Many of India’s listed unicorns have had a rough time since being listed, but they seem to be slowly finding their way around how to do well at the stock markets.

Policybazaar has become the third listed tech unicorn after Zomato to report a profit since being listed. The company reported a profit of Rs. 37.2 crore for the quarter ended December 2023. Policybazaar also said that it had registered a profit of Rs. 4 crore in the 9-month period ending December 2023. Policybazaar’s shares were up 12% after the results became public.

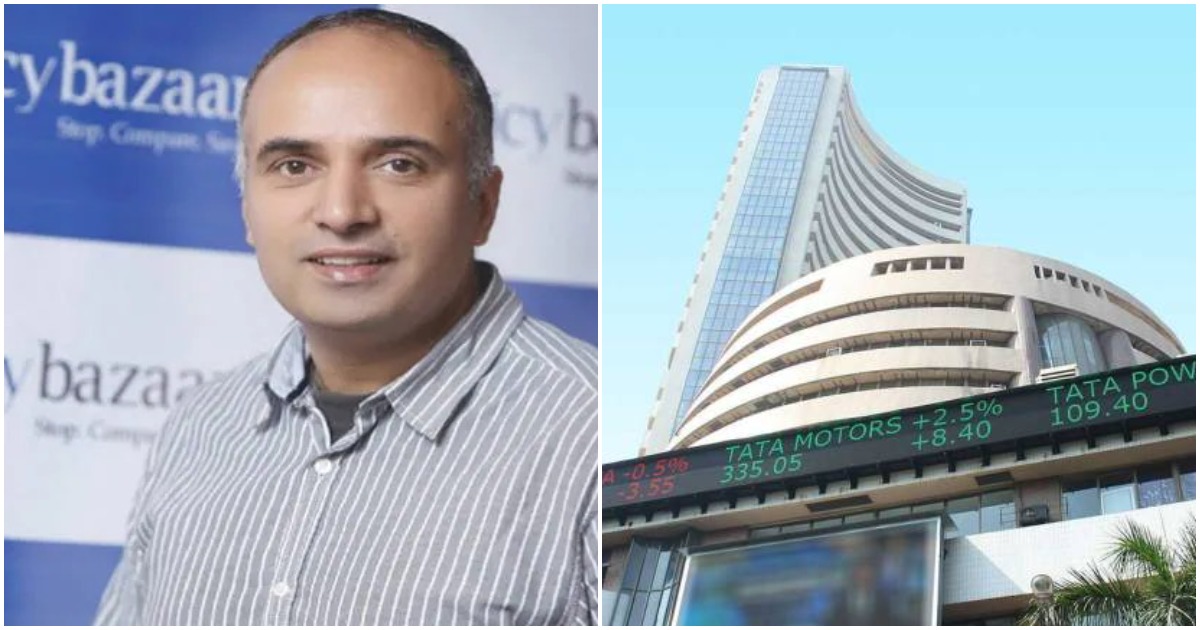

“We aimed for a full year PAT (profit after tax) in FY24,” said PolicyBazaar founder Yashish Dahiya. “We have already achieved it in three quarters with our strongest quarter yet to follow. We had previously also guided that we will touch premiums of Rs 35,000 crore in FY27 and we think we can achieve that considering our last two year growth has been 2.5x,” he added.

This isn’t the first time Policybazaar has reported a profit. In 2017, it was the only Indian unicorn startup out of a list of 43 that had been profitable, reporting a profit of Rs. 12.9 crore in that year. But since then, as the company had tried to hypercharge its growth, it had again slipped into losses.

PolicyBazaar’s latest profitable quarter came with a strong set of numbers. Its revenue from operations grew 43% to Rs. 871 crore in the third quarter of FY24. Its core online marketplaces Policybazaar and Paisabazaar reported a 39% increase in revenues to Rs. 593 crore in the December-quarter. Policybazaar clocked total insurance premiums worth Rs. 4,261 crore for the quarter. and crossed an annual premium run rate of Rs. 17,000 crore. Credit subsidiary Paisabazaar on the other hand touched annualised credit disbursements of Rs. 14,321 crore, and distributed Rs. 3,580 crore worth of loans in the third quarter.

Policybazaar has become the latest listed Indian tech startup to report a profit. Last year, Zomato had reported a profit of Rs. 2 crore in the first quarter of FY24, and had followed it up with a profit of Rs. 36 crore the following quarter. Other listed startups, including Paytm, Delhivery and CarTrade continue to make losses.

And the markets seem to be rewarding listing companies which are making money. Zomato’s stock is up 300% from the lows of last year, and PolicyBazaar’s stock has jumped 12% after it announced its maiden profit. Meanwhile, Paytm, Delhivery and CarTrade continue to languish below their IPO prices. And given how Zomato and Policybazaar have fared, loss-making startups would realize that they soon move to the black if they’re to impress investors in the public markets.