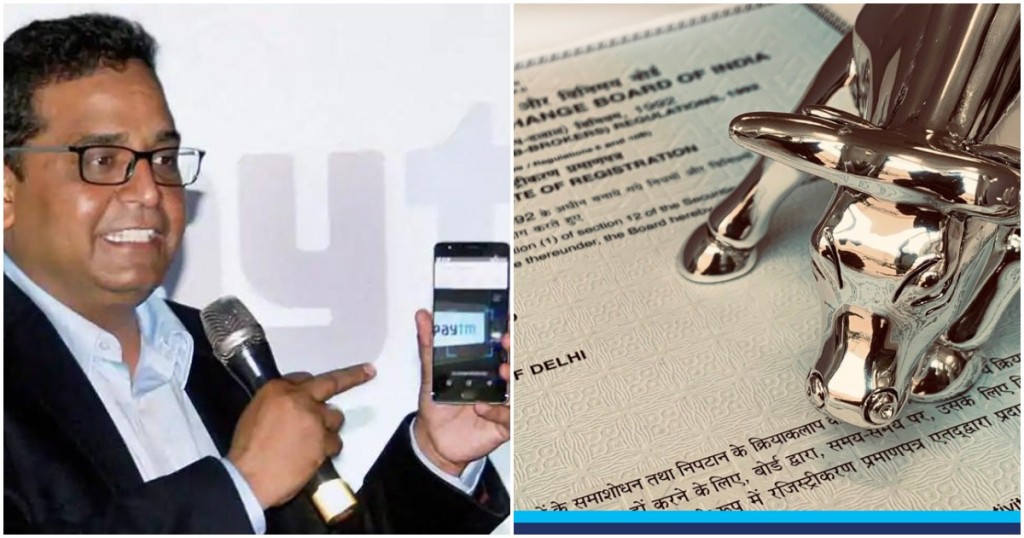

After doing everything from payments, mobile recharges, e-commerce, flight, bus and train tickets, gold sales, movie bookings, and even sales of gold, Paytm is now looking to become a stock broker.

“We are thrilled to announce that Paytm Money has received approval from securities & capital market regulator SEBI (Securities & Exchange Board of India) to start our next offering — Stock Broking,” Paytm said in a blogpost. “In addition to this, we are also excited to announce that Paytm Money’s membership with exchanges — BSE & NSE is also approved.”

This means that people will now be able to buy and trade stocks on Paytm. Paytm has indicated that it will offer more sophisticated forms of investments as well. “We will be introducing new capabilities & offerings on our platform, such as trading in equities & cash segments, derivatives, ETFs and more exchange traded products,” it added. “With this, we are moving closer to becoming a full-stack wealth management platform as we had set out, and inline with our vision & mission to bring wealth creation opportunities to millions of Indians.Our efforts will continue towards providing our users the simplest, most transparent and best investment experience in India,” the blogpost said.

This will place Paytm in direct competition with established stock brokers like ICICI Direct and HDFC, which have been running their broking businesses for years. It will also put it in direct competition like newer entrants like Zerodha, which has quickly become the largest stock broker in the country. Zerodha had, with a combination of a slick tech platform and cheap fees, pushed aside more established players to occupy the top slot in the broking business. Paytm, being a tech company, likely will have the technical nous to build a robust platform of its own. And it’s been known to historically undercut competition, which means that its charges are likely to be low. If Paytm plays its cards right, it might just end up creating a stock broking product that finds lots of users.

Paytm already has a bit of a user-base set up. Last year, it had launched Paytm Money, through which it allowed users to buy mutual funds on its platform. This initial user-base could well end up becoming the first customers for its stock broking operations — Paytm’s reach would’ve ensured that many of Paytm Money users would’ve been first-time investors in mutual funds, and having dipped their toes into the world of investing, could now want to directly buy and trade stocks. Also, experienced investors who’re pleased with their Paytm Money experience will likely use Paytm’s stock broking business as well.

Paytm hasn’t yet specified when it will launch its stock broking operations, but asked users to stay tuned for launch dates and pricing. While stock broking seems like a natural fit for Paytm’s business at the moment, not all of its experiments have gone as per plan. Paytm Payments Bank hasn’t exactly changed banking as it had initially claimed it would, and even Paytm Mall seems to be floundering. Time alone will tell if Paytm’s stock businesses ends up becoming a mainstay for the company, or becomes a product that customers weren’t exactly bullish on.