India’s quick-commerce party was just getting started, but dark clouds seem to already be gathering on the horizon.

The All India Consumer Products Distributors Federation (AICPDF), which represents 4 lakh retail distributors, has accused quick-commerce companies of engaging in predatory pricing. Predatory pricing refers to selling below market cost to drive out competition. The AICPDF is India’s largest representative of retail distributors, and handles products of companies including Nestle and Unilever.

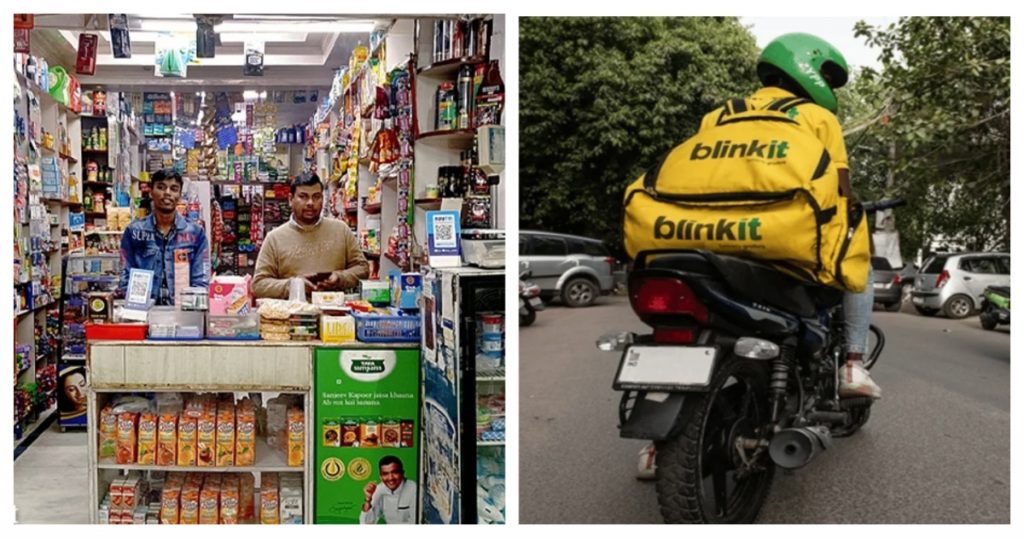

In a letter written to the Competition Commission of India, the group said that several consumer goods companies were dealing directly with quick commerce firms to increase their reach, which was sidelining the traditional salespeople who went from shop to shop to deliver orders. Such practices make “it impossible for traditional retailers to compete or survive,” the letter said. “Implement protective measures for traditional distributors and small retailers to safeguard their interests,” the letter urged. The CCI has powers to initiate an investigation on its own if it find merit in complaints, a government official told Reuters.

This isn’t the first time that Indian retail groups have raised concerns about the operations of quick-commerce companies. In August, the same group had raised concerns that quick-commerce companies could be violating FDI laws. “The FDI rules clearly prohibit e-commerce entities operating under the marketplace model from holding inventory or exercising control over the inventory sold on their platforms. However, it appears that these quick commerce platforms may be engaging in practices that blur the lines between a marketplace and an inventory-based model, potentially violating FDI norms,” it had then said.

And in recent months, the Indian government has taken tough stand on such practices. Two months ago, India’s Commerce Minister Piyush Goyal had launched a scathing attack on Amazon, alleging it had been incurring losses in India for years with an aim of removing competition, and raising prices when it had a monopoly in the market. He had also said that many e-commerce companies were creating shell companies to evade India’s FDI laws.

As such, a large distributor group turning up the heat on quick-commerce companies could lead to some headwinds for the burgeoning sector. Over 50 percent of the shareholding in Blinkit’s parent Zomato is foreign-owned, while the percentages are even greater for Zepto and Swiggy. These companies are only allowed to run a marketplace model in India, and not hold any inventory themselves. But if these quick-commerce companies don’t hold their own inventory, it can make it hard for them to reliably deliver products in 10 minutes. These companies will have the option of creating other companies which could technically hold inventory, but these issues around compliance with FDI regulations could be an important attack vector for Indian’s incumbent distributor network that’s now clearly feeling threatened by the rapid rise of the quick-commerce industry.