India’s quick commerce industry has rapidly grown since Zepto had pioneered 10-minute deliveries in late 2021, but the leaders in the space have been jostling among themselves for supremacy.

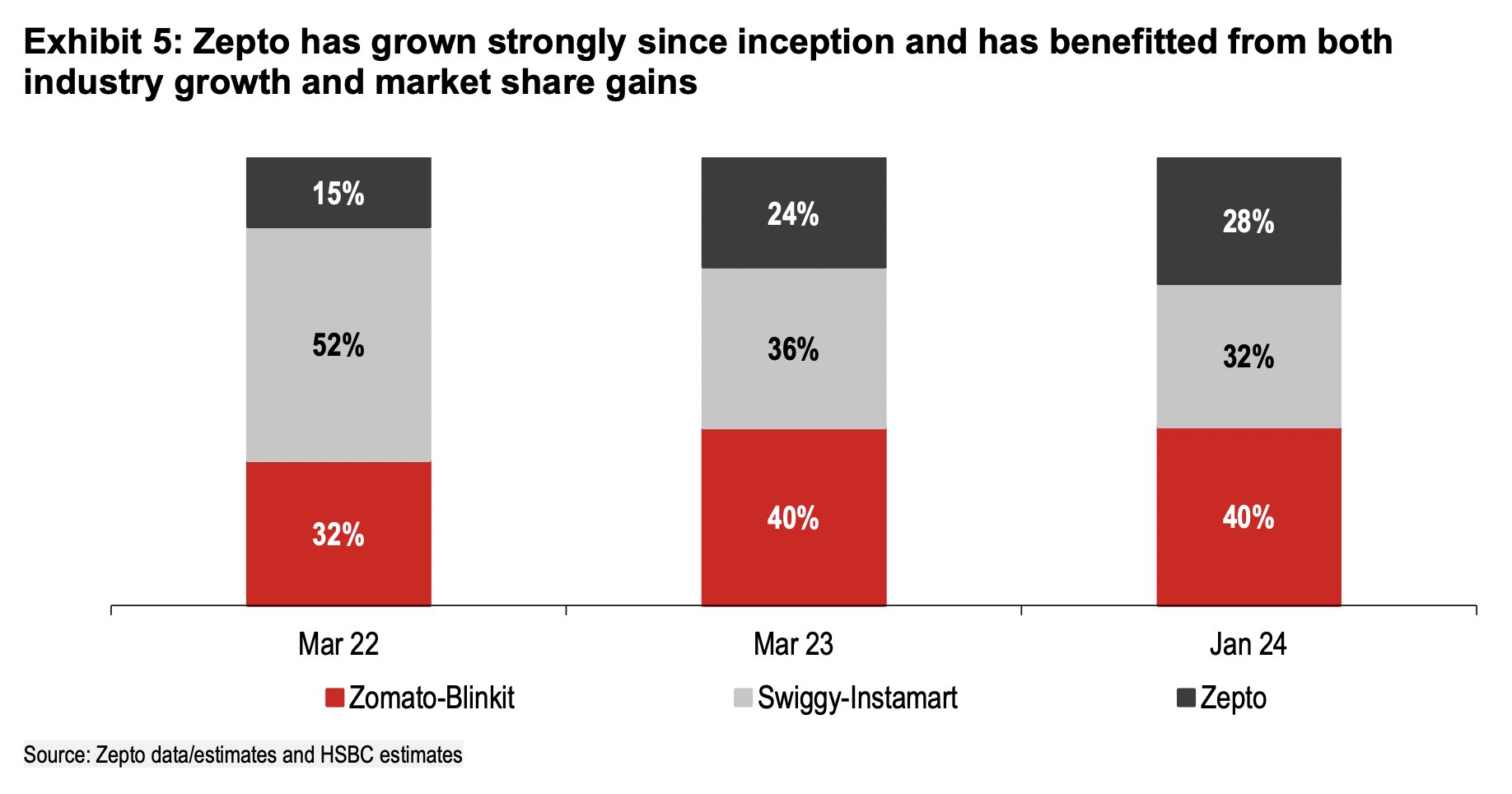

Swiggy Instamart’s share in the quick commerce business has fallen from 52% to 32% in less than two years, a report by HSBC says. This has been largely because of rapid growth from Zepto and Zomato-owned Blinkit in the category. Swiggy, which was India’s top quick commerce platform in March 2022, fell to the second position by January 2024 with its marketshare falling by 40 percent.

In March 2022, Swiggy was India’s largest quick commerce platform with a 52 percent marketshare. It was followed by Blinkit, which had a 32 percent marketshare, and Zepto, which had 15 percent of the market. But just a year later, Swiggy’s marketshare fell to 36 percent, and it was leapfrogged by Zomato, which had a 40 percent share. Zepto also grew smartly, with its marketshare touching 24 percent. By January 2024, Zomato remains India’s top quick commerce play with a 40 percent marketshare, but Swiggy has seen its share erode further — it’s now down at 32 percent, and Zepto is not far behind at 28 percent.

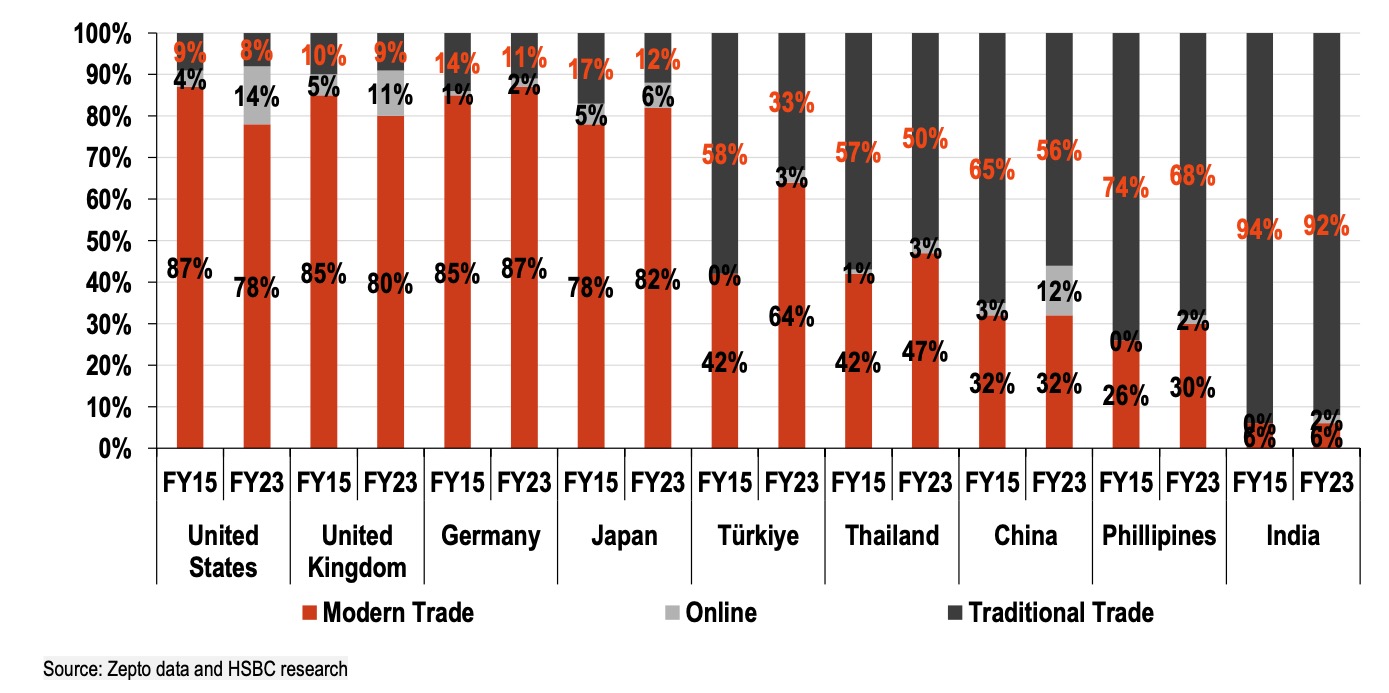

But even as the market leaders have shuffled around in the last two years, the entire category is growing rapidly. The industry has recorded growth 230 percent between 2021 and 2023. HSBC, interestingly, is now suggesting that there might be a lot more headroom for the industry to grow — it says that India’s retail market could graduate straight from unorganized retail (kirana stores) to quick commerce, with modern retail’s (supermarkets, shops) penetration remaining relatively low. This could mean that India, like it did by jumping from having no internet to having mobile internet without an intervening period of broadband, could jump straight from traditional retail to online retail without a corresponding period of modern retail.

All this has big implications for the entire retail landscape. Other companies are looking to enter the quick commerce space — Flipkart, for instance, was not only look to acquire Zepto, but is now launching its own quick commerce play. The growth in quick commerce has also resulted in plenty of market power for the three leading players — Blinkit, Zepto and Swiggy Instamart are reportedly charging small brands a commission of as much as 35-45 percent to be able to list their items on their platforms and give them an access to their userbases. And the industry is expected to touch $6 billion in gross sales by 2025.

All this seems a far cry from late 2021, when quick commerce had first been introduced. At that point, there had been plenty of naysayers saying that nobody wanted their groceries delivered in 10 minutes, and even if people did, it wouldn’t make economic sense to have them delivered so quickly. But cut to two and a half years later, and quick commerce appears to be all the rage with other companies looking to enter the space, and small brands eager to be present on the brand new distribution channel. These are still early days, and no quick commerce company has yet delivered a profit, but it appears that the idea of superfast deliveries is now firmly here to stay.