India’s digital wallet industry has been buffeted hard and often by changing regulations, but it could soon see its biggest change yet.

The Reserve Bank of India has released the guidelines for interoperability among digital wallets, finally enshrining the rules around how wallets from different companies will interact with one another. As a part of the decision, India’s digital wallets will become interoperable, which would mean that users of one wallet will be freely able to transfer money to another wallet. This is in stark contrast to how wallets operated thus far, and restricted their use among users of the same wallet.

The regulations, in effect, put all wallets on an even keel. Users of, say, Paytm, can now freely transfer money to a Mobikwik user, and Jio Money users will be able to send money to Ola Money users. In the first phase, users will be able to transfer money from one wallet to another, with the underlying transactions occurring through UPI. In the second phase, users will be able to transfer money from their wallets to any bank account, and in the third phase, users instruments such as gift cards will also be transfer money to other sources.

A hard reset

This move could upturn India’s wallet landscape as it exists today. For starters, it makes wallets a much more compelling way to transfer money — until now, users of a single company could only transfer money to users of that wallet, but with transfers across wallets possible, every wallet in the country is now connected to every other wallet. This means that the user base of every single wallet is now equal to the number of people who have any wallet account at all. With the number of potential users increasing for every wallet in the country, wallet transactions will likely rise in the coming months.

What’ll happen to individual wallet companies is harder to predict. The move nullifies overnight the network effects that wallet companies had worked hard to build over the last few years — a brand new wallet launching today will have the same userbase as Paytm, which has over 200 million users. This will, to a degree, level the playing field among wallet companies.

But it’s not as though the early movers in the wallet space have completely lost their advantage. As per directives issued earlier this year, the RBI had mandated that users needed to complete their KYC processes in order to transfer money. This, in conjunction with the last interoperability guidelines, would mean that users don’t need to complete the KYC process for every wallet they use; they could simply complete their KYC for a single wallet, and use it for all future wallet transactions. In this case, companies with large KYC user-bases will have an advantage — a new wallet company will have to make its users go through another KYC process for it to be used, which could prove to be a source of friction in signing up new customers.

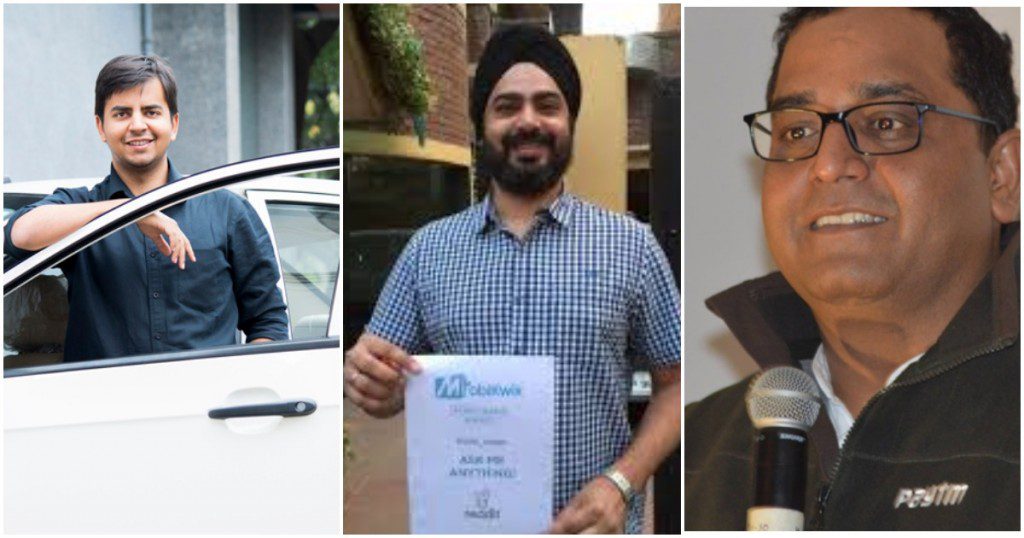

For now, smaller wallet players seem to be welcoming the move. “Wow, thank you RBI! Finally!,” tweeted Mobikwik CEO Bipin Preet Singh. “Game changing for digital payments in India,” he added. There have been no such reactions from Paytm, the biggest wallet player, hinting that it isn’t quite as enthused about the directives. It’s still early days to predict how the move will affect India’s many wallet companies, but one thing’s for certain — it’s likely to give a fillip to wallet payments all over again.