India’s most valuable startup on paper continues to lurch from one crisis to another.

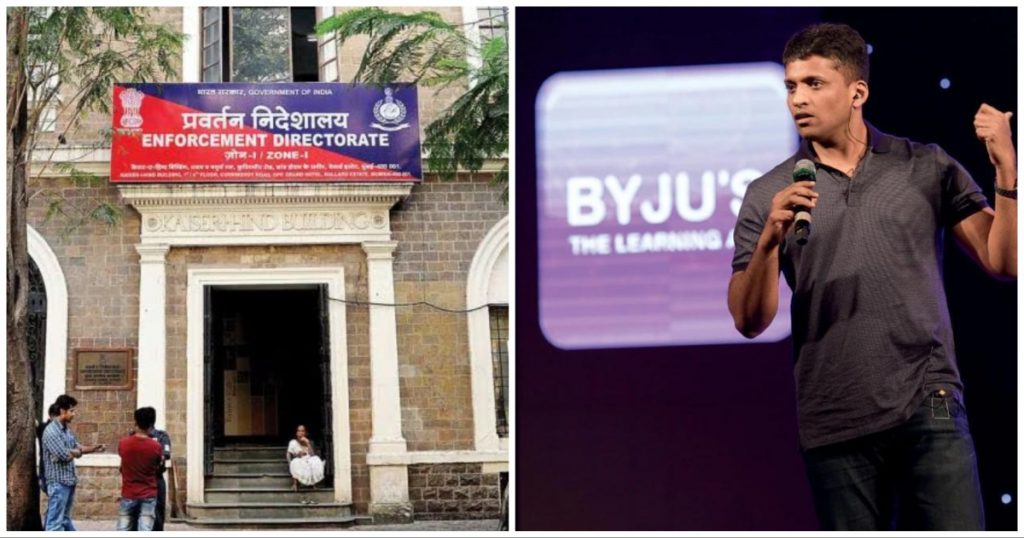

The Enforcement Directorate has issued a show-cause notice to Byju’s CEO Byju Raveendran and Byju’s parent company Think And Learn Pvt Ltd over an alleged contravention of the Foreign Exchange Management Act (FEMA). The amount of the violation is Rs. 9,362.25 crore. Byju’s had earlier denied reports of having received a notice from ED, but the notice was confirmed by the Enforcement Directorate today.

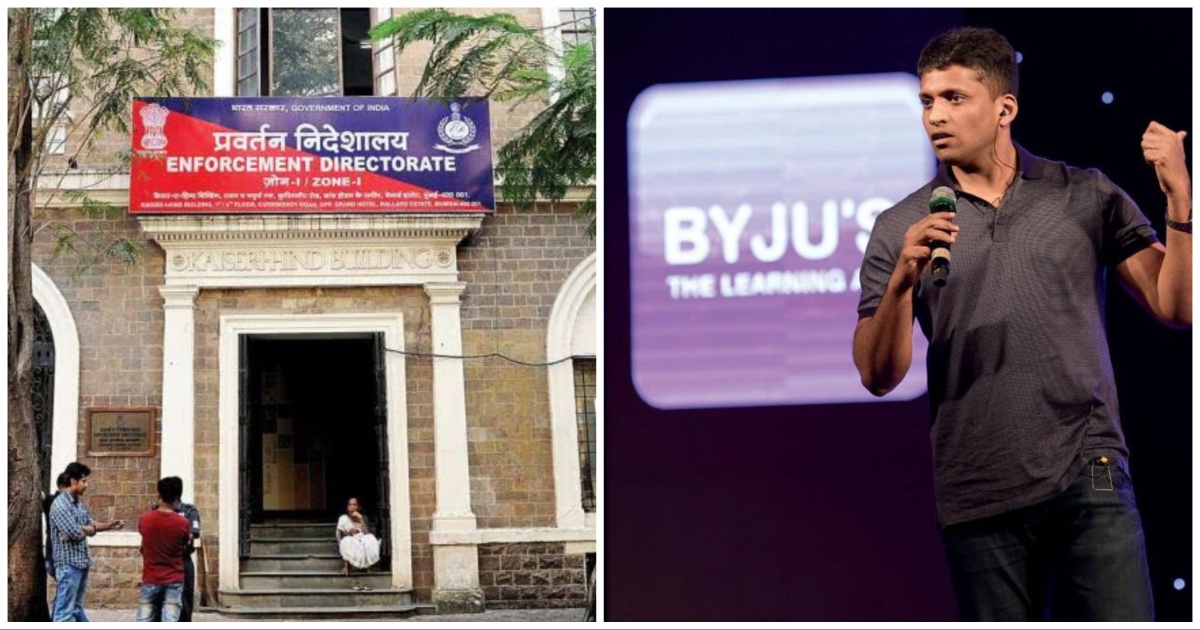

“ED had initiated investigation on the basis of various complaints regarding the foreign investment received by the company viz. M/s Think and Learn Private Limited and the business conduct of the company. The company was also stated to have made significant foreign remittances outside India and investments abroad which were allegedly in contravention of provisions of FEMA, 1999 and caused loss of revenue to the Government of India,” ED’s press release said.

“Based on the above information, ED had conducted searches at the premises of M/s. Think and Learn Private Limited and the residence of Byju Raveendran on 27.04.2023 and 28.04.2023 and seized documents pertaining to all investments received by the company as well as documents pertaining to the overseas investments made by the company,” it added.

“During the course of investigation by ED, statements of Byju Raveendran and the Chief Financial Officer of M/s. Think and Learn Private Limited were recorded. On conclusion of the investigation, it was found that M/s. Think & Learn Private Limited & Byju Raveendran have contravened the provisions of FEMA by failing to submit documents of imports against advance remittances made outside India, by failing to realize proceeds of exports made outside India, by delayed filing of documents against the Foreign Direct Investment (FDI) received into the company, by failing to file documents against the remittances made by the company outside India and by failing to allot shares against FDI received into the company,” the release continued.

Just a few hours prior, Byju’s had denied receiving any such notice after several media outlets had reported the news. The company “unequivocally denies media reports that insinuate it has received any notice from the Enforcement Directorate,” a Byju’s spokesperson had said.

It has now been confirmed in a press release that the notice was indeed sent, and it will be another blow for Byju’s, which has had crisis-laden year so far. Byju’s had delayed filing its FY21 financial results for so long that even the Indian government commented on the issue. The results hadn’t made for pretty reading — Byju’s had lost Rs. 4,588 crore in FY 21 — and Byju’s had then proceeded to lay off thousands of employees. Around this time, questions had been raised in Indian parliament about Byjus’ alleged mis-selling of courses to economically vulnerable parents, and even the country’s child rights body had summoned CEO Byju Raveendran for questioning.

But things kept getting worse — not long after, the Enforcement Directorate had raided CEO Byju Raveendran’s home, and seized incriminating documents over violation of foreign exchange laws. Since then, Byju’s has seen its valuation marked down by as much as half by several investors, and the company had tried to restructure its loan obligations. Byju’s had then been sued by its lenders, but it had gone on to sue them back and refused to pay back its loans amounting to $1.2 billion. Not long after, 3 of Byju’s board members had resigned in unison over concerns over its corporate governance , and a day later, its auditor, Deloitte, had also resigned.

Byju’s is now in the crosshairs of the ED, and has allegedly caused a “loss to the government of India” by breaking foreign exchange laws. It’s hard to imagine how much worse things can get for Byju’s, but at the moment, each month seems to bring with it a crisis bigger than the last.