It’s one of those days when money is getting hammered, no matter where you park it.

Global stock markets, Indian stock markets, and even cryptocurrencies are falling across the board since markets open today. Dow Jones has fallen 1175 points, its highest point fall ever, and is trading down nearly 5%. Indian stock markets have seen their worst fall in two years, with the BSE Sensex trading 3% lower. NIFTY is down 300 points. Virtually every major world stock exchange is also trading in the red.

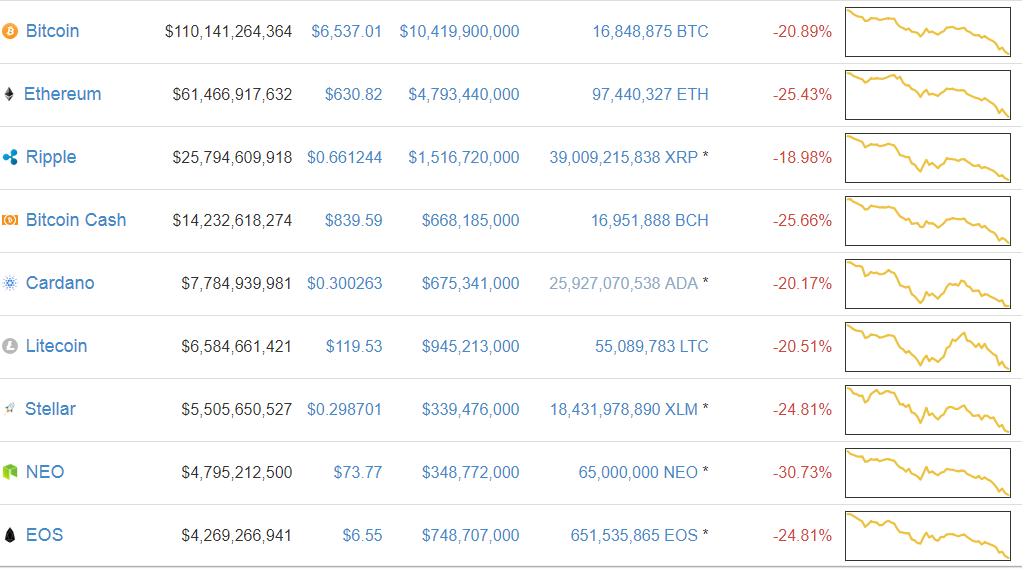

If you thought that was bad, cryptocurrencies are doing even worse. Bitcoin is down a stunning 25% for the day, now trading at just $6,100 — just over a month ago, bitcoin was priced at nearly $20,000. Since then, it’s fallen steeply from its highs, and lost nearly 70% of the value from its peak. Like stock markets, crypto markets are also down across the board, with daily falls as high as 30%.

It’s not straightforward to pinpoint what’s exactly caused this concerted global fall in assets. The US stock market had risen to record levels last year, and experts had been warning about a possible correction. Things were similar for Indian stock markets — 2017 had been a record year, when the markets linearly grew without any major corrections. But markets have stumbled at the beginning of 2018. The Budget announcement on 1st February didn’t help — the government finally decided to levy a 10% Long Term Capital Gains tax on equities, meaning that investors lost out on the tax advantage that equities had enjoyed for around a decade. Indian stocks, which had seen their P/E ratios soar to record levels, are now losing many of the gains they’d accumulated over the last few years.

Crypto is a whole new world altogether. The space had seen record spikes in 2017, with Bitcoin rising 20x during the year, and many other cryptocurrencies had followed suit. But 2018 has brought with it a significant correction in the space. Bitcoin has now lost nearly all its gains before it sharply spiked late last year. In 3 months, bitcoin had risen from $6000 to nearly $20,000; now it’s trading back at $6000 levels.

2017 had been an exceptionally easy year to make money — most global assets had grown, and investors had made merry. But a reversal seems to have begun, with assets across the board are now reverting to more reasonable prices . The fall, though, has been a lot more dramatic than the rise — the NIFTY, for instance, lost all of its gains made over 2018 in a few hours today. The heady days of 2017 are over, and investors have nowhere to hide.