Zomato’s stock might be getting battered at the stock markets, but there’s a class of people who’re buying it in droves — small retail investors.

Zomato’s stock has been picked up in large numbers by retail investors as its price has crashed, Zerodha CEO Nithin Kamath has revealed. He added that this behaviour mirrors the behaviour of retail investors with stocks like Yes Bank and Reliance Anil Dhirubhai Ambani group, which have lost nearly all their value. Zomato’s price has fallen 75% from the all-time high it had made last year.

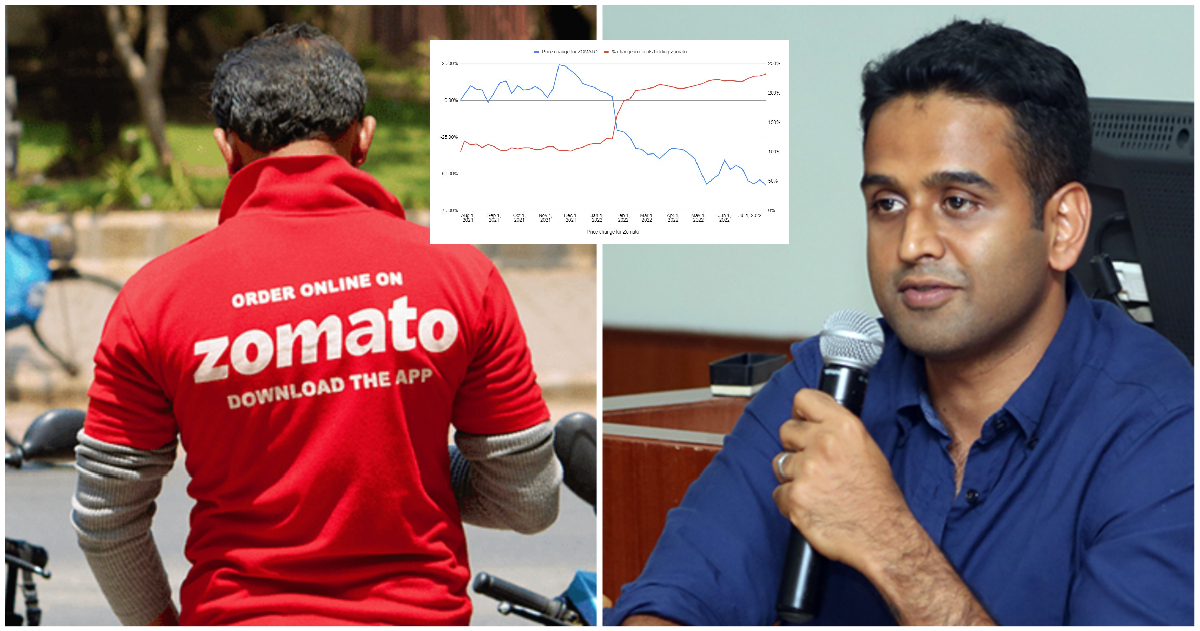

“Every time the prices of retail favorite stocks fall, the number of investors who buy the stock goes up dramatically. We saw this with Yes bank, Reliance ADAG stocks, and now with Zomato,” Kamath wrote on Twitter. He shared a graph which plotted the percentage change in Zomato’s price and the percentage change of Zerodha clients holding Zomato. The graph suggested that as Zomato’s price fell, more and more retail investors — who typically invest through platforms like Zerodha — bought the stock. While Zomato’s stock price has fallen more than 50%, the percentage of Zerodha users who own the stock has gone up by 150%.

“Investing is risky & here are some important things retail investors should keep in mind.” Kamath continued. “In the business of investing, if a stock price is down and it seems like it is a cheap buy, odds are, it will continue to become cheaper. The optimal way to trade is to buy stocks that are doing well and sell them higher as they grow,” he said.

“Avoid averaging down to reduce your avg buy price in the hopes of making a profit or breaking even IF the price goes up. Yes, there are times when it works, but the issue with this strategy is that one bad trade is enough to wipe out all previous profits & more,” he advised. Kamath was a full-time trader before he started a brokerage company in Zerodha.

“We all suffer from Disposition Bias—we feel like selling stocks that are going up and hanging on to stocks that are falling down. To do well when investing, you need to do the opposite—hold on to winners and sell the losers,” he added.

Kamath seemed to be suggesting that the retail investors who’ve rushed to buy Zomato at low prices might end up seeing even lower prices in the coming days. This is something that’s previously happened to consumer brands including Yes Bank, Reliance Power, and Kingfisher, whose stocks went lower and lower until they’d lost nearly all of their value. In all these companies, retail investors were particularly hard hit — these companies, like Zomato, had high brand recall, and had attracted many small investors as their prices fell. But these stocks never recovered, and ended up wiping crores of hard-earned money. It’s perhaps too early to say if Zomato will end up being the next Yes Bank, or the next Kingfisher, but the CEO of India’s largest broking firms appears to have already sounded out a warning to small investors.