Raising money for your venture can be harrowing at the best of times. It takes up valuable time and effort, investors don’t often understand your vision, and the constant rejections can be emotionally draining.

But if it helps, it’s just as hard for people whose companies end up becoming some of the most successful companies on the planet.

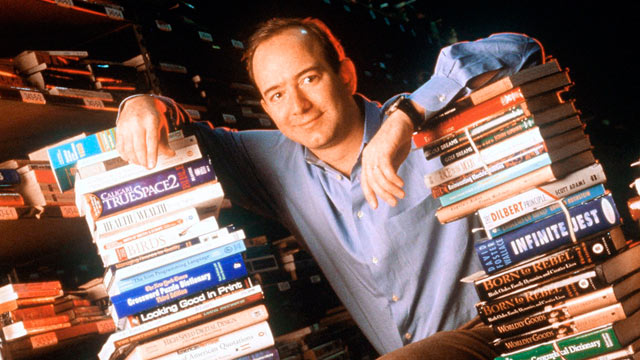

Amazon’s founder Jeff Bezos had found out the hard way. In 1995, when he was trying to raise money for his new firm, Amazon, he did the familiar rounds around venture capitalists that most budding entrepreneurs would be familiar with.

“It was 1995, and the first question every investor asked me was: ‘What’s the Internet’”, he said in an interview. Bezos was truly before his time, and the idea of selling things online would’ve sounded ludicrous at that point. It took a lot of meetings to finally get enough investors on board.”I had to take 60 meetings,”, he says.

Eventually he was able to convince 22 of those 60 investors to come on board. They pitched in around $50,000 each, and Bezos ending up raising $1 million. He had to give up 20% of the company though.

Today, Amazon is worth $336 billion. That $1 million 20% stake would’ve now been valued at $75 billion.

“A lot of people did very well on that deal,” Bezos laughs. But they also took a risk, so they deserve to do very well on that deal.”

But Bezos’ experience shows that fund raising isn’t easy, even for revolutionary companies. “And it was nip and tuck whether I was going to be able to raise that money. So, the whole thing could have ended before the whole thing started.”

If Amazon could have a hard time raising money, maybe that should give hope to hundreds of entrepreurs who are knocking at VC’s doors, hoping for some validation of their ideas.