India’s digital payments revolution has changed how the country transacts — through digital wallets, Indians are now paying their neighbourhood paanwala through a swipe of their phones, their Uber drivers without fumbling around for cash, and their electricity, water and gas bills without ever leaving their homes.

But India’s digital payments revolution has also led to some payments which might not have been expected by either the wallet companies, or the authorities which facilitated them.

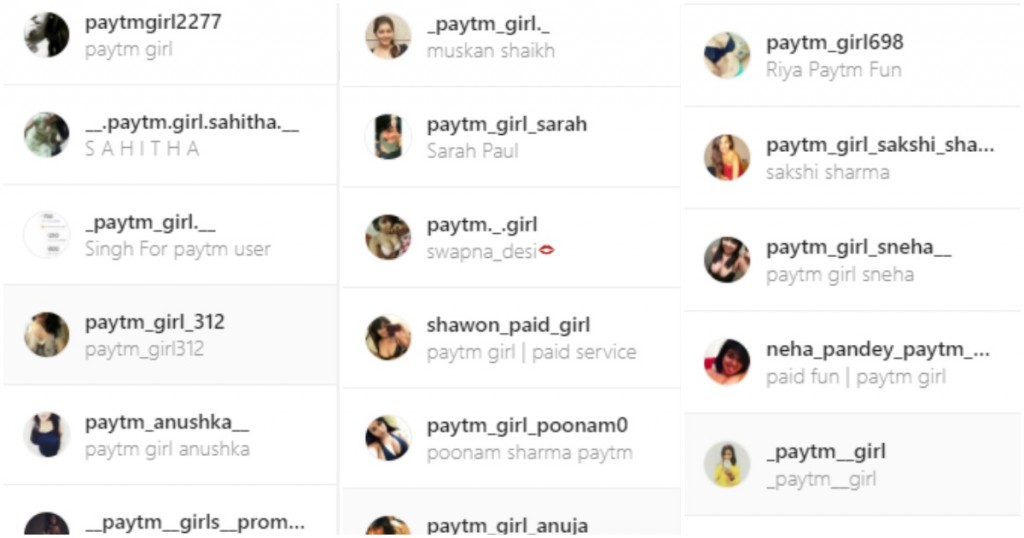

Buoyed by online payments that are instant and largely anonymous, a fledgling sex-chat industry has appeared out of nowhere on India’s cyberspace. And it’s taken on a name that is seen by many to be the flag bearer of India’s payments revolution — Paytm. Accounts calling themselves variants of “Paytm girl” have begun appearing on many social networks. On Instagram, for instance, there are hundreds, if not thousands, of accounts whose names are some variant of the term “Paytm Girl”.

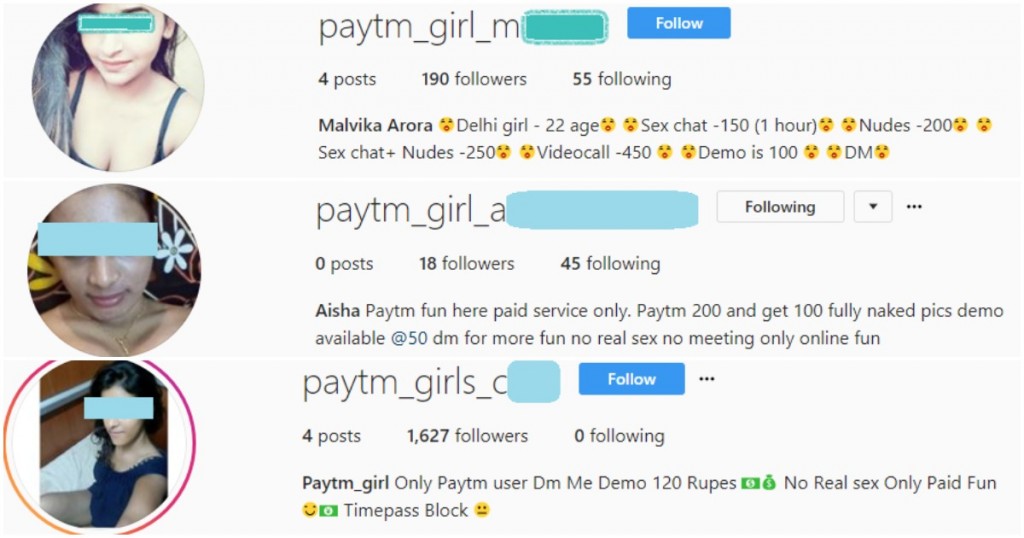

These women aren’t unusually enthusiastic fans of Paytm — they provide a variety of remote sexual services, including naked video calls, audio chats, and sending over nude pictures, all in exchange for payments through Paytm. Once a customer is found, they share their phone numbers, through which they can receive payments on their digital wallet accounts. Payments are almost always made in advance, and once they’re done, a video or audio call can commence through WhatsApp or other apps.

The rates for these services can vary quite a bit, but in general, a single naked picture costs somewhere around Rs. 50. The rates get progressively higher as things start getting more serious — an audio call can cost as much as Rs. 200 per hour, while a video call can set you back by as much as Rs. 500 per hour.

It’s not hard to see why Paytm girls have taken off the way they have — until not too long ago, it was necessary for involved parties to meet in person for a commercial sexual liaison. But cheap smartphones and fast data streaming speeds have meant that people can engage while sitting thousands of kilometers from each other. The missing piece of the puzzle was solved through wallets, which provided relative anonymity and instant cash transfers. These set of circumstances have ended up creating a whole new industry that simply couldn’t have existed until a few years ago.

But simply having internet connections and digital wallets wouldn’t have been enough for the concept to work — the industry appears to have evolved its own procedures to ensure that both parties stay honest. Given the number of Paytm girls accounts that are now available online, a number of fakes have cropped up — the pictures on Instagram can end up being completely different from the women who’ll show up at the other end of the video call. But people have been finding their way around this problem — most Paytm girls provide a cheap demo picture for as low as Rs. 50, thus proving that they are indeed the person behind the pictures on their Instagram profiles. On the other hand, Paytm girls are regulated through good old social proof — the ones with happy customers end up garnering lots of fans, while the ones that renege on their promises can be reported and blocked on Instagram.

It doesn’t always work out though. Rohan (name changed), tells OfficeChai that while there are plenty of real women out there working as Paytm girls, there is the odd flaker — he once paid Rs. 500 to an account who promised him an hour-long video chat, but immediately blocked him. In such situations, there’s little recourse for either party — the legality of the entire transaction is anyway wonky, and nobody wants to approach the police telling them they’ve been scammed by a sex chat worker on the internet.

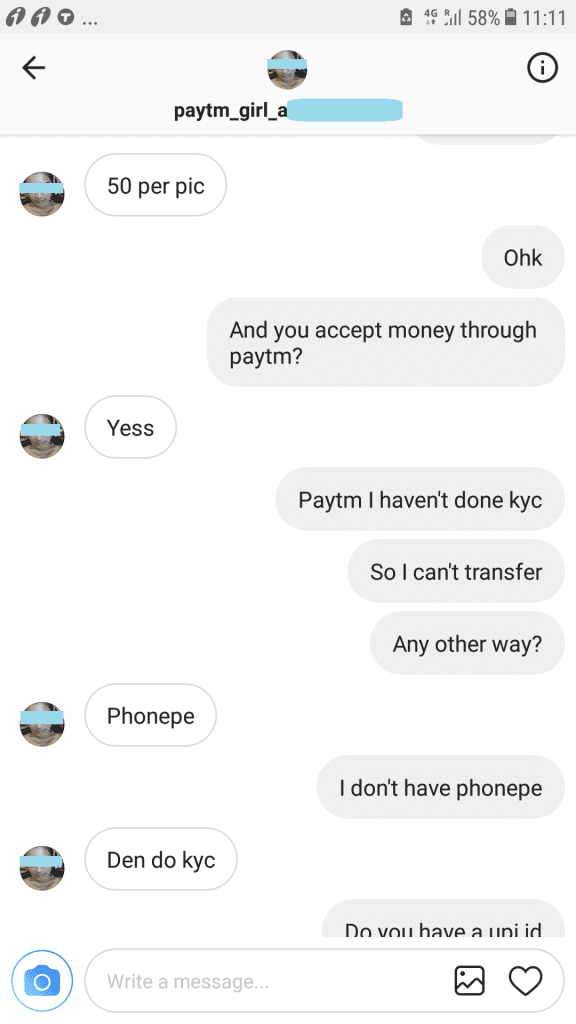

OfficeChai spoke with several such accounts, and they were uniformly business-like. There was very little idle chatter, and conversations usually began with a simple declaration of their rates. Most women are insistent that they will not meet their customers in real life, and seem to be working on this of their own accord. And while the accounts are called “Paytm girl”, they aren’t too fixated on Paytm — when we told an account that we hadn’t finished our Paytm KYC and thus couldn’t pay other users, they suggested that we pay through PhonePe instead.

While it’s unclear if the authorities are in the know about this particular phenomenon, the Reserve Bank does seem to have taken steps in the recent past to regulate digital wallets. Starting 1st March, wallet companies were required to gather an identity proof of their users, such as their PAN card or drivers license, and if they wished to send money to other wallet users, even their Aadhar numbers. It’s possible that the anonymity that wallets were providing was allowing people to use them for unauthorized money transfers and illegal activities.

But that’s how that’s how it goes with any new technology — while wallets have reduced friction from many transactions, they’ve also created opportunities where none existed, and spawned entire new industries. And while going forward wallets might end up getting regulated as much as bank accounts, for now, Paytm Karo is happening in places you’d least expect.