Snapdeal employees, both former and current, are getting increasingly anxious about their stock options.

Former Snapdeal AVP of Engineering Rishi Sharma has said that it’s time to use Snapdeal shares to make cones to sell bhelpuri. Snapdeal, which had last raised money at a valuation of $6.5 billion, now finds itself on the verge of seeing itself sold for a mere $1 billion to Flipkart. In such a situation, it’s likely that the share options that Snapdeal employees had earned over the years could well end up being worthless.

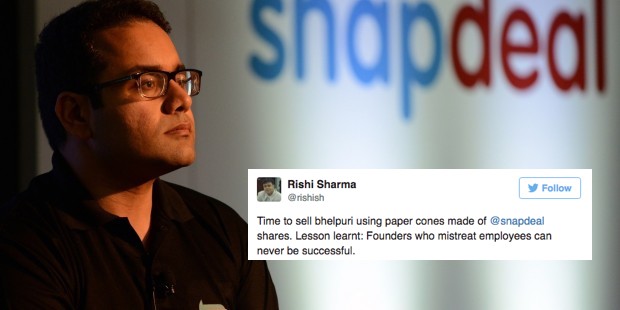

Time to sell bhelpuri using paper cones made of @snapdeal shares. Lesson learnt: Founders who mistreat employees can never be successful.

— Rishi Sharma (@rishish) May 6, 2017

Sharma, who’d been been Snapdeal from November 2014 to April 2016 and helped set up the company’s Bangalore engineering office, also seemed to lay the blame on the company’s founders, Kunal Bahl and Rohit Bansal. “Founders who mistreat employees can never be successful,” he said. Bahl and Bansal had earlier sold nearly 25% of their stake in 2015 before its valuation crashed, netting themselves Rs. 80 crore each.

Most Snapdeal employees, however, had no such luxury. A former executive who spent five years with the company said that employees weren’t allowed to sell their shares. “It was like an unsaid rule. You have to take an approval from the promoters and the investors if you plan to liquidate your ESOPs,” they told Moneycontrol.

Snapdeal employees, in addition to high salaries, had been lured with promises of generous employee stock option plans. A Snapdeal employee who’d joined the company as an Analyst and eventually become a Manager over four years told OfficeChai that he’d managed to accumulate Rs. 80 lakh of Snapdeal shares.”It is a little disappointing that the company has not informed us anything on what plans they have for us. I have mentally written down the stock options,” said another employee who’s been with the company for two years.

Snapdeal had raised $1.56 billion through its lifetime. Being sold for a value less than that would typically give a company’s investors first preference in terms of liquidation, followed by its founders, and eventually followed by the employees. Snapdeal’s implosion has hurt several parties – several sellers have not been paid and are now suing the company, and the general investment climate around startups has suffered. But the worst hit from Snapdeal’s struggles might be its employees holding Snapdeal shares.

1 thought on “It’s Time To Use Snapdeal Shares To Sell Bhelpuri, Says Former Snapdeal AVP”

Comments are closed.