Swiggy’s IPO might have had muted interest from investors — the retail portion of its IPO was subscribed only 1.14 times — but it seems to have delivered the goods on opening day.

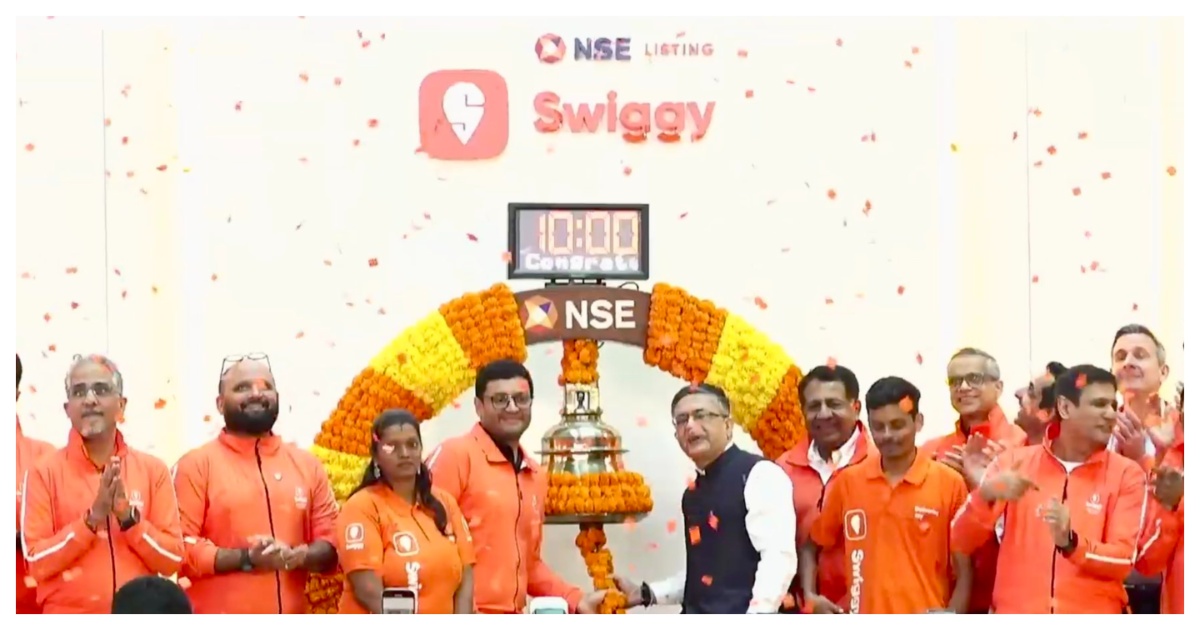

Swiggy went public today on the stock markets. The IPO price had been set at a price between Rs. 371 and Rs. 390, but the stock opened at Rs. 442, representing a 13 percent jump over its IPO price. The stock gave up some of its gains soon after, but then spiked again towards the end of market close, ending at Rs. Rs. 456, up 17% for the day.

Swiggy’s strong performance was made more impressive given how the broader markets had underperformed during during trade today. Both the Nifty and Sensex fell over 1 percent on the day, and the midcap and smallcap indices were down nearly 3 percent. Zomato’s shares were down 0.6 percent. Swiggy, though, ended the day 18% over its listing price.

It’s perhaps the choice at which Swiggy chose to list that helped it make gains in trade today. Swiggy competes head-on with Zomato, but chose to go public at a valuation less than half that of its arch-rival. Zomato does have superior metrics, and is seen to be innovating faster than Swiggy on newer verticals such as live events, but investors clearly felt that the Swiggy scrip was undervalued, especially in comparison to Zomato, and chose to buy into it. At close of trade today, Swiggy had a market cap of Rs. 1.02 lakh crore, compared of the market cap of Rs. 2.28 lakh crore for Zomato.

Swiggy’s IPO conservative IPO pricing could have been inspired by Paytm’s debacle at the bourses. Paytm had chosen to go public at a valuation of $21 billion, which was much higher than its last private round of $16 billion. The stock had crashed on listing, becoming the worst-performing large IPO anywhere in the world. Even three years after the IPO, the stock is languishing at one-third of its IPO price. This appears to have made other startups become more cautious in pricing their public market debuts — earlier, Ola Electric too had listed at a discount to its last private valuation.

But Swiggy’s IPO will count as one of the biggest wins from India’s startup ecosystem. The company was founded just 10 years ago, and had to slug it out with a slew of food delivery companies like TinyOwl, UberEats, Foodpanda and others in its early days. Swiggy managed to become one of the two companies that survived the food delivery wars, and eventually expanded into other areas like groceries, and most recently, medicine deliveries. The battle isn’t over though — Swiggy will have its task cut out as a public company and will have to compete with Zomato and food delivery and Blinkit, BigBasket, Zepto, JioMart and Tata’s Neu Flash in quick commerce. But for now, Swiggy’s IPO had made tons of money for its executives and early employees, and will be yet another milestone for India’s fledgling startup ecosystem.