There’s no shortage of stock market gurus claiming to teach people how to profitably trade on the stock markets, but official data shows that it can be incredibly hard to make a living trading the stock markets in India.

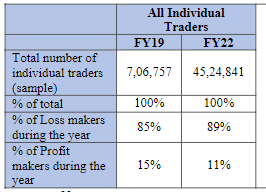

89% of stock market traders in India made losses in FY22, a study by SEBI has found. The study looked at the transactions from the country’s top 10 brokers, which represented a majority of overall stock market transactions in the country. The study determined that only 11% of all individual traders managed to make money from trading, while the remaining 89% made losses.

SEBI found that the number of stock market traders has shot up since the coronavirus pandemic. The total number of traders who traded in the F&O (Futures and options) market went up from 7.1 lakhs in FY19 to 45.2 lakhs in FY22, which represented a 500% increase in 3 years. The coronavirus pandemic, which confined lots of people to their homes, appears to have prompted many to start trading in the stock markets.

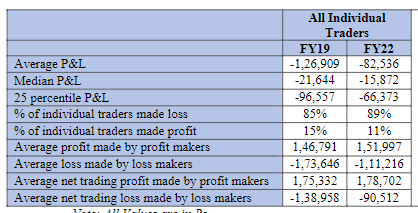

But a vast majority of these traders lost money — the average stock market trader lost Rs. 82,536 in FY22. The median trader also made losses, losing Rs. 15,872 in the same period. And it’s not as though the traders who managed to make profits made it big — the average active profitable trader made a profit of only Rs. 1.5 lakh per year, which barely puts one over the poverty line. In comparison, the average loss-making trader lost Rs. 1.1 lakh per year.

Only a very tiny fraction of traders cornered all the profits. The top 1% of traders accounted for 51% of total profit earned by all traders in India. The next 4% accounted for a further 24% of total profits, which meant that 5% of the top traders alone cornered 75% of the total profits that were made trading the stock markets.

SEBI said it came up with the report to make investors aware of market risks. The regulator believes that periodic data analysis and disclosure of this nature can significantly enhance investor awareness around market risks and it “will shortly issue guidelines in respect of additional risk disclosures required to be made by brokers and exchanges to investors”.

This isn’t the first time that data of this nature has been unearthed. In January 2022, Zerodha CEO Nithin Kamath had said that less than 1% of traders in India earn returns higher than a bank FD over a period of three years. Even with the SEBI data, only 11% of traders managed to make money in FY22, and these traders could find it hard to remain in the top 11% in the coming years, so it’s possible that an even smaller fraction of traders would make money over a longer time horizon.

But this doesn’t seem to have stopped all sort of trading gurus having mushroomed during the coronavirus pandemic, all peddling their own stock trading courses and Telegram groups. These courses often charge high fees, and claim to able to teach the principles of successfully trading the stock markets to anyone who enrolls. But with SEBI now having come out with official data, and shown that a tiny fraction of stock market traders can even manage make profits, it would perhaps be wise to take any claims of earning riches trading the stock markets with a giant pinch of salt.