[This post is written by Arpit Agarwal, Principal at Blume Ventures. This post is an abridged version of a post published here. The previous posts in this series can be read here and here. You can get in touch with him on Twitter and Linkedin]

The only two things that matters to a VC when she invests in a startup is the stake she’s getting and the amount she’s investing. If you’re seen as obsessed too much about valuation, you’re likely to be considered a hard-nosed founder. So be smart and play for ‘lower dilution’ instead. In case you argue that these are one and the same thing, think again 🙂

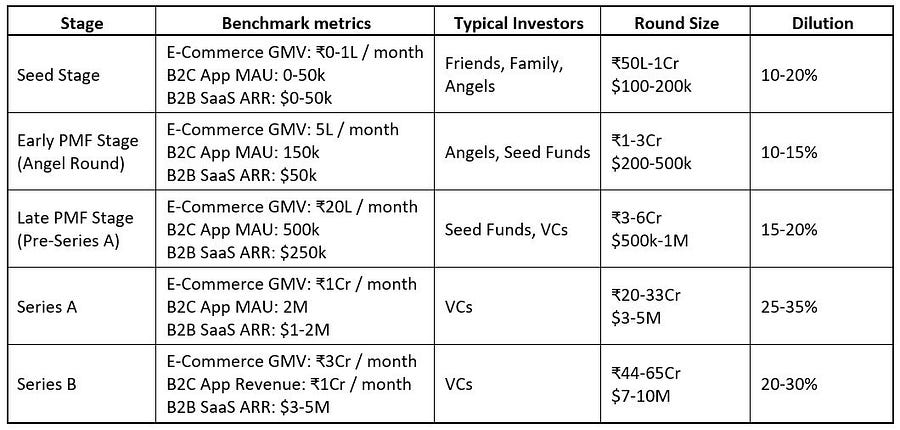

The table below presents a broad structure of startup funding in India today. This is what is considered ‘average’ in our industry. Please note that all these numbers are only representative in nature and deals frequently happen on both sides of these extremes. Also, like any well-functioning market, these prices represent only a momentary equilibrium and this changes over time:

(In this table, GMV is Gross Merchandise Volume, or the total sales; MAU is Monthly Active Users; and ARR is Annual Recurring Revenue)

What are the Terms and Conditions?

- At any stage of investment, the investor is making a forward judgement on the exit outcome. Hence, it is common for investors to bake the exit scenario in the way you are being valued. For example, if a Series A investor, who’d typically expect a startup to exit at $500M, may value a startup which may exit at only $250M (in their minds) much more harshly than a startup which could easily build a $1B or more as an outcome.

- All the rules of the market —namely, demand and supply — still apply. It is not uncommon for serial/exited entrepreneurs to raise money at 5–10x valuation than first-time entrepreneurs.

- Valuation remains the last step. Hence, if you don’t pass any of the filters a VC has in their model, your willingness to price yourself very attractively doesn’t count.

How can you use this information?

First, it is always a great idea to know what’s the playbook on the other side. At the same time, smart people would know that such discrete classifications can’t be taken for granted. Second, whenever you have term-sheet on offer, you should know that valuation is largely formulaic for a VC, hence pay immense attention to the terms that come along with it. That’s the detail most first-time entrepreneurs struggle with!

Finally, as most experienced entrepreneurs will tell you,

forget valuation and focus on creating things of value.

If there’s value, valuation cannot be far behind. And creating anything of value is incredibly hard in any economy, doubly so in India. Once you are past your curiosity about valuation, you’d notice that life after raising VC money becomes much harder. In fact, the more you raise (by corollary, the higher your valuation) the more complicated it will get!