Several Indian founders have been pilloried on social media for the scams that were unearthed at their companies, but the CEO of one of India’s most prominent startups thinks that the blame also lies with another party.

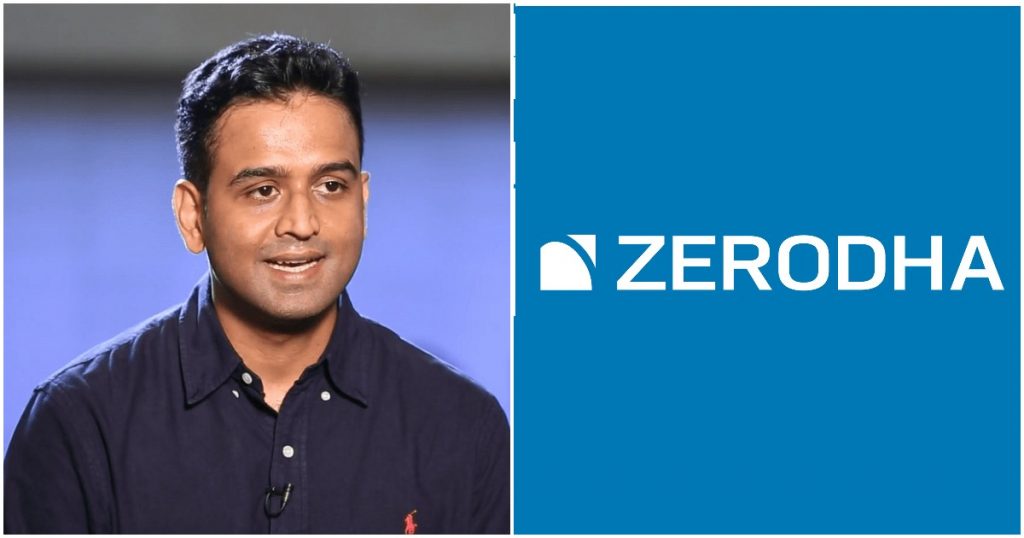

VCs are equally to blame for the growing numbers of corporate governance issues being unearthed at Indian startups, Zerodha CEO Nithin Kamath has said. “Corporate governance issues coming to light in Indian startups will only increase with time. While founders will be blamed, the venture capital (VC) ecosystem is equally to blame,” he tweeted. Over the last few months, it has emerged that prominent startups including GoMechanic, Trell, Zilingo and Mojocare had falsely reported fake revenue and growth numbers.

Kamath went on to explain why he believed that the Venture Capital ecosystem had contributed to founders choosing to misrepresent their companies’ growth metrics. “The root cause of this is the overestimation of the size of Indian markets by founders and VCs,” Kamath tweeted.

“While India is a fast-growing economy that will hopefully be an economic superpower in the future, it isn’t that today. The size of the target market by revenue needs to increase significantly to justify the valuations of the startup ecosystem in the country,” he added.

“I think most VCs have miscalculated this & maybe oversold the India opportunity to their investors (LPs),” Kamath said. LPs are the institutions who give money to VCs, who in turn invest it into startups. “In a small market like ours with limited M&A opportunities, large exits within 7 yrs (the lifecycle of a fund within which founders are expected to give exits) are hard,” he added.

“Building a resilient business in India takes time. I can’t think of many who have done it in <10 years. If VC funds have 7-year lifecycles and push startups for exits within 7 years, how can anyone build a good business?” Kamath said.

“Given what the VC ecosystem is selling to their limited partners (LPs), the founders have to sell a story that syncs to raise funds. I have seen so many startups funded whose decks were almost delusional. In an ideal world, VCs should help correct this, not fuel the delusion,” Kamath continued. “For example, I’ve decks where startups claim 30–50 crore Indians will be investing by 2027, and they can capture 10%+ of that. This is when we had ~6 crore Indians filing income tax returns. Someone should have asked what they were smoking instead of funding them,” he said.

“Most of the governance issues coming to the fore now and in the future will likely not be traditional fraud but misreporting things to justify the stories founders have oversold to raise capital,” Kamath predicted. “If the incentive is to constantly oversell, we get what we’re seeing. So the blame isn’t just on the founder, but also on the VC ecosystem that fueled it,” he concluded.

It’s a compelling argument. Kamath says that VCs and founders both believed that India’s market size was bigger than what it really was, and raised money based on their misplaced assumptions. When it turned out the market was much smaller than had been estimated, founders responded by faking revenue and growth numbers to justify the valuations at which they’d raised money. And the theory, if true, would suggest that many more scams could be in the offing — given how India had reported record levels of fundraising over the last few years, it might soon end up seeing a record number of new startup scams too.