If you have been struck by an idea and aim to culminate it into a successful venture aka startup, then you are eligible to take advantage of the Startup India initiative launched by Prime Minister Modi earlier this year. The Prime Minister had talked about ‘Startup India, Stand up India’ initiative during his Independence Day speech last year. On January 16, 2016 he unveiled the action plan of the initiative to develop an ecosystem for startups to grow further. The plan aims at promoting bank finances and promises to encourage job creations.

However, it’s been 10 months since the action plan was launched, but still many people and startup entities are confused about how to take advantage of the scheme. Here’s our attempt to answer your queries regarding the scheme.

What is a Startup?

The action plan defines startups as, “Startup means an entity, incorporated or registered in India not prior to five years, with annual turnover not exceeding INR 25 crore in any preceding financial year, working towards innovation, development, deployment or commercialization of new products, processes or services driven by technology or intellectual property. Provided that such entity is not formed by splitting up, or reconstruction, of a business already in existence. Provided also that an entity shall cease to be a Startup if its turnover for the previous financial years has exceeded INR 25 crore or it has completed 5 years from the date of incorporation/ registration. Provided further that a Startup shall be eligible for tax benefits only after it has obtained certification from the Inter-Ministerial Board, setup for such purpose.”

In addition to the above points, it’s important to remember that an entity is termed as startup if it’s registered under Companies Act, 2013, under section 59 of Partnership Act, 1932, as partnership firm or under Limited Liability Partnership Act 2002, as a limited liability partnership. Which means Solo Proprietorship Firms cannot benefit from the startup India scheme.

An entity is considered as a startup only if it aims to develop and commercialize a new product or service or significantly improves an existing product or service, that adds significant value for customers and workflow.

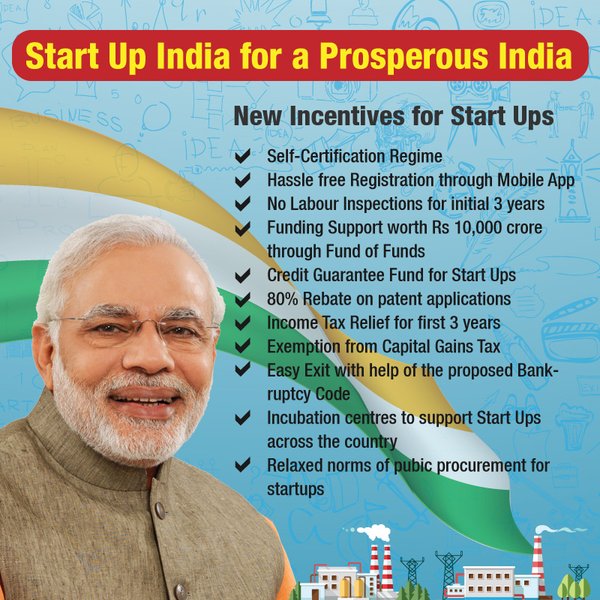

Key advantages of Startup India scheme

- Self certification

- 3 Years exemption from inspection

- An online portal and mobile application

- 80% deduction on patent filing fee

- A single point hub for hand holding

- No tax in profits for 3 years

- No capital gain tax for 3 years

- 10,000 crore fund dedicated to promote startup

- Bankruptcy bill 2015 – 90 days window to startups to close businesses

- 80% discount of patent filing fee

- Mobile app for startup registration in one day

- 500 tinkering labs

- 35 public private incubators

- 31 innovation centres at national institute

- credit guarantee scheme for loans

- 5 new bio clusters and 7 new research parks

- Patent regime and IPR to be simplified

How to apply for the Startup India Scheme

Visit the official website of Startup India to register your business and provide relevant documents for self-certification and tax exemption.