At times it can take a crisis on foreign shores to appreciate how well things are going on your own.

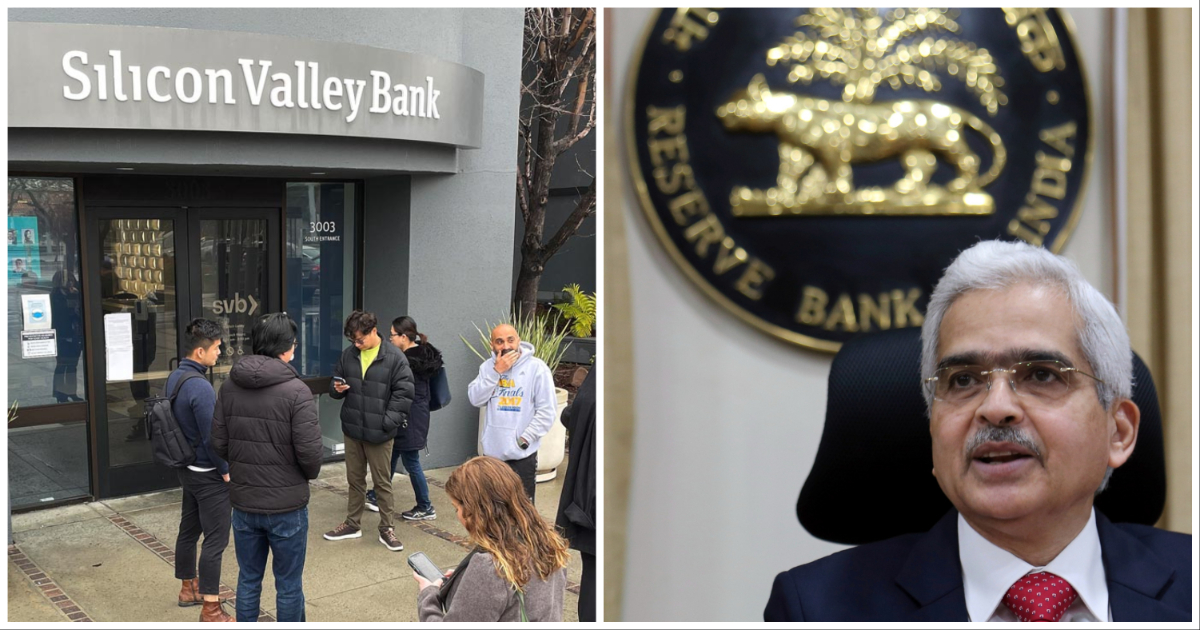

India’s entrepreneurs have lauded the efforts of the Reserve Bank of India and govt regulators after the dramatic collapse of US’s Silicon Valley Bank, which held the deposits of thousands of American startups. Silicon Valley Bank was shut down by US regulators on Friday after rumours had circulated that it was running out of funds. The news prompted a run on a bank, with as much as 25% of all deposits being withdrawn in one day. As the bank shut down its withdrawals leading to panic in Silicon Valley, some Indian entrepreneurs began talking about how different things were in India.

“WhatsApp groups are buzzing with appreciation for Indian regulators like RBI who have been consistently conservative,” said Snapdeal founder Kunal Bahl. “There is no doubt that time and again, their approach has ring-fenced India from systemic risks. We have a lot to thank them for. Just ask those stuck in Silicon Valley Bank right now,” he added.

“Silicon Valley Bank failure has investors calling for government aid,” said angel investor and former Infosys CEO Mohandas Pai. “India has RBI and Shaktikanta Das to make sure We are safe here! RBI is tough but safety is high,” he said, while tagging PM Narendra Modi and Finance Minister Nirmala Sitharaman.

“Hearing some of our startup portfolio saying money is in HDFC or Kotak is a huge relief,” wrote VC Aviral Bhatnagar. “Never expected that a $200Bn US bank larger than HDFC would be radioactive, while Indian banks would be sterling Big credit to Indian regulators + banks for saving us from huge tail risk,” he added.

Paytm CEO Vijay Shekhar Sharma replied “100% true that!” to a tweet which said that more than UPI, the world needed Indian Banking Regulator’s swiftness and expertise in preventing financial messes.”

“I remember when there were rumours about ICICI Bank 10 or 12 years back. RBI held an emergency meeting on Sunday and opened their currency chest on Sunday Any regulator across the world can’t match @RBI. Our Financial Systems are in great hands,” said GoQii founder Vishal Gondal.

“When your entire system is leveraged, the debt is $32 trillion, credit card debt above $1 trillion, tons of student loan. And u raise rates by 5% and tighten liquidity, you are inviting an accident. India is lucky to have RBI,” said Compcircle Managing Partner Gurmeet Chadha.

Finance influencer D Muthukrishnan also lauded RBI’s efforts. “RBI’s role in financial stability is vastly underrated. Every single depositor of banks in this country believes his money is safe. And it has always been safe. Banks have failed. But no depositor has ever lost. RBI is the best central bank in the world,” he tweeted.

It’s not hard to see why Indian entrepreneurs are so appreciative of the role played by the RBI over the last few years. The coronavirus pandemic has upended financial systems around the world, but the most visible impact has come from the US, where a three-decade old bank, which was among the top 15 largest banks in the country, has collapsed, and funds of thousands of American startups are stuck. The impact has also been felt by Indian startups, with as many as 60 Indian startups which had raised funds from Y Combinator also seeing their money stuck with Silicon Valley Bank. But Indian banks have been chugging along as normal, and haven’t stumbled once through the entire global crisis. It remains to be seen how the Silicon Valley Bank situation plays out, but it’s brought into sharp focus the skillful maneuvering of the Reserve Bank and other Indian regulators in managing the pandemic — and its after effects — in India.