The stock markets have been getting pummeled over the last few days, and the effects are already showing up in fintech companies.

Zerodha CEO Nithin Kamath has said that he’s seeing degrowth in Zerodha’s business for the first time since the company was founded 15 years ago. “The markets are finally correcting. Given that markets swing between extremes, they can fall more just like they rose to the peak,” he wrote on X.

“I’ve no idea where the markets go from here, but I can tell you about the broking industry. We are seeing a massive drop in terms of both the number of traders and volumes. Here is the trading volume chart. Across brokers, there’s a more than 30% drop in activity. Combined with the true-to-market circular, we are seeing degrowth in the business for the first time since we started 15 years ago,” he added.

“This drying up of volumes shows how shallow the Indian markets still are. The activity is more or less among those 1-2 crore Indians. By the way, if this continues, the government will not make even Rs 40000 cr from STT in FY 25/26, at least 50% below the Rs 80,000 cr estimate,” Kamath said.

Kamath also shared charts which showed the fall in trading and investing activity. NSE’s daily equity turnover was down 41 percent from its all-time high for retail traders, and the overall turnover was down 42 percent. The turnover had been relatively steady after the pandemic, but had surged in 2023. All those gains now seem to be lost, and the equity turnover levels seem to be back where they were two years ago.

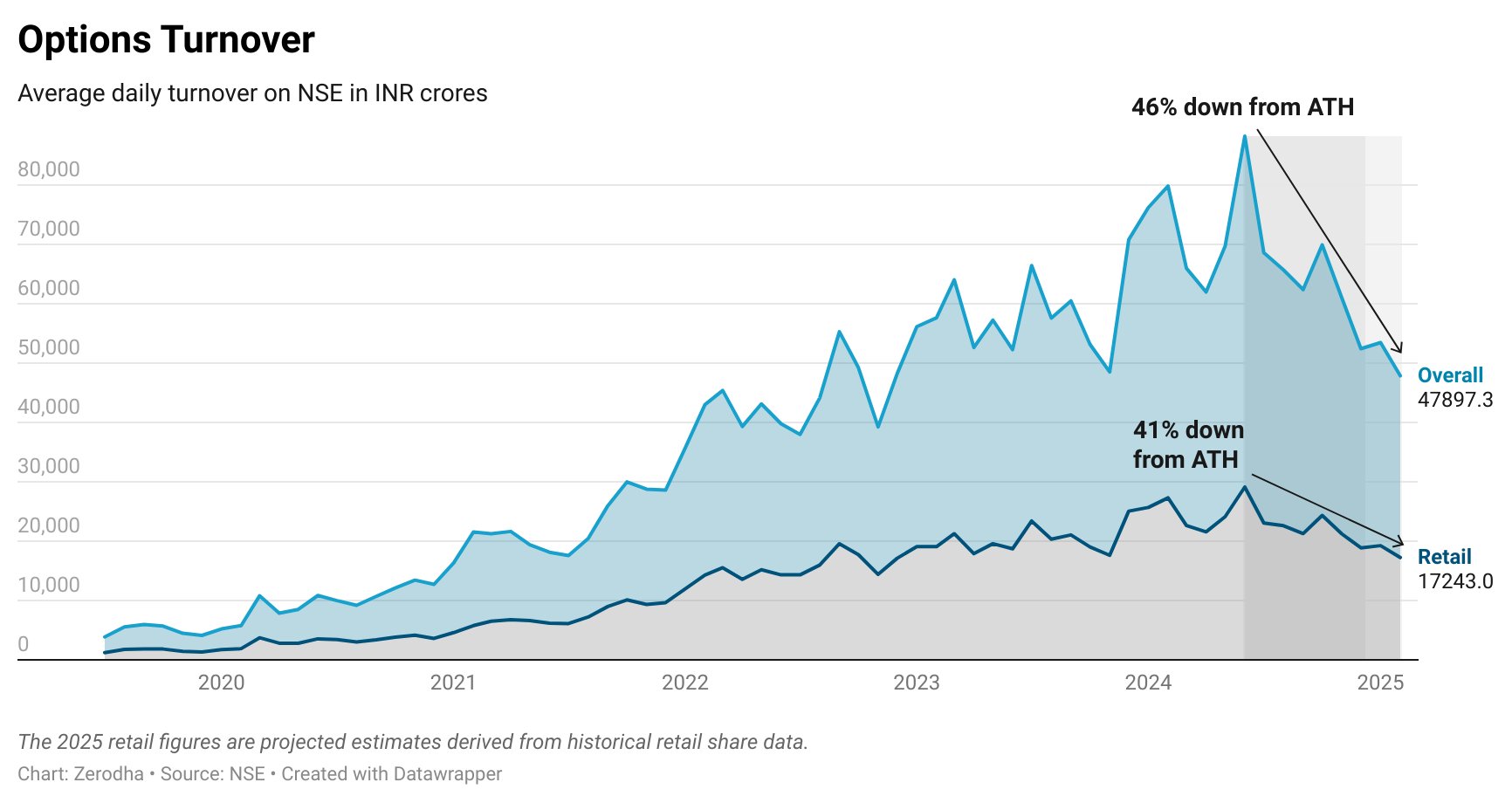

He shared a similar chart on option turnover volumes. These were down 41 percent from the all-time-high for retail traders, and 46 percent lower overall. Like with the equity turnover, these numbers are now back at where they were in 2022-23.

The fall in equity and options trading has mirrored the fall in the broader stock markets. The Nifty is down 16 percent from the all-time it had made last year. This has meant reduced involvement in the market both for retail and institutional traders, who are no longer seeing quick gains in the markets. As a result, the revenues and profits of brokers seem to have been hit, with Kamath saying there has been a 30 percent drop in activity for brokers.

It isn’t every day that a CEO talks openly about their company degrowing, but Nithin Kamath has a long history of being upfront about Zerodha’s risks and performance. During the 2021 funding boom, he’d said it was the stupidest time for fintech firms to raise money, saying that broking businesses would suffer when the stock markets fell. He’d also said that Zerodha wasn’t keen on going public because their performance was largely determined by stock market performance which was largely outside their control. But the recent stock market correction seems to be different from the others so far — it’s caused Zerodha to degrow for the first time in 15 years, and Nifty today gave its fifth consecutive negative daily return for the first time in 3 decades. India’s stock market is down only 16 percent from its peak so far, but the pain seems to be already showing across the ecosystem.