Most entrepreneurs start their business and and are immediately running in the race to become a successful business persons. However, many founders are too busy promoting their products that they forget to establish the basic payroll needs of the firm, which can create significant problems in the future.

With this write-up, we hope to help startups out with their accounting management.

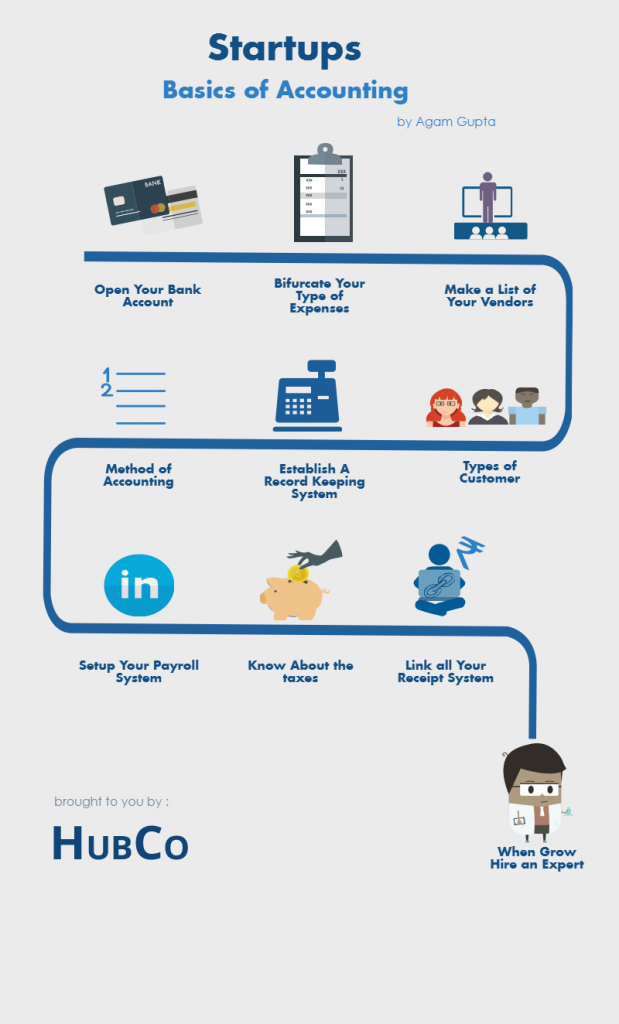

Below mentioned is the list of some small business accounting steps with the help of an Infographic, which will give you the confidence to know you’ve covered your basics, and you are ready to move on to your product development and be more focused towards your product growth.

Let us explain these points one by one:

1.Bank Account

The first and foremost thing to start with is to open a bank account, a place where you can put your money and from where you can take your money out. Having different bank accounts will make your life easier like for tax payments, vendor payments, receipts from payment gateways, receipt in cash or through cheque. Once you register your company or firm, you can open your bank account with the help of pan card application and registration certificate quickly.

Before going for opening up of a current account, please compare all banks fees and features they give you.

2.To know about your expenses

To start a business with a solid base, you need to know about your expenses, and what expenditures you incur the most. You should have a proper system of keeping all your bills and other important records.

This is the most important step that allows you to monitor your growth and helps in knowing the financial position of the company at any point of time.

Some of the expenses which mostly incurred – Food and Beverages, Entertainment expense, Courier Expense, Conveyance, Repair and Maintenance expenditure.

3. Identify Your Vendors

The next step is to determine your vendors. Make a list of them and ensure to keep a proper record of payments and purchases. Also, it is good to verify your balance in vendor’s account at the specified point of intervals.

4.Maintain data about your Customers

This point is also crucial regarding the growth perspective of the company; you need to verify your product types, and accordingly you should tag your clients with the products they have bought from you. Also, this exercise will help you in upselling of other products to your existing customers.

5.Develop a Recordkeeping/Bookkeeping system

Bookkeeping means recording of your day to day transactions, categorizing them in their heads and reconciliation of banks with your accounts.

As you are new to accounts and your business, also you should start to think which method you should follow to do your accounting-

There are three methods you can use-

a.Do It Yourself {DIY} – You can choose to go the DIY route and use software likeQuickbooksor Tally, or you could use a simple Excel spreadsheet to maintain your accounts.

b.Outsource the Accounts– You have the option of using an outsourced or part-time accountant that’s either local or cloud-based.

c.Hire an Inhouse Accountant – If your business is big enough, you can opt for an in-house accountant for your company who can do all your work under your roof.

6.Identify the method of Accounting

After establishing your system, you need to determine the basis of accounting you should follow in your business-

- Cash Method: Income and Expenditure are recognised/booked at the time when they received or paid.

- Accrual Method: Income and Expenditure are recognised/booked at the time when the transaction occurs irrespective of the fact, whether cash received for the particular transaction or not.

More than 95% of Indian businesses use the accrual method of accounting as it depicts the actual profit or loss of the company through the year.

7. Set up Payroll / HR System

If you’re a young business, and you won’t have employees in numbers that you cannot manage, but as the time passes and business grows you need to hire employees and for them you need to decide their rosters, salaries and also take care of any tax part that this deducted from their earnings.

8.Keep a track of your Taxes

In business, always you need to take care about your growth hindrances, and also, you need to take care if any penalties or any Government compliances you need to adhere to.

There are some taxes which you need to take care as and when applicable on your business like Service Tax (if you are a service provider), Sales Tax (if you are a Trader), Excise(if you are a manufacturer) and so on. These taxes needs to be taken care crucially as if this is not followed you need to end up paying high penalties and bear real punishment from the government.

9.Improvise as you go

Like practice makes a man perfect, as you start with simple keep-ups in a spreadsheet, and as you go, you keep on changing your record keeping methods, your transaction booking methods. The little time you spend doing your accounting will be more than worth the time you save for your business.

10.Hire an Expert when needed

If you are unable to maintain your accounts properly, or it is difficult for you to handle the tax and compliance part, then you should be advised to go with an expert.

In the market, there are various accounting and compliance firms available with which you can choose.

[The author, Agam Gupta, is a practising Chartered Accountant and a co-founder of Hubco.in, a leading portal to get your accounting outsourced and Service tax registration. You can contact him at [email protected].]