Startups might be trying to outflank traditional businesses with technology, but they still seem to be retaining many of the questionable business practices of the businesses they’re trying to disrupt.

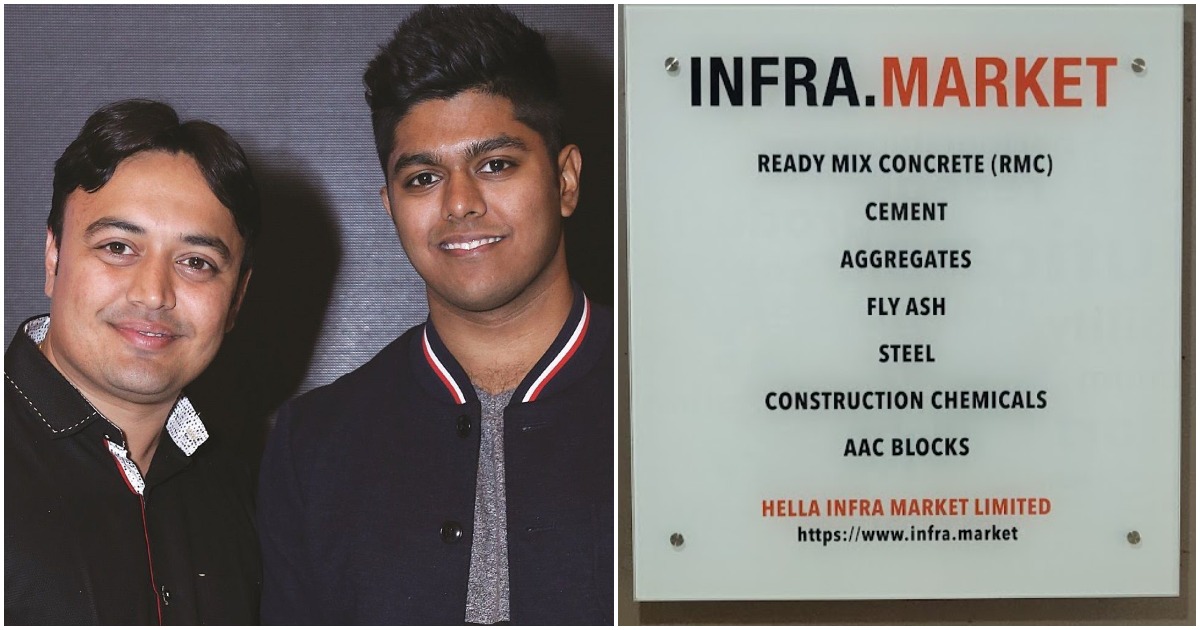

Construction materials startup Infra.Market, which had entered the unicorn club in February last year, failed to disclose Rs. 224 crore of income to evade taxes, a probe by the Income Tax department has found. The IT department had raided the startup and the homes of the founders last week. The IT department also said that it had “obtained huge foreign funding via the Mauritius route” by issuing shares at “exorbitantly high premium”. The probe into the startup also uncovered a complex hawala network of Mumbai and Thane based shell companies. Unaccounted cash worth Rs. 1 crore and jewellery worth Rs. 22 lakh were seized in the raids.

“Income Tax Department conducted a Search & Seizure operation on a Pune & Thane based unicorn start-up group, primarily engaged in the business of wholesale and retail of construction material, on 09.03.2022,” an IT department notice said, which didn’t refer to Infra.Market by name but it widely believed to be about the Pune-based company. “The group has Pan-India presence having annual turnover exceeding Rs. 6,000 crore. A total of 23 premises were covered in Maharashtra, Karnataka, Andhra Pradesh, Uttar Pradesh and Madhya Pradesh, in the search operation,” the notice said.

“A large number of incriminating evidences in the form of hard copy documents and digital data have been found & seized during the search operations. These evidences revealed that the group has booked bogus purchases, made huge unaccounted cash expenditure and obtained accommodation entries, aggregating to the tune of over Rs. 400 crore,” notice continued.

The IT department says that the founders have confessed to evading taxes, and have agreed to pay up. “These evidences were confronted to the Directors of the group, who admitted under oath this modus operandi, disclosed additional income of more than Rs. 224 crore in various assessment years, and consequently offered to pay their due tax liability,” the notice said.

More worryingly, the notice also raised questions about how the startup had been funded. “The search action also revealed that the group had obtained huge foreign funding via the Mauritius route, by issuing shares at exorbitantly high premium,” the notice said. Last year, Infra.Market had raised a $100 million Series C round led by Tiger Global. Existing investors, including Foundamental, Accel Partners, Nexus Venture Partners, Evolvence India Fund and Sistema Asia Fund had also participated in the round.

The investigation also uncovered a complex web of shell companies that had allegedly been used to evade taxes. “During the search operation, a complex hawala network of some Mumbai and Thane based shell companies was also unearthed. These shell companies exist on paper, and were created only for the purpose of providing accommodation entries. Preliminary analysis has revealed that the total quantum of accommodation entries provided by these shell entities exceeds Rs. 1,500 crore,” the IT department said.

Infra.Market had remained tight-lipped about the charges. “We continue to cooperate with the authorities and provide all necessary information to the department to solve all queries they have in relation to their search. We continue to work with the department to solve all their queries related to the company. We will wait for the final investigation report is out to comment further. Since the matter is subjudice we would not like to comment further,” Infra.Market co-founder Souvik Sengupta said.

The Infra.Market incident is the third instance in the last two weeks when charges of fraud and misappropriation have been raised against Indian startups. BharatPe had earlier alleged that its founder and MD Ashneer Grover had stolen large sums of money from the company through fake firms which were being run by his wife’s relatives. Last week, lifestyle app Trell had laid off hundreds of employees after alleged related party transactions by the company’s founders and other financial irregularities had been uncovered at the firm. And with the tax authorities now claiming bogus expenses, hawala links and shady foreign funding at Infra.Market, the spectre of financial fraud seems to be most definitively raising its ugly head over the Indian startup ecosystem.