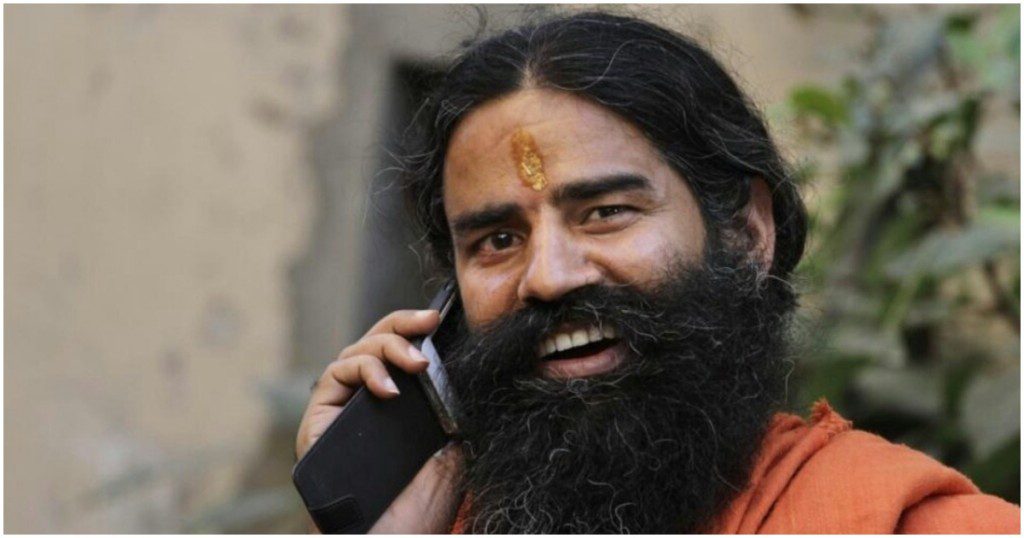

Until a few years ago, Patanjali was the rising star on India’s FMCG space. With revenues of over Rs. 10,000 crore, it had shot past incumbents like ITC Consumer and Godrej, and had its eyes trained on the top spot. Its astonishing growth had also led to some bold pronouncements — Patanjali could soon annouce its IPO, Baba Ramdev had hinted, and Patanjali had planned to expand into other verticals, including fashion.

But the fairytale growth story had appeared to lose steam — in 2017, Patanjali’s revenues grew at 0 percent, and the following year, they ended up falling 10 percent. People wondered if Patanjali’s success was a flash in the pan, and if its best days were already behind it. Patanjali, however, doesn’t seem to be quite done yet.

Patanjali claims to have achieved revenues of Rs 3,562 crore in the first half-year (April-September) of 2019, the highest ever in the first half of any financial year. The company estimates that for the second half of 2019-20, the revenues would be almost double of what they had in H1, which means that Patnajali could well report its highest-ever revenue figures by the time the year is done. During the first half-year of 2018-19, the company had reported revenues of just Rs 2,513 crore.

According to its filings, food and beverages accounted for 62% of its total sales during 2018-19. Chemical-based products, pharmaceuticals, medicinal chemicals and botanical products contributed 35%. Patanjali, however, has not revealed its profit or loss for the period.

Patanjali said that the introduction of goods and services tax (GST) in 2017 had severely disrupted its operations. A report by CARE Ratings had mentioned that the company was unable to adapt in time to the GST regime and develop infrastructure and supply chain. In 2018, the company hired about 11,000 field personnel to strengthen its sales and distribution. In October 2019, CARE Ratings had downgraded Patanjali Ayurved credit rating by two notches, from A+ to A- seeing weakening of its financial position due its proposed takeover of soya manufacturer Ruchi Soya Industries Ltd.