Not willing to take the alleged reports of it shutting down and being on sale with no buyers, lying down, Foodpanda has finally spoken up. The restaurant aggregator and logistics startup, claims that they are still going strong in India and the company will be profitable in the next 3 years.

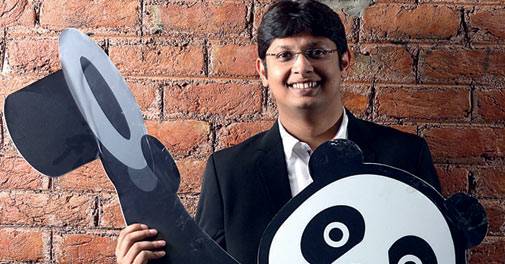

Speaking to Business Standard, Sauraabh Kocchar, CEO of Foodpanda India said about India “It is a $300 billion market, we are planning to play a much bigger role and stay the market leader. We are not selling out, we are leaders by far in this category in this industry and we intend to keep going at it and play a more dominant role.”

Foodpanda was in the news for wrong reasons last year when Mint had ran an expose on the corruption prevalent in the company followed by news of students taking the company to court over billing miscalculations and finally for laying off employees en masse. Critics and cynics had begun to write off the company and news of its imminent sale and parent company Rocket Internet giving up on its Indian businesses have been surfacing.

“We are maturing in our process and technology, which also means that tough decisions would need to be made. Technological advancements are helping us run a much leaner business,” added Kochhar.

The company also said it had adequate cash in the bank and was not looking for fresh funding. “We have many investors interested in investing in us in India and abroad but we are not looking for any fresh rounds of funding. If something happens, we are open for a fresh round of funding, but we are not actively looking for funds,”

The company is bullish on its prospects in India, a country it counts amongst the top 5 markets, the other being Russia, Singapore, Saudi Arabia, HongKong and Malaysia.

Kocchar predicted an imminent consolidation in the food tech market, which has been troubled with many players of late, and hinted that one of other two big players in the market may shut down or be acquired.