When Walmart had acquired Flipkart last year at a valuation of $21 billion, some eyebrows had been raised — it was felt that Walmart might have overpaid for the Indian e-commerce company, and could see its investment erode in the following years. But there are now indications that Walmart might not have done so poorly on the deal after all.

PhonePe itself is worth $7 billion (Rs. 50,000 crore), a Morgan Stanley report has said. PhonePe, being a Flipkart-owned company, had come along with the deal when Walmart had acquired Flipkart, and Morgan Stanley reckons that it could emerge as a significant factor for a “handsome uptick” in Walmart’s share price going forward. And Morgan Stanley says that $7 billion isn’t even the most aggressive estimate — in a bull case, PhonePe could be up being worth as much as $20 billion.

“If PhonePe can monetise financial services, we see it gaining substantially higher market share than in our base case. We model bull case revenues of $70 million from payments, $690 million from the distribution of financial services, and $2.5 billion from consumer lending,” said the Morgan Stanley report, talking about its predictions for 2029. The report highlighted how the growth of Unified Payments Interface (UPI) and the overall financial service markets were the two most significant factors for PhonePe’s valuation and unlocking new revenue opportunity. The report estimated that PhonePe could end up with 25 percent market share over the next 10 years, down from the 30 percent it enjoys now because of the entry of newer competitors like WhatsApp Pay.

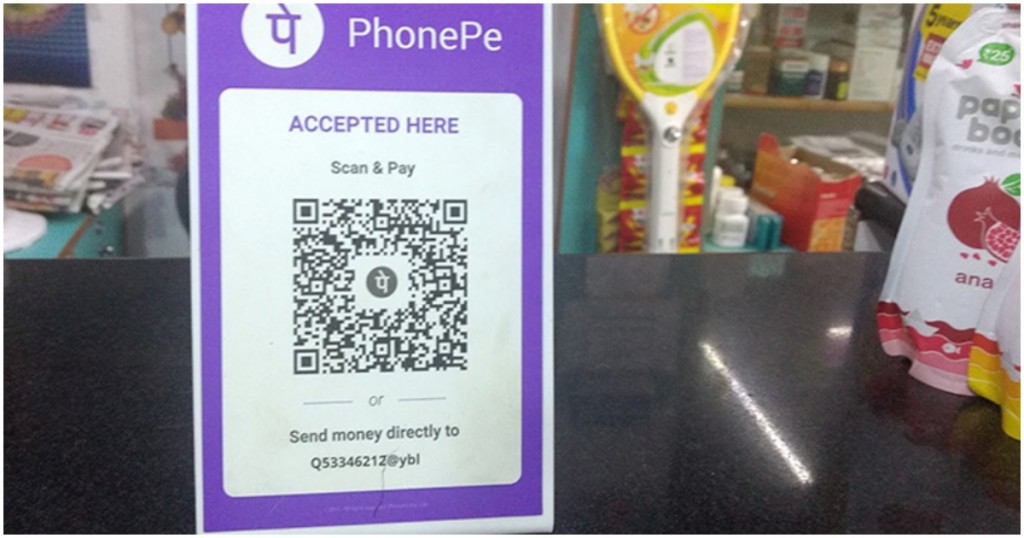

Making predictions for 10 years out is fraught with risk at the best of times, and especially so in the fast-moving world of startups, but PhonePe might have the building blocks to be able to go on Morgan Stanley’s foretasted growth trajectory. It has managed to create a solid payments business, with it now being India’s second largest UPI app behind Google Pay, and also has other products on its app, including bill payments and recharges. PhonePe is also moving up the value chain in terms of financial products — it also has launched a platform to buy mutual funds on its app. And with all the data that the company has been collecting over the last few years, PhonePe could soon move into lending, and thus perhaps unlock even more value for its shareholders.

But there will be significant challenges too. Google Pay has already quickly moved up the ranks to become India’s largest UPI app, and WhatsApp is expected to launch its payments product in the coming months. PhonePe, thus, will end up competing with Google and Facebook for India’s payments pie, and might find it hard to hold its own against the two global giants. But PhonePe is backed in yet another global giant in Walmart, and this could end up becoming an interesting three-way for dominance in India’s financial space in the years to come.