Startups are thought to have ‘made it’ when they become a unicorn with a valuation of $1 billion. They’re also thought to have made it when they list on the public markets through an IPO. But it turns out that building a startup can be a long, hard grind.

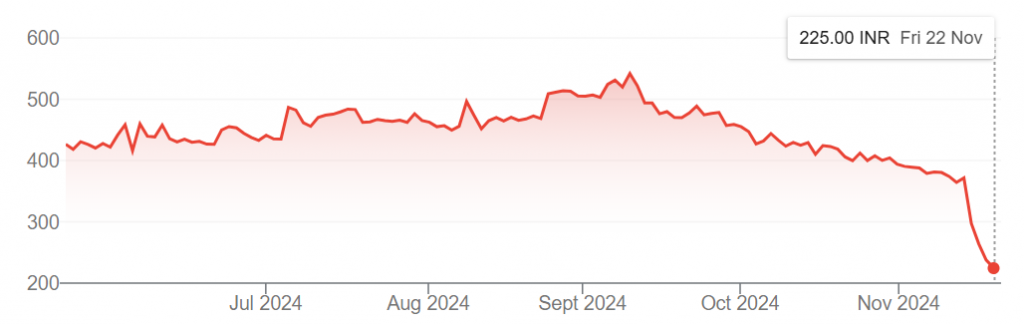

Mamaearth’s parent company has lost 50 percent of its market cap in the last two months. In September 2024, Honasa Consumer’s stock was trading at Rs. 541 a share, and the company was worth around Rs. 15,000 crore. But in November, just two months later, its stock has crashed to just Rs. 227 a share with a market cap of Rs. 7,300 crore. This represents an erosion of Rs. 7,500 crore of its market cap in two months. Simultaneously, Mamaearth is now worth less than $1 billion, and has lost its unicorn tag.

Mamaearth’s share had been trading steadily around a value of Rs. 500 over the last few months. It touched a high of Rs. 541 over in September, but then began losing steam, and declined to Rs. 400 levels from September to November. But the last three days have seen the share crash 20%, 10% and 5% in trade respectively, which has meant that Mamaearth has lost 50 percent of its value in just over 60 days.

The biggest drop in Mamaearth’s shares has come right after the company had announced its quarterly results last week. The results hadn’t made for pretty reading — Mamaearth’s had reported revenue of Rs. 417 crore in the September quarter, which was 17 percent below its revenue of Rs. 498 crore in the previous quarter. Mamaearth’s revenue was also 10 percent lower than the revenue of Rs. 460 crore that it had reported in the same quarter last year. The slowdown had caused Mamaearth to slip into losses — it reported a loss of Rs. 15 crore in the quarter, compared to a profit of Rs. 35 crore in the previous quarter, and a profit of Rs. 38 crore in the same quarter last year.

More crucially, there had been some indication of stress in the business before the results were declared — in July, distributors had raised concerns over excessive, unsold and expired Mamaearth inventory. Mamaearth had been an early entrant into the personal beauty space, but its success has spawned several similar companies, which are now competing with it for market share. To make matters more complex, several quick-commerce brands have popped up, which have made it easier for new brands to reach consumers, which is eating away into Mamaearth’s advantage.

And a 50 percent drop in its market-cap — and the losing of its unicorn status — will rankle for Mamaearth. The company had been founded all the way back in 2016, and through a lot of work ended up becoming one of India’s biggest success stories in the D2C space. And with its valuation having dropped to half over a period of a few weeks, Mamaearth will have to rebuild and restore faith for its investors — and consumers — in the coming years.