Paytm wallets are once again pretty much unusable for users who haven’t completed their KYCs.

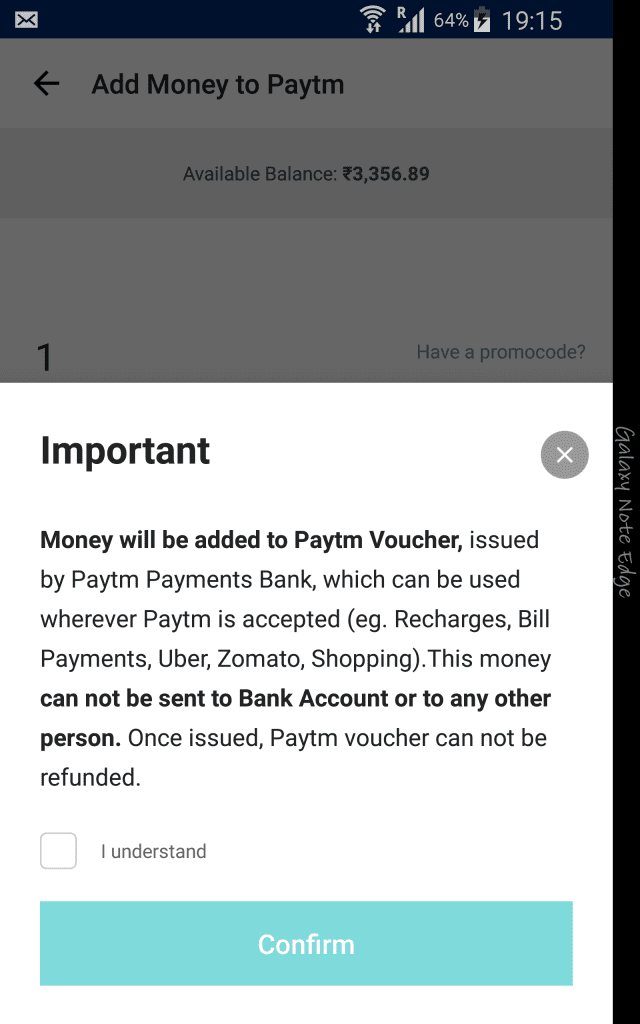

Paytm appears to have quietly rolled back its “Paytm Voucher” program, through which it allowed users who hadn’t completed their Know Your Customer checks to continue to add money to their wallets. As per RBI guidelines, mobile wallets were not allowed to let non-KYC add money to their wallets after 28th February. But starting 1st March, Paytm had begun letting its non-KYC users add “Paytm Vouchers” instead of money — these vouchers could be used wherever users paid through Paytm, but couldn’t be sent to other users, or transferred to bank accounts.

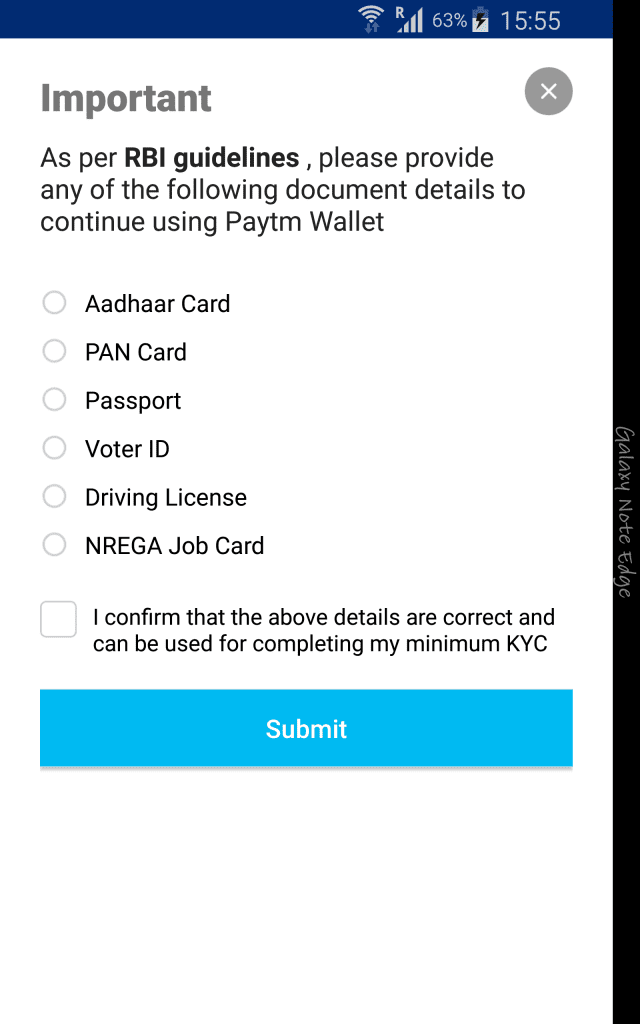

But barely a week after they were introduced, the option to load Paytm vouchers no longer appears on Paytm’s app. Non-KYC users are instead asked to submit their details for a partial KYC — this includes any one of Aadhar Card, PAN Card, Passport, Voter ID, Driving License or NREGA Job card. Only when users submit details of one of these documents are they allowed to top-up their Paytm wallets.

It’s unclear what’s prompted the change — we’d contacted Paytm when they’d first introduced Paytm vouchers, and VP Deepak Abbot had insisted that Paytm Voucher was compliant with RBI guidelines. Paytm had told us that Paytm Vouchers fell under the “Gift card” category in the RBI circular on Pre-paid instruments. The RBI guidelines state that Bank and non Bank entities are allowed to issue gift cards. These gift cards can have a maximum value of up to Rs. 10,000, and as per the RBI, a “separate KYC would not be required for customers who are issued such instruments against debit to their bank accounts in India.”

As such, it would’ve appeared that Paytm was in the right in issuing these vouchers. These vouchers could’ve come in handy for people who didn’t want to share their KYC details with Paytm, but still wanted to operate their wallets — users would’ve been able to pay bills, and make offline and online purchases on Paytm. But Paytm appears to have discontinued its voucher program, and its popular wallet — which has over 250 million users — is again pretty much unusable if customers haven’t gone through their KYC checks.

This could be a bit of a problem for the company — while there are no numbers currently available around what percentage of wallet users have completed their KYC processes, industry experts had estimated that only 10-30% of users had finished their checks by 1st February. Paytm would hope that it has built enough trust, and its wallet has enough utility for its users for them to hand over their KYC details to the company — if it hasn’t, it could see a large portion of its user base erode away in the coming months.

1 thought on “Paytm Has Quietly Removed The Option To Add Money Through Paytm Voucher For Non-KYC Users”

Comments are closed.