Zomato and Swiggy are currently locked in a duopoly in India’s food ordering space, but one company is rapidly gaining on another.

Zomato now has a 57 percent market share in India’s food ordering space, a report from Goldman Sachs has said, and Swiggy is at just 43 percent. This is up from the 55 percent market share Zomato had last year. At least since 2018, Zomato has been gaining market share each year over Swiggy.

The latest report means that Swiggy continues to squander the head start it had on Zomato in the food delivery space. Swiggy had started its food delivery operations in 2014, but Zomato, which had been founded all the way back in 2008, at that time only listed menus of restaurants. Zomato entered the food delivery space in 2015, a year after Swiggy had begun delivering food.

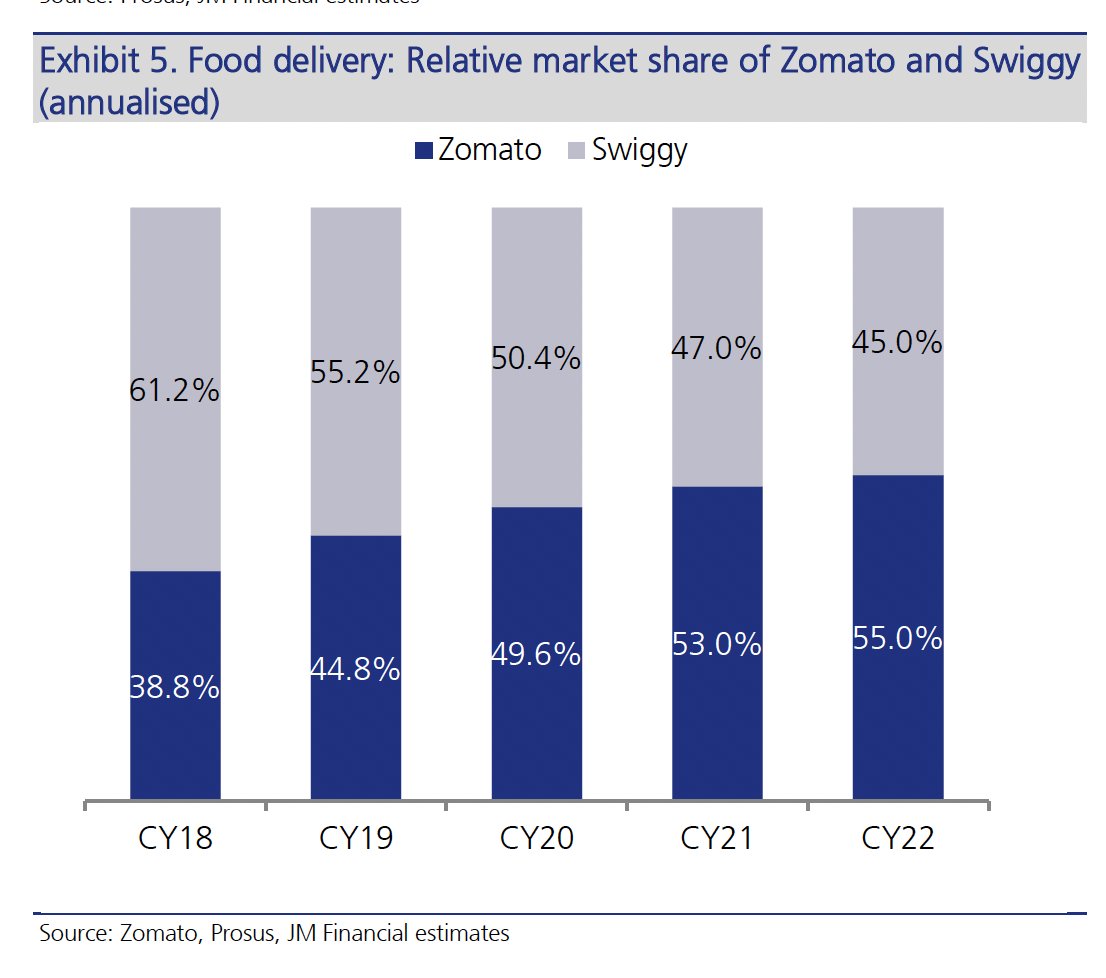

By 2018, Swiggy had a commanding lead in the market, accounting for 61 percent marketshare compared to Zomato’s 39 percent. But since then, Zomato has steadily grown its food ordering business. It rose from 39 percent in 2018, to 45 percent in 2019. In 2020, the year the pandemic struck, Zomato and Swiggy were neck-and-neck with 49.6 percent and 50.4 percent market share respectively. But Zomato has continued to grow its market share since then: it rose to 53 percent in 2021, and to 55 percent in 2022. In 2023, Zomato appears to have managed to raise its market share to 57 percent, while Swiggy is now left with just 43 percent market share.

And Zomato seems to be still growing faster than its nearest rival. Zomato’s gross order value rose 36 percent year-over-year, compared to 26 percent growth at Swiggy; Zomato’s overall adjusted revenue grew by 56 percent this year, compared to 24 percent revenue growth at Swiggy. Even in the quick commerce segment, Zomato’s Blinkit is the largest player, and is twice the size of its nearest competitor. And most impressively, even as Zomato is growing, it is also managing to make money — Zomato reported an EBITDA income of $5 million last year, while Swiggy reported a loss of $158 million. This also seems to be reflecting in the two companies’ valuations — Zomato is currently valued at around $20 billion in the public markets, while Swiggy’s valuation is currently at around $15 billion. And even though the two companies are the only players left in the food delivery space, it’s clear that one is doing a lot better than the other — and is pulling ahead in the race.