India is now home to a several successful startups, but they might be Indian in name alone.

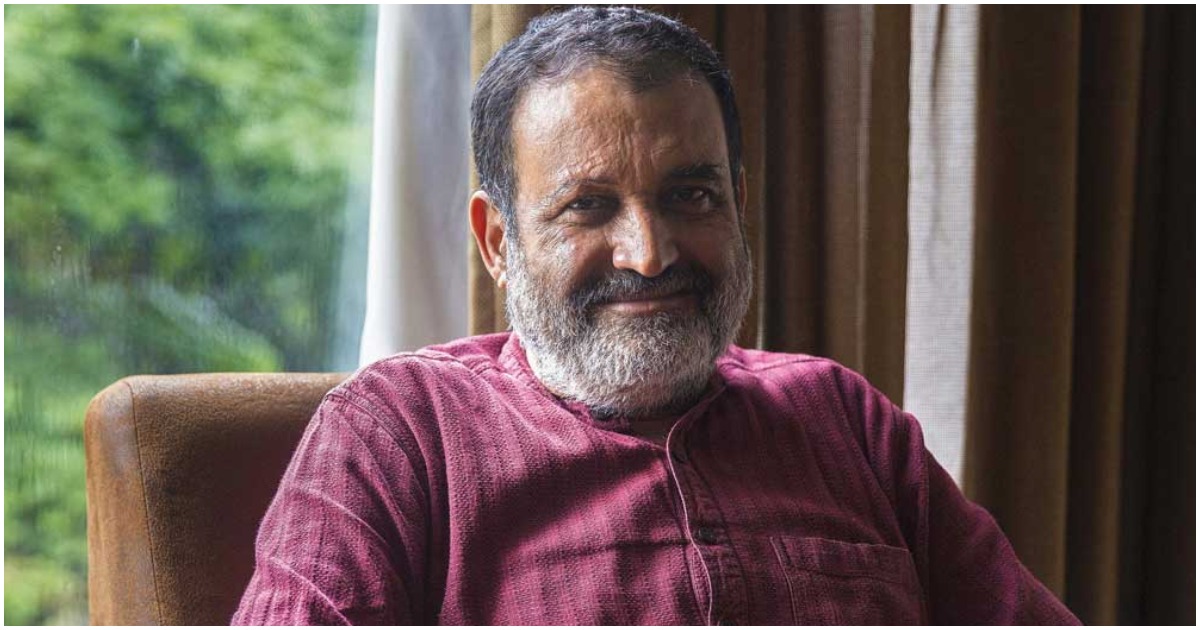

Former Infosys CFO Mohandas Pai has said that only a tenth of the $60 billion that has been invested into Indian startups since 2014 has come from domestic investors. He said that the future of Indian startups is bright — by 2025, there will be one lakh startups and 100 unicorns in India with a collective valuation of $500 billion. But 65 of these unicorns will be majority owned by foreign investors, which ran the risk of turning India into a “digital colony.”

Pai sounded more disappointed with Indian billionaires, who have the capacity invest in startups, but are more willing to invest in real estate and even bank deposits. In an apparent reference to the spate of frauds, Pai said the billionaires also tend to pass the risk on money invested to banks. He said the biggest letdown has been from financiers in Mumbai, and asked entrepreneurs to educate such professionals on the need of the hour. Pai asked why Indian pension funds or insurance companies cannot invest, and questioned how companies in the same sector from abroad are coming in and taking interest here.

Pai’s colleague and Infosys Chairman Narayan Murthy agreed that the non-participation of Indian investors in building Indian startups was a cause for concern. “This is one of the most important issues that we have been discussing. That is, what are the policy changes that are required to make sure that there is more of Indian and domestic money coming into the startup sector because today it is by and large from abroad,” he said.

Several prominent startups in India now have a foreign entity as their largest investor. Japanese company Softbank is the largest investor in Paytm, Ola, Oyo Rooms, Snapdeal, and Delhivery, while Alibaba is the biggest investor in Zomato and Big Basket. With these companies essentially answerable to foreign players, some concern might be justified — if data does indeed turn out to be the new oil, these companies will have an enormous amount of data on ordinary Indians, and it’ll need to be made sure that this data isn’t misused by foreign powers. Also, with foreign companies essentially controlling companies that are closely intertwined with the lives of ordinary Indians in everything ranging from payments to commuting to food delivery, they can exercise a substantial amount of influence in the everyday lives of Indian citizens. And with these companies now employing millions of Indians, foreign entities like Softbank have become the behind-the-scenes paymasters of a significant portion of the Indian population.

India, of course, has reason to be doubly cautious of foreign interference in commerce. In the 1600s, English traders had landed on the shores of India only to trade in spices, but over the course of 300 years had ended up as rulers, subjugating indigenous Indians and looting India of much of its wealth. In the 21st century, foreign companies have once again set their eyes on India, this time as startup investors. India would do well to be on its guard so that history doesn’t end up repeating itself.