It’s been a week since Rs 1000 and Rs 500 notes were demonetised. Expectedly, the stock markets have fallen since the announcement. The BSE Sensex, which closed at 27,591.14 on November 8, 2016 stood at 26,298.69 on November 16, 2016, registering a decline of 4.7%. Here’s how the different sectors have responded to the demonetisation move.

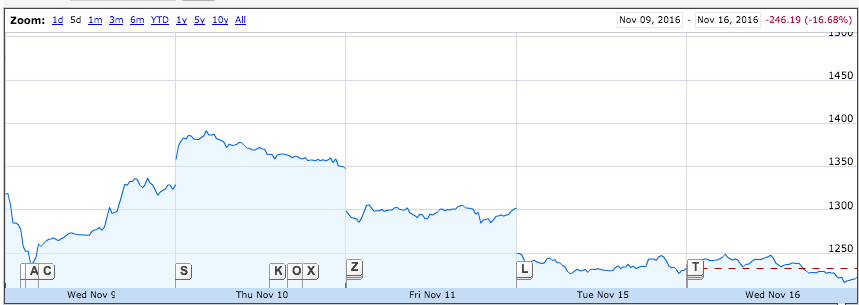

BSE Sensex

The sectors which have borne the brunt of the beating have been realty, consumer durables and auto sectors. While BSE Realty index has declined by 17.2% during the period, the BSE Consumer Durables index and BSE Auto index have fallen by 13.2% and 11.4% respectively. The metal and capital goods sectors have fallen less. The BSE Metal index has declined by 3.2% while the BSE Capital Goods index has fallen by 3.1%. The sectors which have been impacted the least are the banking and healthcare sectors. While BSE Bankex has fallen by 2.2%, BSE Healthcare has declined by only 1.9%.

BSE Realty Index:

BSE Consumer Durables Index

BSE Auto Index

Within the consumer durable sector, stocks of jewellery companies registered the steepest fall. P C Jewellers fell by a whopping 32% followed by Gitanjali Gems by 25% and Tribhovandas Bhimji Zaveri by 22%. In the realty sector, DLF declined by 24% and Ansal API by 16%.

According to observers, the demand of white goods in the coming months could decline as major portion of sales is cash-based. The mid-term outlook for the gems and jewellery sector could also be impacted. The demand for housing sector, especially in the luxury and ultra luxury segments is also likely to be affected, bringing down prices in the next 3-6 months.