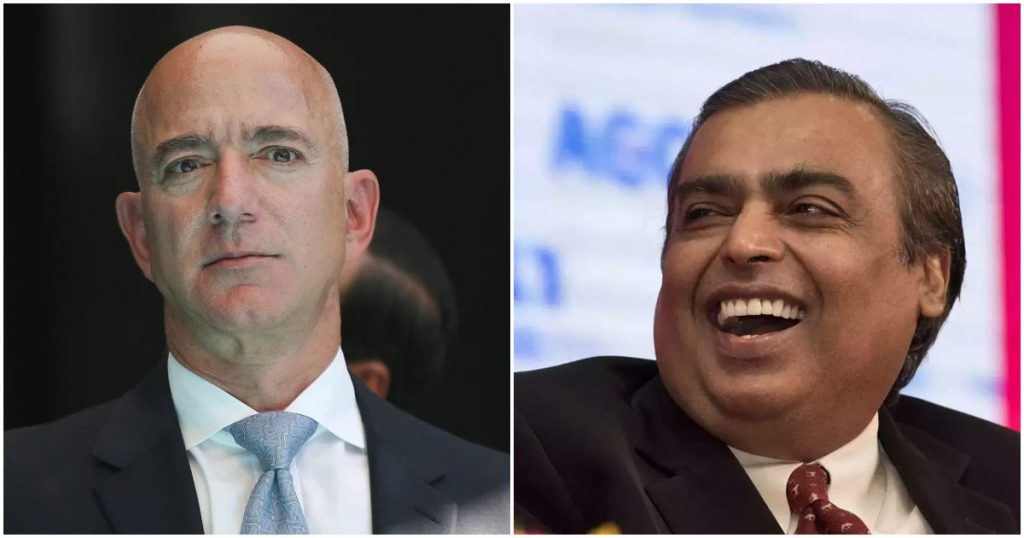

It appears that Reliance might well be having the last laugh in its year-long tussle with Amazon over the future of the Future Group.

The Competition Commission of India (CCI) has suspended Amazon’s deal with Future Group after it reviewed complaints that the American e-commerce giant concealed information while seeking regulatory approval. In a 57-page order, India’s anti-trust regulator said Amazon suppressed “the actual purpose and particulars” of the 2019 deal and sought to “establish false representation and suppression of material facts”. CCI said it was now “necessary to examine” the deal afresh and said its approval “shall remain in abeyance” until then. CCI also slapped a Rs. 200 crore penalty on the American e-commerce giant.

This is a massive blow to Amazon, which was counting on this deal to prevent the sale of the Future Group to Reliance. In August 2020, Reliance had acquired the retail & wholesale, logistics & warehousing business of Kishore Biyani’s Future Group for Rs. 24,713 crore. But Amazon had immediately raised an objection — Amazon had acquired a 49% stake in Future Coupons in 2019, and Future Coupons in turn owned a 7.3 percent stake in Future Retail. Amazon was thus a minority shareholder in Future Retail, and it contended that the Future Retail sale to Reliance couldn’t happen without its approval.

It had initially appeared that Amazon’s objections wouldn’t amount to much — in November 2020, the Competition Commission of India had approved the Future Group-Reliance deal. But Amazon then approached an arbitrator in Singapore, which ruled that the Reliance-Future Group deal couldn’t go ahead. In what seemed like a turn of events, the Delhi High Court then also then ruled that that status quo must be maintained on the deal.

But in an even more dramatic turn of events, the Competition Commission of India has now said that Amazon’s initial deal with the Future Group — through which it had acquired a 49% stake in Future Coupons — was invalid, thus negating the entire premise of Amazon’s argument. If Amazon’s initial deal with Future Coupons is invalid, it has no right to block the Future Group-Reliance deal. To add insult to injury, the Competition Commission of India has also slapped a Rs. 200 crore penalty on Amazon.

“Amazon had suppressed the actual scope of the Combination and had made false and incorrect statements” in relation to the commercial agreement, “which are intertwined into the scope and purpose of the Combination,” the CCI order said. Amazon was charged by the complainants of not disclosing the intent to indirectly control the parent firm, Future Retail Ltd, through its acquisition of 49 percent stake in Future Coupons.

According to CCI, Amazon said that the rationale for this investment was the business potential of Future Coupons, to create long-term value and provide return on the investment made by Amazon. “However, the Internal Correspondence of Amazon clearly shows different purposes for envisaging the Combination (i.e., ‘foot-in-door’ in the Indian retail sector, secure rights over Future Retail that are considered as strategic by Amazon and Commercial Arrangements between the retail business of Future Group and Amazon),” the order read.

This isn’t the first time that Amazon has been accused of unethical business dealings in India. Earlier this year, a bombshell Reuters report had accessed communication between Amazon and US officials to suggest that the company had deliberately skirted FDI laws in India. India’s FDI rules don’t allow e-commerce companies to also sell products on the platforms they operate, but Amazon, through a group of companies it had influence over, circumvented these rules and made large sums of money.

Also, in June this year, an investigation by the Guardian found that Amazon had received a tax demand of Rs. 54 crore from Indian tax authorities for not adequately paying taxes in the country. Amazon is also being investigated Competition Commission of India (CCI), for alleged anti-competitive practices, predatory pricing and preferential treatment of sellers. Just last month, another report had alleged that Amazon had bribed government officials, and had sent its senior counsel on leave pending an enquiry. Yet another report in October had alleged that Amazon had copied products from Indian-owned brands launch its own clothing line, and had then put its own brands ahead in search results. But the CCI has now ruled that Amazon misled the commission while gaining approval for its 2019 deal with the Future Group, and this could be yet another — and perhaps most significant — addition of its list of violations in India.