Reliance has been aggressively acquiring all manner of startups in the recent past — now it appears to want to involved in growing them as well.

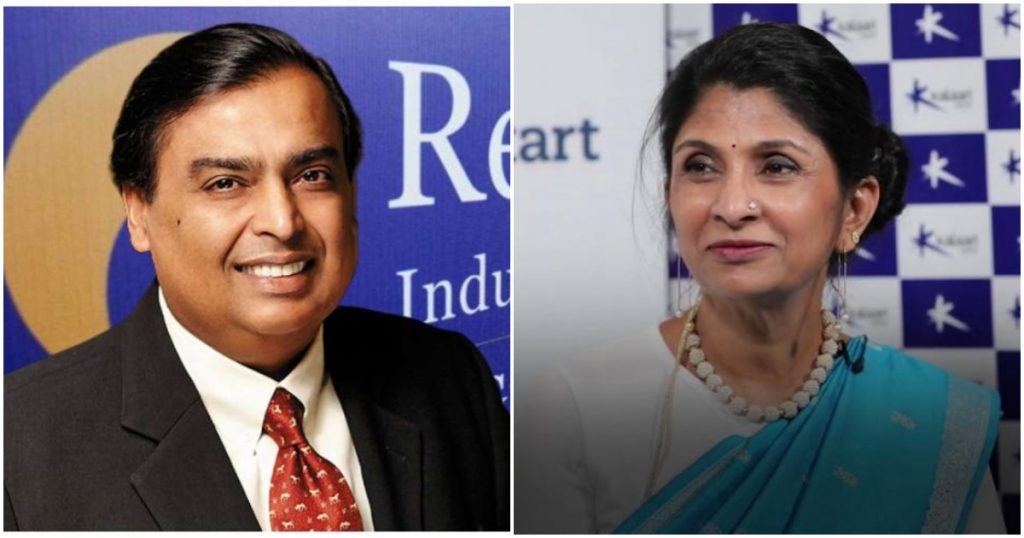

Reliance has become the anchor Limited Partner for VC firm Kalaari Capital’s fourth fund, ET reports. A Limited Partner provides funding for a VC firm, which in turn invests the money into startups. It had been previously reported that JioPlatfoms was finalizing a $100 million investment in Kalaari Capital, and had committed a further $100 million over the next 12 months.

Kalaari Capital is one of India’s most prominent Venture Capital firms, having invested in companies including Snapdeal, Cashkaro, Instamojo, Cure.fit, Scoopwhoop, Myntra, and several others. Incidentally, as many as four of its invested companies have been previously acquired by Reliance. In 2019, Reliance had acquired a majority stake in chatbot company Haptik in a Rs. 700 crore deal, and had acquired a 96% stake in furniture company Urban Ladder for Rs. 182 crore. In April this year, Reliance had invested Rs. 500 crore in ed-tech company Embibe, and in July had acquired 15% of lingerie e-commerce company Zivame. All four of these companies counted Kalaari Capital as one of their investors.

There has also been some controversy around Reliance’s startup deals which have involved Kalaari Capital — Kalaari Capital had sold 15% of its stake in the startup Milkbasket against the wishes of its founders to MN Televentures, which is thought to be close to Reliance. The founders had hinted that by selling 15% of their company to MN Televentures — its owner is on the board of Jio Infocomm — no company other than Reliance would want to acquire it. After the founders had delayed in handing over the shares to MN Televentures, MN Televentures had approached the National Company Law Tribunal. With the company embroiled in a legal dispute, it had become hard for the company to negotiate with other acquirers, possibly giving Reliance a good price if it wanted to acquire MilkBasket.

It, however, does makes sense for Reliance to be involved in startup investing — through JioPlatforms, Reliance is now looking more and more like a tech company, running an audio streaming service in JioSaavan, acquiring a stake in an operating system in KaiOS, and running a whole suite of apps on its Jio platform. Other large tech companies, including Google and Facebook, also have dedicated arms that invest in startups — this not only allows them to earn returns on their investments, but allows them to have an ear close to the ground in the tech space, and be in the lookout for trends and opportunities. Reliance has been looking to cast itself as a tech company over the last few years — it’s only natural that it wants to be closer to the action as far as tech startups are concerned.