Flipkart is taking steps to be head-and-shoulders above the competition as far as India’s online fashion space is concerned.

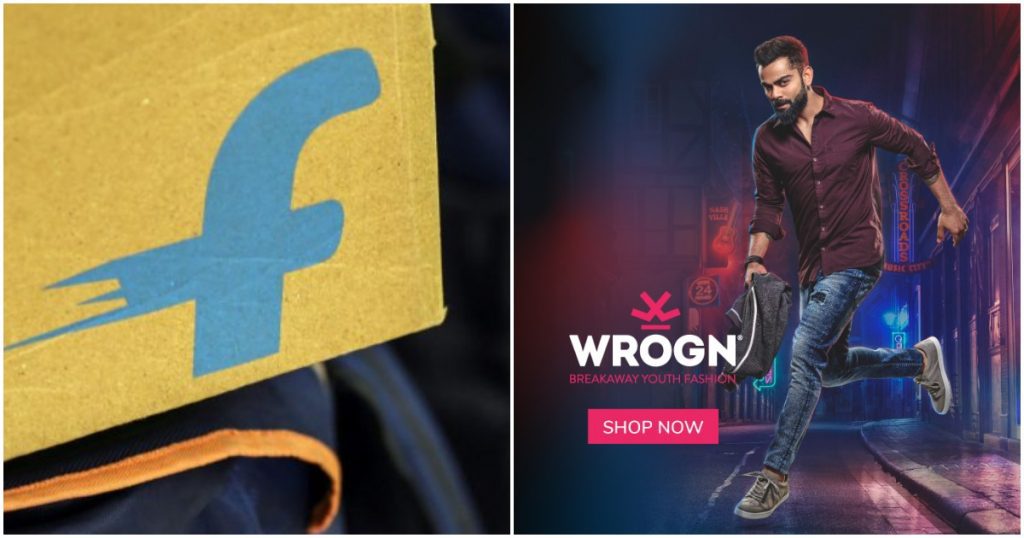

Flipkart has made a strategic investment in Universal Sportsbiz (USPL) as a part of a the company’s Series F round. The round also saw investment from existing investor Accel, which incidentally was also Flipkart’s first investor. Universal Spotsbiz creates fashion brands in partnership with celebrities, and so far has three such brands: Wrogn with Virat Kohli, Imara with Kareena Kapoor, and Ms. Taken with Kriti Sanon.

“USPL’s unique brands, backed by celebrity endorsements, have a strong appeal for the young fashion-driven Indian consumer. This investment will help USPL and the Flipkart Group find deeper synergies as we continue on our commitment to grow an ecosystem of partnerships that deliver value for consumers and brands,” said Kalyan Krishnamurthy, CEO at Flipkart Group. He added that Wrogn was among the fastest growing men’s casual wear brands in India, and is also one among the top-selling brands on Flipkart-owned Myntra. Additionally, Universal Sportsbiz’s products are sold through over 750 offline retail outlets across 100 cities, with the company clocking a 40-50% year on year growth.

The investment builds on Flipkart’s already-impressive fashion portfolio. Apart form its own fashion arm, Flipkart runs Myntra, and had earlier acquired Jabong and then merged it into Myntra. Earlier this year, Flipkart had spent Rs. 260 crore to purchase a significant minority stake in Arvind Fashions, which runs brands including Flying Machine, Arrow, US Polo, and Tommy Hilfiger in India. Last week, it had spent Rs. 1500 crore to purchase a 7.8 percent stake in Aditya Birla Fashion, which runs brands like Allen Solly, Peter England, and Louis Philippe. Additionally, Flipkart is also an investor in fashion brand HRX, which is co-owned by Hrithik Roshan.

Flipkart’s sizable investments in the fashion category give the company a leg-up over competition in the space. Amazon has a 5% stake in Shoppers Stop which it had purchased in 2017, while JioMart can benefit from the 45 fashion brands Reliance Retail runs in India, including Armani, Burberry and Jimmy Choo. There are several verticals to the jigsaw that makes up e-commerce, but Flipkart is trying to make sure that it’s creating some distance between itself and its arch-rivals when it comes to fashion.