The National Payments Corporation of India has provided greater detail into how it plans to make sure that no single entity can have too much control over UPI ecosystem.

NPCI has provided clarity into how it’ll implement its previous ruling, which had said that no UPI app can have more than 30% share of payment volumes in India. The guidelines have come into effect on 1st Jan 2021, and companies which currently exceed the 30% threshold will have a period to 2 years to bring down their market share to 30%. Currently, PhonePe accounts for 42% of transactions, while GPay has a near 38% market share.

“The Volume Cap for a TPAP shall be effective from 01st January, 2021 and the approved logic to calculate the Total Volume of the TPAP shall be uniformly reported on the NPCI website,” a circular from NPCI said. “As a first step to achieve compliance, NPCI has started reporting UPI app’s value and volume on the NPCI website, which shall be further improved in accordance to the SOP in the due course. NPCI shall share the details on the TPAP volumes, the compliance to the SOP and actions taken with the Regulator,” it added.

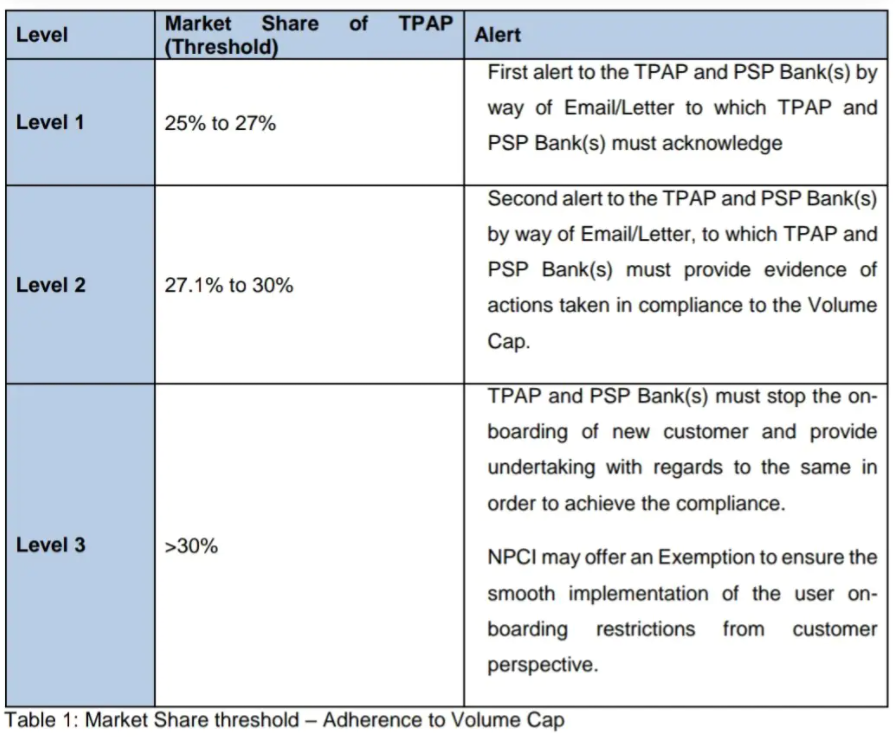

NPCI has also created an elaborate three-tier structure to ensure compliance. Apps will touch Level 1 when their market-share reaches 25-27%, and will be sent an alert, which they must acknowledge. They’ll touch Level 2 when their market share is between 27.1% and 30%, and at this point the apps must take steps to bring down their market share, and then share them with the regulators. Level 3, or above 30% market share — at which PhonePe and GPay are at currently — requires apps to stop onboarding new users.

NPCI says that the systems are designed in such a way that the current users are not impacted. There will also be a provision to exempt the players to some extent when the volume cap is reached, so that it does not create sudden disruption in the market. Such exemptions will be for a limited time period of 6 months based on the request by the app to their bank when they breach a threshold. This could mean that companies won’t immediately have to stop onboarding new users, and will have a two-year window to meet the compliance requirement.

However, at Level 3, companies will need to send out the following messages to new users. “Dear user, as per NPCI rules any UPI app with more than 30% market share cannot onboard new customers until their market share goes down. Currently, <App name’s> UPI market share is <XYZ>% so unfortunately, you’ll have to wait a while before you can access our UPI services. We apologize for the inconvenience and promise to notify you as soon as NPCI allows us to onboard you again,” the message will have to say.

It’s an elaborate system, and show how serious NPCI is about implementing a guideline it had first mentioned last year. The regulation is perhaps necessary — UPI now processes more payments than debit cards and credits, and having a single private player control a large fraction of this space could lead to systemic risks to the entire Indian payments system. By capping the market share of individual apps at 30%, NPCI will ensure that no single player will be able disproportionately control the UPI space.

This comes as bad news for the leaders in the UPI sweepstakes — PhonePe and Google Pay had spent large sums of money to acquire UPI customers, and will now realize that not only will they not be able to corner the entire market, but will also have to actively bring down their percentage of transactions, which is an odd situation for a private company to be in. On the other hand, the biggest winner of this new ruling might be Paytm — it had pioneered the digital payments revolution in India with its wallet-based payment system, but had been outstripped by both PhonePe and Google Pay with their UPI implementations. Now with both PhonePe and Google Pay constrained at 30%, Paytm can hope to bring up its own market share and match them in UPI transactions. And all this while, it’ll still have its own wallet-based system, so it might once again take the lead in the overall payments systems in the country. Digital payments have always been a topsy-turvy space in India, and the latest ruling might upend the market once again.