[This article is a part of our First Person series, in which entrepreneurs and professionals share their stories about their startups, lives and careers.]

As I sit down to write this blog entry on why our offline model failed, a realization sets in. All the hundreds of conversations with mentors, friends, colleagues and investors across the globe over the last three years discussing this business is now seeing a closure. Yes, at Pricebaba our identity has been connecting local retailers to consumers on the web and after INR 2 crore invested, over 2400 retailers in 15 cities on-boarded, INR 300+ crore worth of inquiries and 86+ million visits on Pricebaba.com, we failed to make a business around this.

Some of you probably already see where this is going. Let me put it upfront. We are very motivated by a challenge of solving a real problem, not copy a proven western model and paste it in India with our PR folks cooking up a story around our journey later on. What I am doing with this post is sharing a lot of details about how we did what we did, what we were thinking and decisions we took. Thus, we do not want to be just another name written off the race with a face saving acqui-hire or shut down with vague wordings on our homepage.

Also, before we begin, let’s be clear. Pricebaba.com is a 25-member strong team and I am incredibly proud of what we have done so far and what we continue to work on. Yes, we aren’t dead. I would have said ‘we aren’t dead yet’. It isn’t uncommon for every startup to pitch their venture with such vigour — that their idea will happen and not may happen, no matter how uncertain the outcome. However in the below post, I will keep the pitching hat aside. We are a very powerful team working on a tough problem that accommodates our learnings from running Pricebaba all along. Survived by our user traction and revenues (yay), we are just getting started in our journey to create an impact.

So here is the Pricebaba offline model dissected.

Our understanding of the market before starting Pricebaba

A big belief statement and documented analysis of the market is not how we started Pricebaba in 2012. It was a lot of chaos back then, but decoding now, here is what we spoke about and what we believed. We didn’t see value in just showing online prices from various sites to a user because that just seemed like a very simple problem and had no USP.

- We believed that people in India use the Internet to research products, but largely shop locally.

- Discovery of products locally is difficult and business directories do not go to brand level, forget providing product / price level info.

- Online and offline prices are not on par. We strongly believed back then that offline is cheaper and there are fundamental reasons for the same [1].

- There is still resistance in people to shop online. Buying a book online vs buying a mobile online are very different levels of commitment.

- A lot of decision-making happens at the storefront after looking at multiple products and exchanging phones is easier locally.

- Both online and offline retailers will co-exist for the foreseeable future. Retail in India would be fragmented between these channels and not dominated by just local or online mediums.

What changed

E-commerce boomed right when we started going aggressive i.e. 2013-14. A lot of heavy discounts took place online and it took a good mindshare. This helped us too when onboarding retailers, but the consumer value in what we were doing was often questionable or in doubt.

A lot of smartphones that got very popular started going online-only, which we believe was the biggest push (apart from discounts) till date for consumers moving online to buy smartphones.

A note on our operations:

Before we jump into the business model and product, let’s talk about operations. Everyone assumes that operation-heaviness will be a big obstacle when starting a business like ours. We find that surprising given that folks such as Zomato, Flipkart, Ola, etc. have had to do tremendous amount of operations and field work. In our case, it was still very very limited amount of ground work. Here is how our offline ops worked.

Our onboarding for retailers was super smooth from day one and launching a city was two weeks effort end-to-end. This included photographing them, geo-tagging (using a web interface or manually entering lat / lan numericals when our browser-based app failed), verification of phone nos, tax registration, etc. A lot of cities initially were launched by interns and we didn’t need any ground presence there post launch. Given our category, number of stores in a city generally ranged from 100-300. While we worked to get all stores onboard, for us a few (two to three) good stores in a given locality of the city was very good coverage for our users.

We rejected a good number of stores mainly due to missing tax registration or because they were not reachable when re-verifying over the phone. We also had a criteria of listing stores that stocked a minimum number of mobile phone brands; the hypothesis was that stores that have more stock are more capable of offering better service and prices to our users.

In the initial days we didn’t have concrete update on what phones the store stocks and certainly didn’t have SKU level updates. We had smart groups for tagging retailers with particular type of phones so that we show their name against a product listing which they were most likely to sell. This was a hack. We looked at trends on how retailers stock products — this was brand-wise, price range-wise or attribute-wise (like CDMA). The idea was to not aim for 100 percent data accuracy on day one, yet be much better than online directories who just do category-level mapping.

Being in the mobile phones business helped us as we dealt with very few SKUs (top 100 SKUs would easily satisfy 80 per cent of the demand).

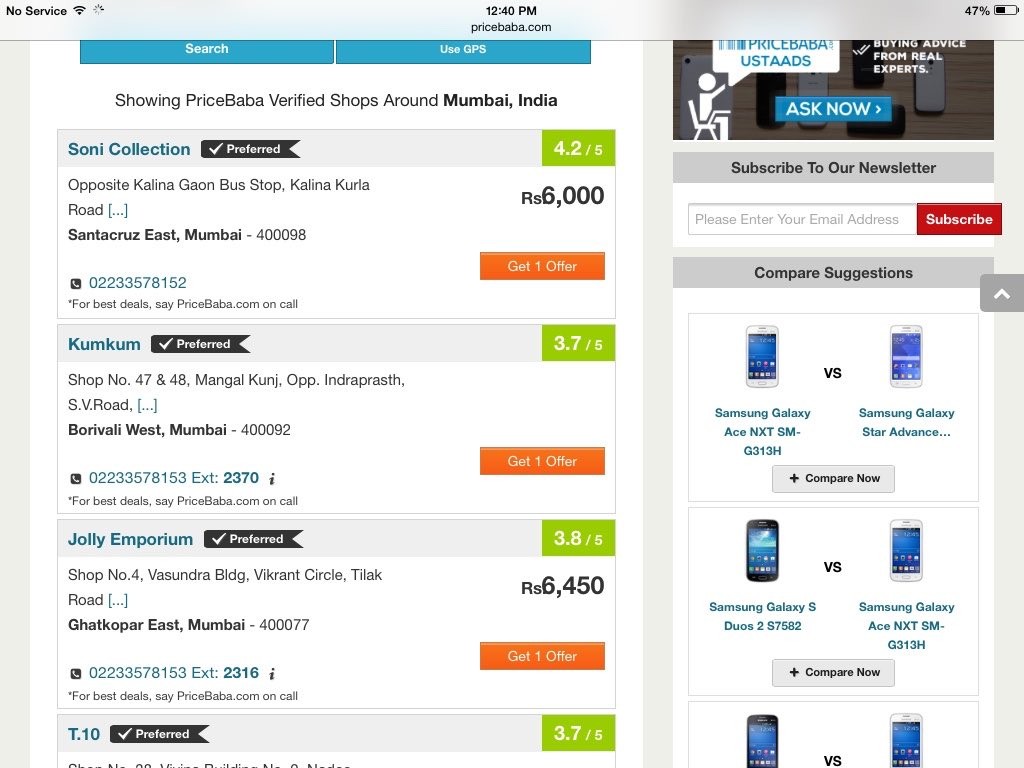

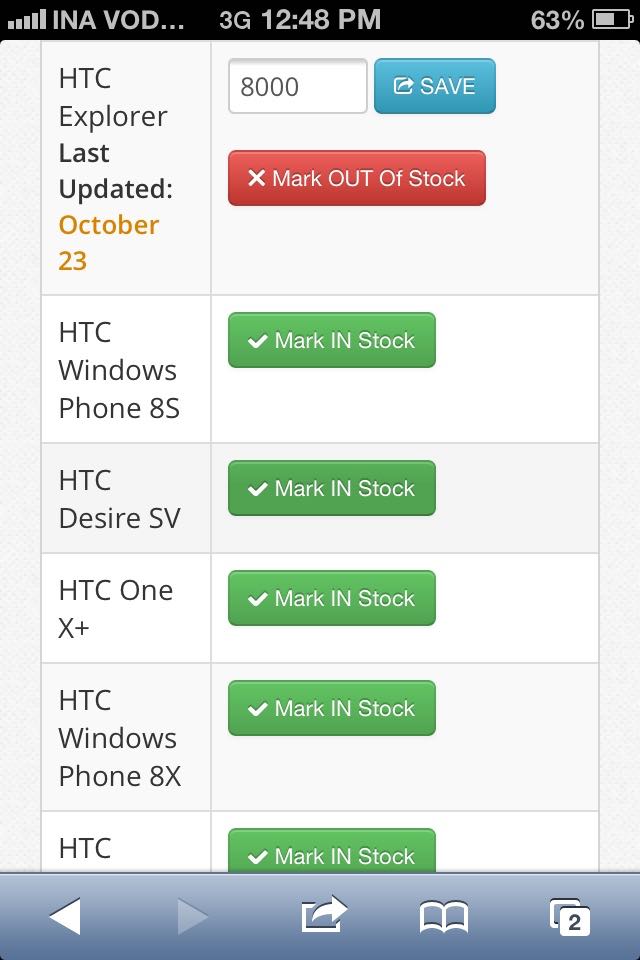

Over time, we rolled out web login for retailers and allowed them to update their stock status and price. We also gathered rough estimates for how many days should a price quote be valid for (we also started displaying the last updated data next to the price), for how many products does a retailer needs to update price for most of our users to be happy and how many shops from a city should we target to get price updates. Retailers who were more proactive of course got more inquiries and the algorithm rewarded retailers who updated price more frequently.

One of the things most feared by businesses in this segment is fake price updates from stores. Given our communication and rapport with stores, we did not face this issue in a big way. In our lifetime, we may have banned not more than 2 stores from the platform for misuse. Most errors that happened were due to an extra digit being pressed or missed (1,700 instead of 17,000). That was easy to tackle both during the updation and at the backend. We also built systems to predict if a price was valid or not and had a few minutes of curation effort every day to fix those. Even when managing 15 cities and 500 retailers updating data every month[2], this part of the business never became a big challenge for us.

Of course, like everything tech, our technology for local retailers could have been much better; we could have gone multi-category, we could have given an Android app to our retailers too — why didn’t we do it? There aren’t concrete answers for these questions. We wanted to do all of that, but didn’t get there. Specifically, the app for our retailers didn’t look necessary for mobiles as a category and the frequency that we were looking at. We instead tested an app for our field ops to geotag retailers and photograph them. For the most part of our existence we had two full time developers (Tirthesh + 1). So a lot of such efforts to improve our product / ops was done by some awesome interns or simply deprioritized till we had more resources.

The Business

Pricebaba started in 2012 after I moved out of running a tech blog OnlyGizmos to join Tirthesh in this journey of helping our friends shop more powerfully. Given that the top question that always came to me from friends was around finding the right price for a mobile phone, we decided to focus on helping this segment first; hence, the name Pricebaba.

Having started my career in 2002 as a retailer, I had a good hang of the local markets in Mumbai. So there was good amount of confidence on how to digitise these stores and get data from them. There were always open questions about the business and we wanted to organise the data and bring it online to see what impact it had. The mission was to get 1M users a month and then think of monetisation.

Looking back, we could have iterated and tested a lot of things much more quickly. Lack of organisation, planning, funds crunch (until August 2014, we always had a runway of three to six months), technical limitations on the platform, etc. slowed us down significantly. Also, not to forget our blind optimism on the prospect of digitising local retail!

There are several ways of monetising a O2O business like ours.

- Online directories sell a subscription package that sends leads to paid retailers.

- If part / full transaction money is being collected online (remember the group buying sites?), a cut can be taken.

- A listing fee is charged to be listed i.e. become a paid directory with no listings.

- Charge a fee to promote a retailer over others. Think Google ads on their search results page!

We were open to all of these except taking transaction money at our end. Our belief was to be a RoPo (Research online Purchase offline) player. So becoming a e-commerce player by doing transactions at our end didn’t fit our thinking. We tried all of the other options.

We did charge a subscription fees to a good 9% of our retailers in Mumbai. However, even 10 per cent of 400 retailers paying Rs 12,000 each year (sold as Rs 24,000 with 50 percent discount) wasn’t enough. We wanted to increase our subscription amount per retailer, but that didn’t happen.

Here are some issues in making monetisation work in this business, despite reaching a run-rate of sending ~INR 60 crore worth of leads to local retailers in a single month.

- Conversion: a two-fold issue

i) When a consumer sees a nearby store and the price mentioned next to it, why would he/she place an inquiry to that store via an online portal? What’s the incentive? The information that a user wants is visible upfront. So, the overall conversion of visitors to leads / inquiries is very low (under 0.5 per cent, though with some optimisations it can go a bit higher).

A common suggestion is to offer users cashback, give an exclusive offer, etc. to make them go via us or come back and report to us. Problem is with the razor thin margins and commission (if at all) paid by a retailer to us, we would be paying from our pocket to fund this gap. There are no special pricing or additional things that a local retailer can give just for a partner like us. They would give that deal anyway to a consumer standing at the store front.[3]

ii) From the number of inquiries sent to a store, the total conversion rate isn’t very high and even the ones that convert are hard to measure. A lot of this conversion also depends on how aggressively and promptly the shop follows up on the inquiry and its price competitiveness.

- Follow-up strength of local retailers

Stores not following up with consumers is also a very bad experience and that happened with most leads. So, unorganised retailers were not up to the mark. We couldn’t reach a point where we could reward retailers who did better follow-ups.

We started with having an in-house team doing follow-ups on behalf of retailers and helping consumers place an inquiry. But that just didn’t work commercially for a product like mobile phone where margin for both retailer and us is very low.

- Competition with online players and other local retailers is race to bottom

This one is probably an industry-wide issue. A lot of consumers started coming online to only look for cheapest price, deals, etc. And given we started showing online and local players together, some local players had complains that customers keep calling to ask for discounts or quote online prices. This, of course, happens offline too where walk-ins at the store quote online prices, but phone calls to negotiate the price was something some of our local retailers weren’t happy with.

Somewhere being in a market where ecommerce and online shopping started getting synonymised with deals / free goods / lowest prices, it was hard to acquire organic users with the right mindset. Searching local prices online isn’t an established behaviour and if the motive of that online search for best price is greed, then we were bound to have a tough time serving our local retail partners who have to personally talk to consumers, rather than throw a checkout page at them.

Mistakes?

- Spoiling retailer habits

We listed both paid and free retailers together. With every retailer starting as a free customer, converting them to paid at a later date was very tough. Some of our team members believed that we shouldn’t have gone multi-city and instead focussed on converting free retailers to paid sooner in each city. Our approach, however, was to get more and more data online till we got enough organic traffic to start making a dent in the retailers’ businesses (and charge them).

Letting free and paid retailers co-exist with the only benefit for our paying customers was priority listing meant that we sent a lot of leads to retailers who didn’t pay. This was necessary because our paid retailers weren’t always offering a product or even following up with customer leads. So, we gave the user more options. We ended up with cultivating a habit of free with no major push for following up with leads. Somewhere we are today convinced that most local unorganised retailers aren’t in a position to follow-up and convert business inquiries sent to them.

- Not focussing on repeat users

We didn’t realise how necessary multi-category would be for repeat users. With just one category (mobile phones), our users had no reason to come back to us more than once a year. While we always wanted to go multi-category and were advised for the same repeatedly, somewhere (resource constraint aside) we didn’t prioritise it enough in a race to prove the model with one category first. Also, going multi-category with the RoPo model was far harder than mapping inventories from ecommerce sites.

PS: Fast forward to 2016, as an online price comparison site Pricebaba is now adding new categories every month, Laptops being the first one.

Product challenges

- App vs Web

We were pretty clear that a web interface works just fine for us, rather than making the user download an app for buying a mobile phone, which is a yearly event at best. We went responsive back in 2012 itself and the site worked great on smartphones. However, some mobile browsers and slow connections needed extra work (especially on heavy pages). An app would have been a must-have for us if we were present across multiple categories and there was a repeat use case.

A counter argument was of course that car portals have an app, then why can’t a mobile phone-focussed product like ours have one as well? We debated, started sketching the app twice but decide against it. Had we gone the app way, we may have had a different experience to share.

Amongst other product challenges, our web-only presence had its own limitations in offering a hyperlocal service to our users.

- Detecting user location:

One of our challenges was to upfront show users relevant shops from their city as soon as they loaded Pricebaba. And that has never been an easy problem for anyone to solve. We used a service called MaxMind to try and figure a user’s city based on IP, but city-level data in India is hardly accurate. So we had to largely rely on the user’s input.

We began with a Google-powered location box where users can enter their area / pin-code and we can show nearby stores. Later we shifted to our own city and area drop boxes which worked much better on slower connections and improved our conversions.

For sometime we also automatically requested users’ location on mobile web from the browser (required users to give consent) and automatically show nearby stores. However, given that a pop-up would show up the first time a user loaded our site, we did away with it. Had we known that the user was visiting us for only looking up local stores, we could have continued with that browser-based location collection.

- Showing both online and offline prices together

We had our challenges showing both online and local prices together. Compared to less than 10 online players, we could have as many as 400 local retailers selling a product in a city. How do we show all of this content to our users?

We started with offline listing on top and online sites listed below it, gradually moving to showing both of them side by side. This does get tricky on a mobile screen. Our thesis was to clearly segment users who want to go online vs local. This was partly so because we started with local prices and online was an afterthought.

Ideally, if you know the user’s location (hyperlocal area), you can show two-three local stores with the best price and online stores together. After all, the users wants to know the best price at which they can buy!

- DND and SMS OTP is a pain

Since collecting phone numbers was our primary way of generating leads for local retailers, we had our challenges with sending messages to customers who are in DND (Do Not Disturb) list. We were a little over-cautious and started with an OTP (One Time Password) before any lead went to a retailer. While the drop off wasn’t very big, it was still hovering around 30%.

It was only much later that it occurred to us that we can always pass the user’s phone number to the retailer; we just needed the OTP verification before we could send messages to the user’s phone number. So we made a system that automatically verified if the phone number provided was valid and sent the lead to our retail partner and gave an optional OTP to the user or a simple opt-out.

What Next?

So what next for Pricebaba? Simply put – Pricebaba continues to exist for improving shopping experience for its users. We are constantly enhancing our product research engine that we have built with all our learnings over the last few years. And of course there are interesting pilots in search of the next big thing ;).

Hat Tip – CleverTap

On product and analytics we must mention that signing up for CleverTap (Wizrocket back then) early on was a great support for us. Founder Anand Jain and the CleverTap team helped us realise our conversion funnels and drop-offs that we were otherwise not looking at very deeply. Today we use CleverTap for a variety of things including saving user preference, conversion tracking, user surveys, targeted emails and notifications.

If there is anything you want to ask, tweet me @annkur and I will try and add it here

[1] Our belief on why offline can be cheaper was based on a simple calculation. For an online marketplace, the payment gateway cost of ~1.5%, delivery & packaging cost and CAC adds up to a minimum 3-5% of the transaction value. Add to that the marketplace commission which can be as high as 7% for mobile phones! A local retailer is happy to make Rs 500 on a Rs 10,000 phone and sell it. And for high-end phones like an iPhone, even Rs 2000 on a Rs 45,000 bill is very good margin for local retailers.

[2] In the initial days we bought leads from other directories and kept the retailers engaged.

[3] Some parts of this is doable with retail chains.

Thanks Tirthesh, Shivam, Nishit, Maneka and Rohan for reading, editing and contributing to this post.

[This author of this post, Annkur P Agarwal, is the founder of Pricebaba.com. This post originally appeared here.]