For decades, India’s software services have been its most visible export. The Indian government’s digital payments systems, though, appear to be taking their place.

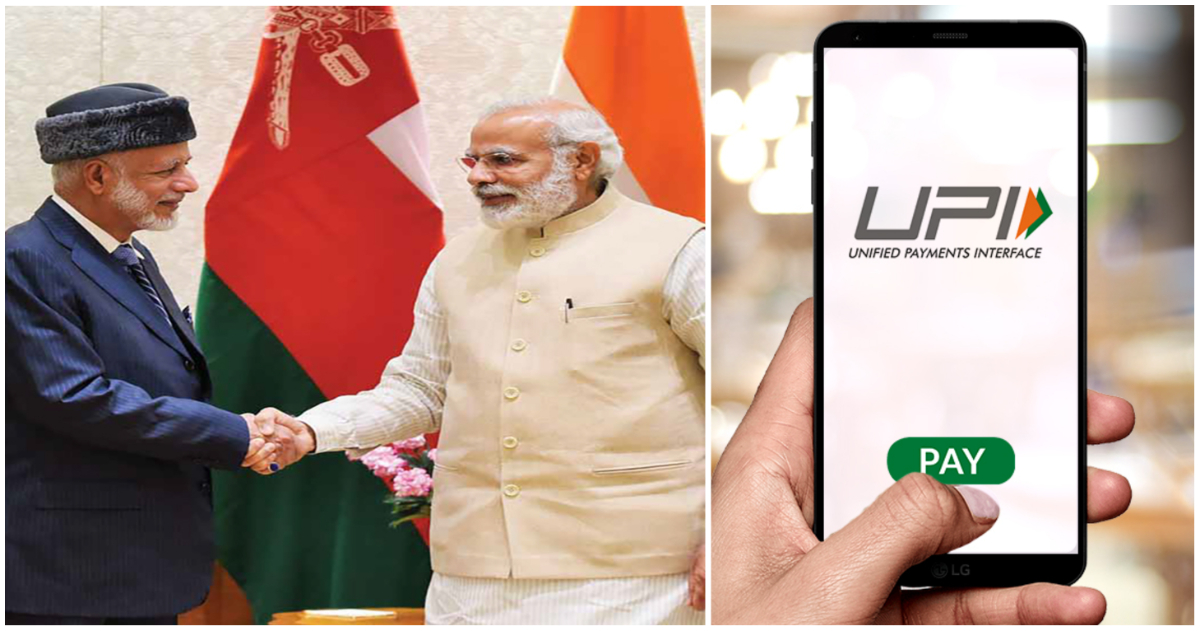

India and Oman have signed a Memorandum of Understanding (MoU) for the acceptance of UPI payments and RuPay cards in Oman. The MoU will enable the acceptance of Indian RuPay cards issued by banks in India at all OmanNet network ATMs, POS & E-commerce sites. The MOU will also enable building partnerships for real-time cross border remittances between India and Oman using UPI rails.

Oman is home to a large Indian diaspora — as many as 6.5 lakh Indians live in the country — so UPI-enabled remittance systems could help Indians living in Oman send money seamlessly to India. Acceptance of RuPay cards in Oman will also help Indian travelers make payments when they’re visiting the country.

Oman isn’t the only country that’s readying to accept UPI payments. In April 2020, NPCI had established an international arm, NIPL, to expand the deployment of UPI and RuPay solutions outside of the country. In July last year, NIPL partnered with Bhutan’s central bank RMA to enable QR-based UPI transactions in the country. This February, NIPL had tied up with payments gateway Gateway Payments Service and fintech company Manam Infotech to enable UPI-based payments in Nepal. NIPL had also announced a partnership with NeoPay, a payments subsidiary of UAE’s Mashreq Bank, allowing Indians in the UAE to make payments using UPI on the company’s terminals across the country. UPI is now also accepted in Singapore, and NPIL has also bid to create a similar system for Myanmar. Earlier this year, France had signed a landmark agreement with India to accept UPI payments and RuPay cards.

This is rapid international expansion, and is perhaps fueled by the success of UPI and RuPay in their home country — UPI now processes more transactions than credit cards and debit cards in India put together, and there are more RuPay cards than Mastercard and Visa cards in the country. Buoyed by these results, the Indian government now seems to be quickly working to take both UPI and RuPay international, and seems to be finding a receptive audience even abroad.

It’s hard to overstate how significant these moves are. International finance is one of the trickiest industries to disrupt — moving money across borders not only requires a high degree of security and technical robustness, but also means complying with a maze of varied regulations across the world. For Indian products to seamlessly navigate the world of international finance, and to find acceptance in places ranging from France to Singapore to Oman is a feather in the cap of India’s chief payments body. It’s not just Indian startups that seem to be making moves abroad — India’s government-run products seem to be coming into their own as well.