People starting off their companies spend most of their time courting and wooing investors, but one of the biggest investors in the game says that it might not be the best use of their time.

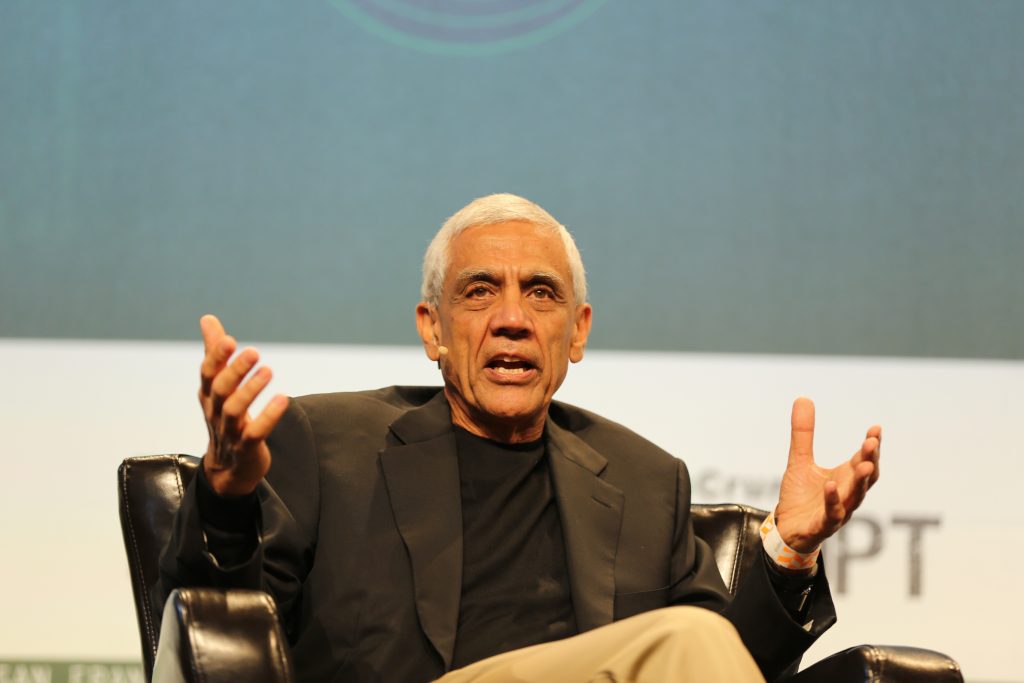

90 percent of investors add no value to a startup, says Vinod Khosla. Vinod Khosla is the co-founder of Sun Microsystems, and has invested companies including Doordash and Instacart through Khosla Ventures. Khosla didn’t just say that 90 percent of investors were useless, but went a step further — he said that 70 percent of investors add “negative value” to a company.

“I get in a lot of trouble for saying this, but 90 percent of investors add no value (to a company),” he told OpenAI’s Sam Altman in an interview. “In my assessment, 70 percent of investors add negative value to a company. That means they’re advising a company when they haven’t earned the right to advise an entrepreneur,” he added.

He said that the practice of advising entrepreneurs — without adequate experience to back it up — was prevalent across the investing industry. “Some of the junior people here (at Khosla Ventures) when they ask me, hey at this other firm young people are going on boards, can I be on a board? I say you haven’t earned the right to advise an entrepreneur,” Khosla said. “So it’s unfair to the entrepreneur. Just because you got an MBA and joined a venture firm doesn’t mean you’re qualified to advise an entrepreneur,” he continued.

“The biggest piece of (being able to advise an entrepreneur) — not the only way — is have you built a large company. Have you gone through how hard it is, how uncertain it is, how traumatic it is to go through?” Khosla said.

Khosla seems to be implying that most VCs haven’t build big companies themselves, so are unable to give any actionable advise to their portfolio companies. Worse, some of them still choose to dispense their advice, and given their own lack of experience in building a company, end up hurting the companies with their suggestions. Which just goes to show that startup founders might not need to worry very much about how they raise money — as long as they’re able to fund their business, it probably doesn’t matter where it came from.