Reliance’s near two-year-long pursuit of the Future Group appears to have ended in disappointment.

Reliance has told stock exchanges that its Rs. 24,713 crore deal with the Future Group cannot go ahead as Future Group’s secured creditors have voted against it. Yesterday, Reliance had failed to secure the the necessary 75% approval from secured creditors to proceed with the deal, with only 31% of secured creditors — which include banks and financial institutions –voting in favour of the deal, and 69% opposing. Future Retail’s lenders include Union Bank of India, Bank of India, Bank of Baroda, State Bank of India, Indian Bank, Central Bank, Axis Bank and IDBI Bank.

The secured creditors overruled the unsecured creditors, 78% of which had voted in favour of the deal, and Future Retail’s shareholders, 85% of which were in favour of the deal. “The shareholders and unsecured creditors of FRL (Future Retail) have voted in favour of the scheme. But the secured creditors of FRL have voted against the scheme. In view thereof, the subject scheme of arrangement cannot be implemented,” Reliance said.

The vote appears to put an end to the two-year-long saga which had witnessed twists, turns, litigation, and even what appeared to be a hostile takeover of Future Retail’s stores. In August 2020, Reliance had announced it acquiring Future Group’s retail, wholesale logistics And warehousing business for Rs. 24,713 crore. But Amazon had objected — Amazon had previously acquired a 49 percent stake in Future Coupons, which was a part of the Future Group, and contended that the sale couldn’t have taken place without its consent. The battle had been fought in courts, first in Singapore and then in India. The CCI had also gotten involved, and had deemed that Amazon’s investment in Future Retail had broken FDI rules, and fined it Rs. 200 crore. Things, however, had come to a head earlier this year, when it had emerged that Reliance had acquired the leases of as many as 350 Future Group stores, and had quietly taken them over.

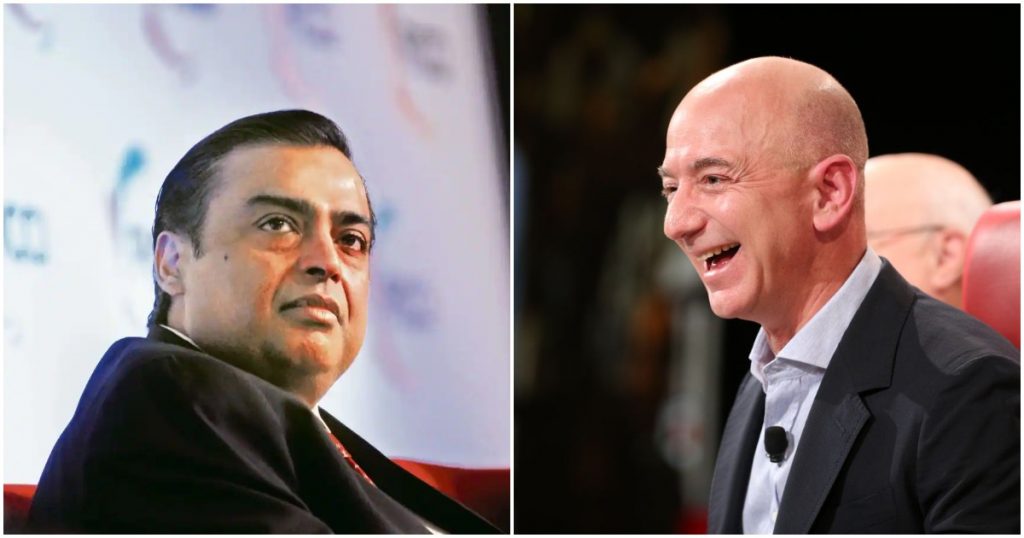

But Reliance pulling out of the deal could be seen as a victory for Amazon, which had fought tooth and nail to prevent Reliance from acquiring the assets of the Future Group. But the victory might be pyrrhic — without Reliance’s acquisition, Future Retail will likely go into bankruptcy, and its assets will be sold to pay off creditors. Reliance too, might’ve already acquired control of many of Future Group’s stores, so it’s possible that it’s gotten something out of the entire controversy. While the two-year-battle has no conclusive winners, it could end up being just the first first salvo in the war over Indian retail that could be fought between Jeff Bezos and Mukesh Ambani in the years to come.